Concepts

DX is the new UX

UX (User Experience) has emerged as a key source of competitive advantage over the past two decades.

But three key shifts

– unbundling of the value chain,

– growth in API-based business development, and

are creating a new competitive frontier.

DX (Developer Experience) will emerge as a key source of competitive advantage over the next decade and more.

DX is emerging as the next big battleground in a world of many application programming interfaces (APIs) competing for the scarce resource of developer commitment.

Yes, DX has always been important.

So what’s new now?

This time is different?

So far, DX has largely been a way to strengthen the moat around an already-competitive business, not to build the moat in the first place.

But the three shifts above will create a new generation of companies – I call them developer-led platforms – which will primarily build competitive advantage through DX rather than through solving problems for users.

This is in contrast to the companies of the past that used developers primarily to extend the core platform (developer-extended platforms) and improve/extend existing user propositions that were already delivered through the core platform.

Instead of helping just strengthen an already established moat, DX will increasingly be the primary way to build a moat around your business.

Let’s unpack this further!

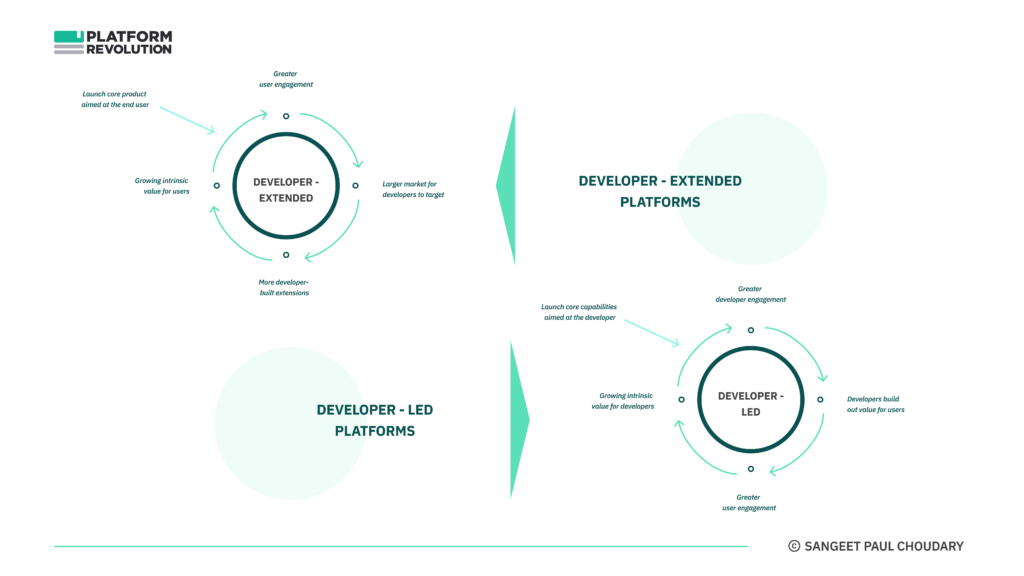

Developer-led vs developer-extended platforms

You might argue that developer experience has always been important. What’s changing?

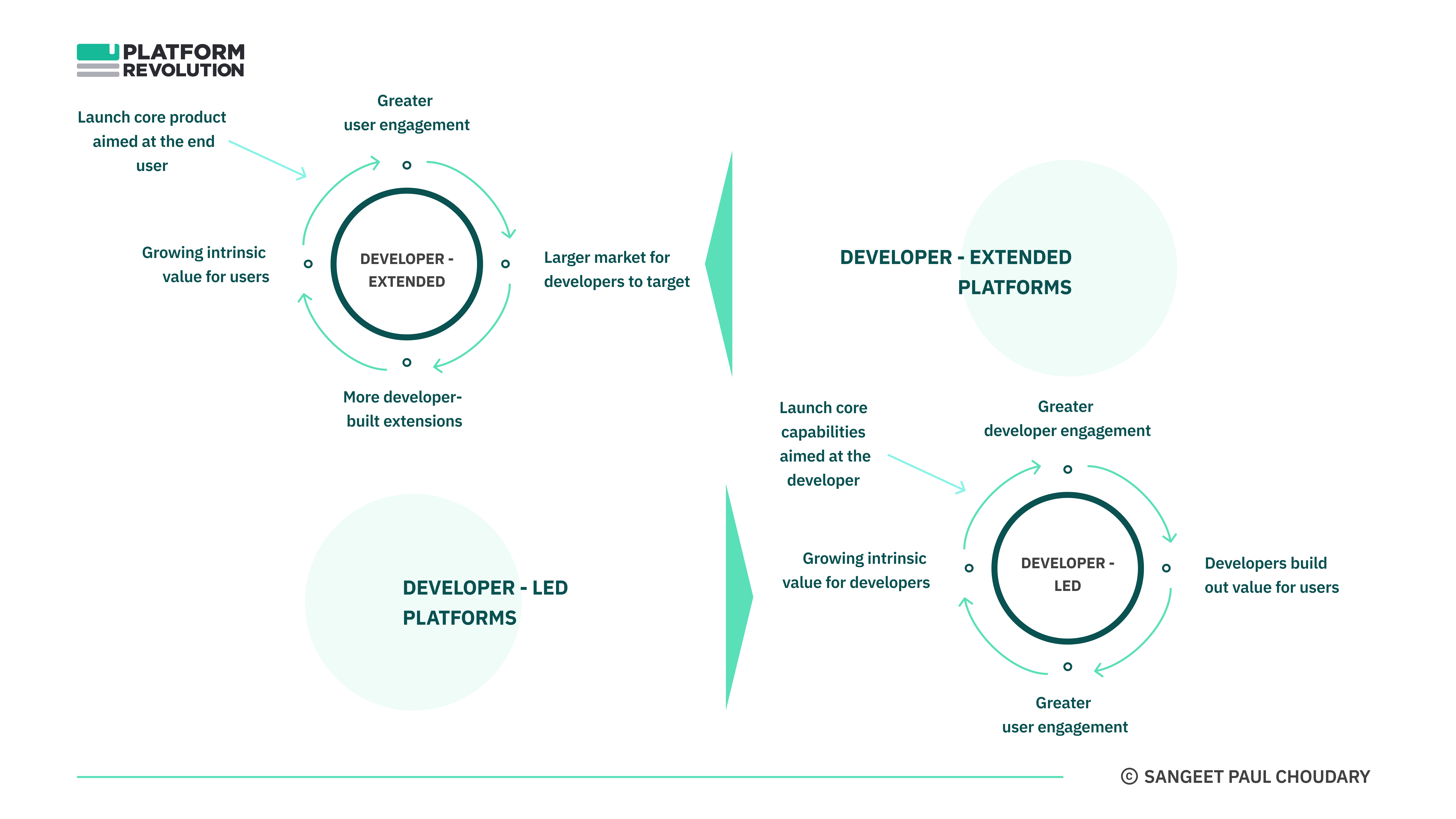

To understand what’s different, we need to understand the difference between developer-led and developer-extended platforms.

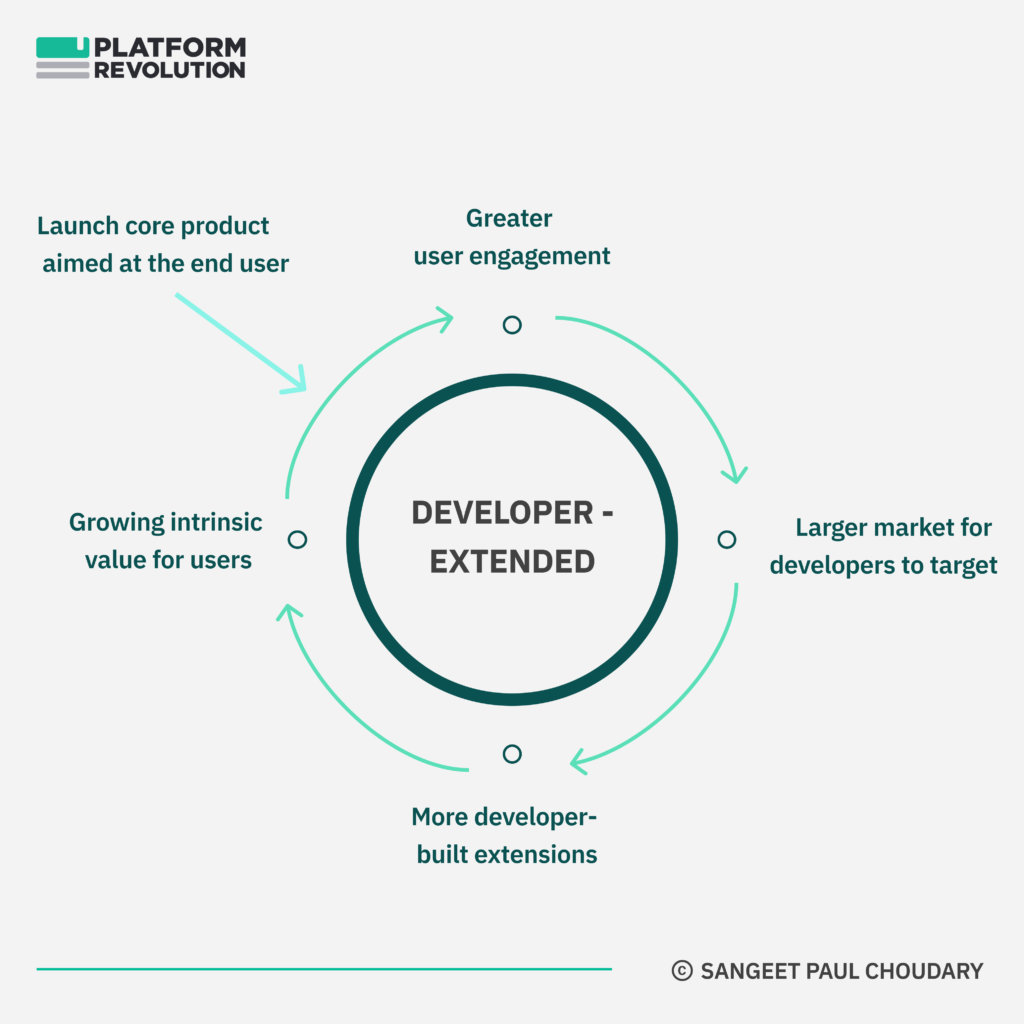

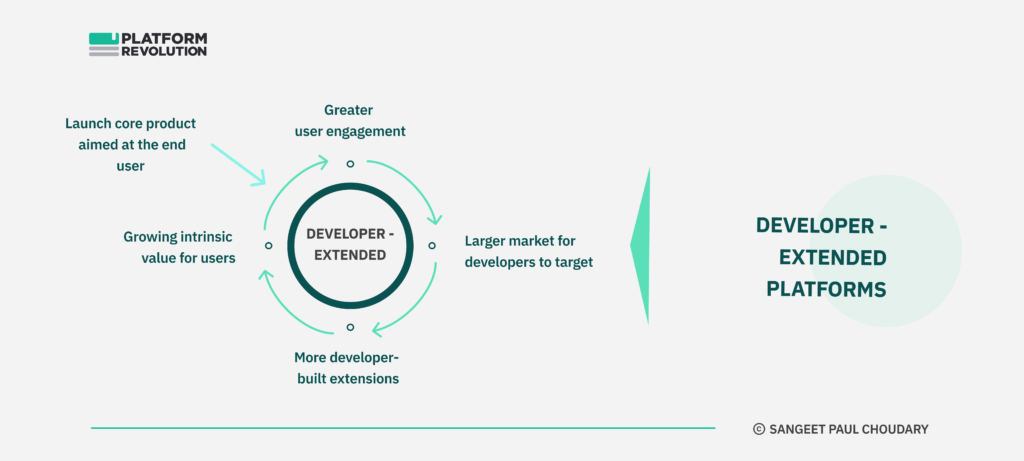

The majority of developer engagement over the past four decades (since the dawn of personal computing) has been on developer-extended platforms.

These platforms follow a common playbook.

- They launch a core product with superior UX to gain traction on the consumer side.

- They use consumer traction to attract developers.

- Developers extend the core product making it more usable (scale) for a broader market (scope) of consumers.

- Consumer traction increases, and the flywheel sets in.

The iPhone is a great example of the above phenomenon. The iPhone itself was a great product that rapidly built a large customer base. This attracted developers on board who created a host of apps to extend phone functionality, enabling users to customize their phones based on the apps they downloaded.

Consumer traction is the key source of competitive advantage for developer-extended platforms. The core product itself should be strong enough to gain consumer traction in its own right and build a moat. Developer extensions then spin the flywheel faster and deepen the moat.

Once set in motion, the flywheel ensures developer commitment and late followers struggle to compete. R.I.M. was a late follower with the Blackberry App Store and tried attracting developers by guaranteeing a minimum sum of $10,000 to every app on the Blackberry 10, that was certified by Blackberry and had generated a minimum of $1000 in actual sales. Despite these incentives, Blackberry failed to attract high quality developers, who had already committed resources to competing platforms (iOS and Android) with much higher consumer traction.

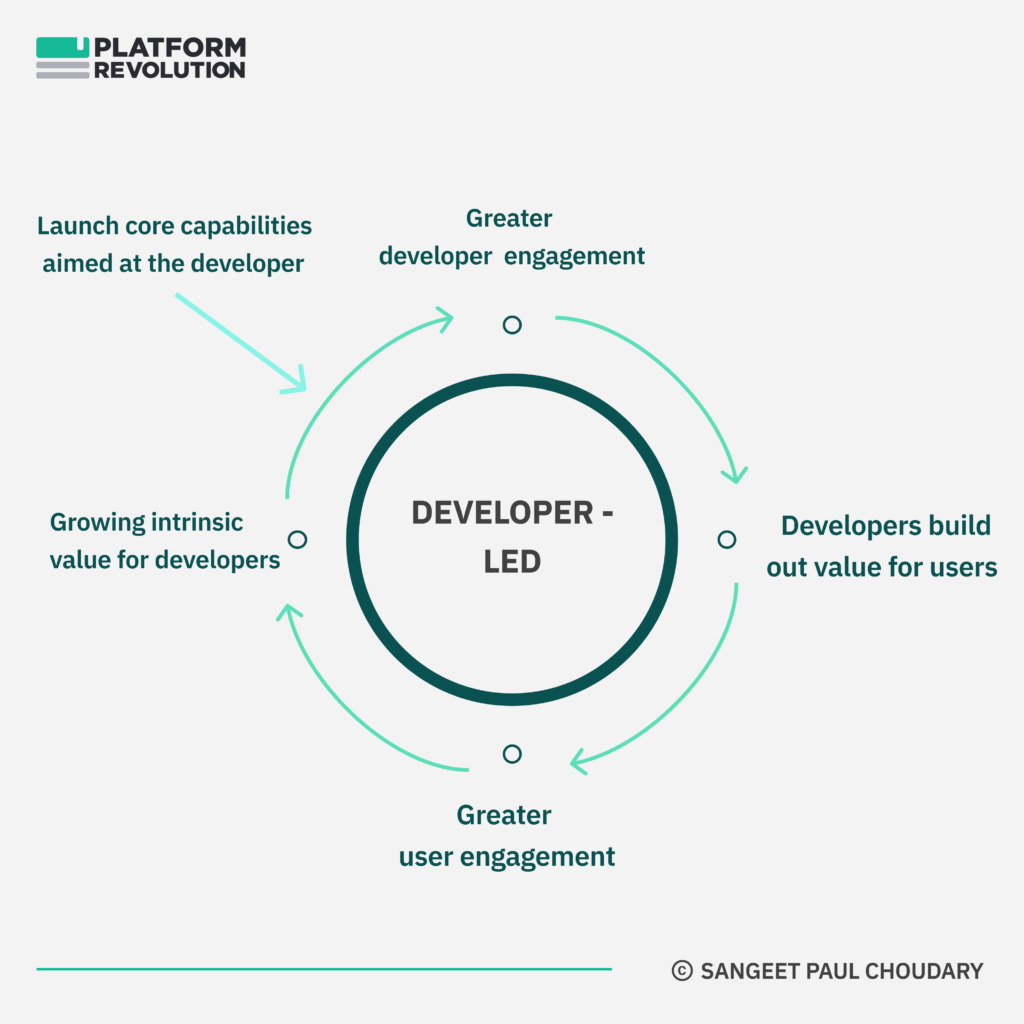

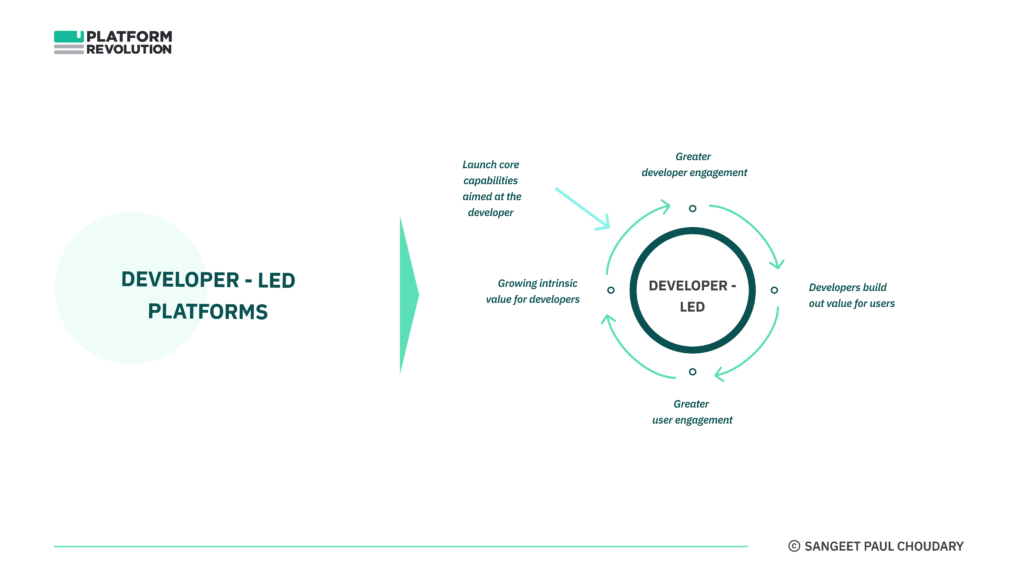

Developer-led platforms are fundamentally different.

Instead of relying on consumer engagement to attract developer commitment, they rely on developer commitment to attract consumer engagement.

Their playbook looks something like the following:

- They launch a core toolset with superior DX to gain traction on the developer side.

- They use developer traction to build value for consumers.

- Consumer engagement increases as developer build new functionality (scale and scope) around the core toolset.

- Developer traction increases as market adoption of the platform among consumer grows, and the flywheel sets in.

Developer commitment is the key source of competitive advantage for developer-led platforms. The core toolset doesn’t get consumer traction. Developers come on board and extend it towards consumer usage.

In this way, developers don’t simply deepen an already existing moat for the business. They help dig the moat in the first place.

And, of course, this is what MidJourney comes back with…

App developer in hoodie digging a moat around a castle

A little less brooding, a little more digging might help…

Developer-led vs developer-extended – the key difference

Back to the point, we need to isolate the key difference between developer-extended and developer-led platforms.

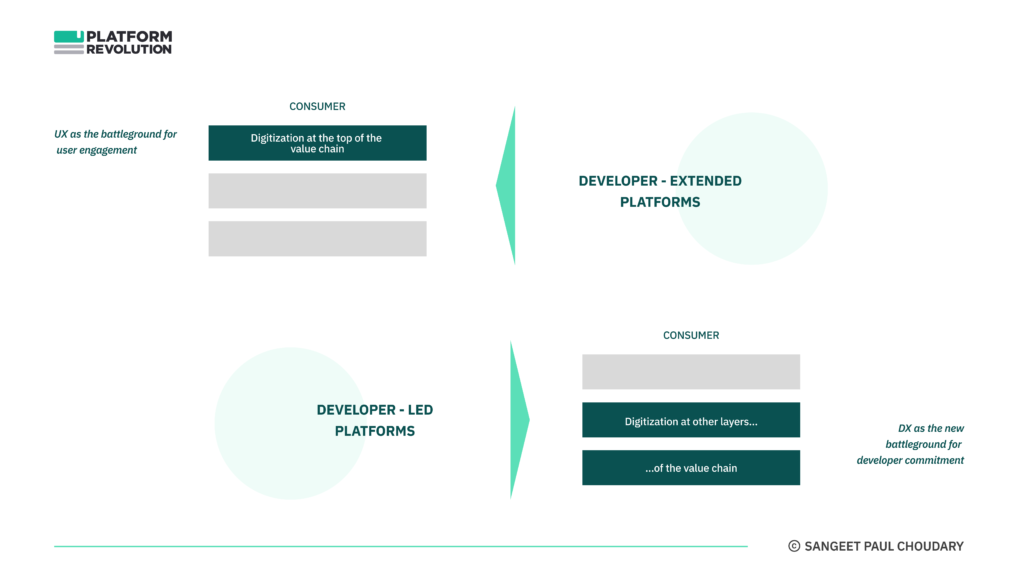

As shown above, developer-extended platforms compete primarily on the basis of consumer engagement. Their key source of competitive advantage is UX. Developer commitment spins the flywheel subsequently but only to the extent that it improves the UX.

On the contrary, developer-led platforms compete primarily on the basis of developer commitment. Their key source of competitive advantage is DX. Consumer engagement spins the flywheel subsequently but sustainably does so if it also contributes to improving value for developers.

What’s driving this shift? Why now?

What’s driving the rise of developer-led platforms. And what makes DX the new source of competitive advantage?

To understand what’s driving this shift, we look at the factors that drove the rise of UX as a source of competitive advantage and the interestingly-linked factors that are now driving the rise of DX as a source of competitive advantage.

The rise of UX

The rise of UX as a key lever of competitive advantage over the past two decades was driven by:

(1) the digitization of the consumer interface to business, and

(2) the consequent economics of the attention economy.

The impact of the cloud first manifested closest to the consumer. A whole range of consumer tech startups took to offering cloud-hosted services back in the early-to-mid 2000s.

When the top of the value chain was digitized for the first time, the economics of scarcity shifted away from scarcity of resources to a scarcity of user attention.

The rise of the consumer cloud coupled with the shift to smartphones in 2007 created a constantly connected global consumer market. In this constantly connected consumer market, consumer attention was scarce.

Application developers started competing for this scarce resource. Those that were able to best harness this scarcity were the ones who would win.

Not all developers could harness scarce attention from scratch. Naturally, they gravitated to the points where such attention was already harnessed – consumer-facing platforms – either as employees at these platforms or as developers extending these platforms.

User engagement emerged as a key source of competitive advantage and user experience (UX) became one of the key battlegrounds over the past decade of tech.

User experience design required a combination of customer empathy and the ability to use data to deliver highly personalized delightful experiences.

Companies invested in activating the ever-distracted user, delivering the next dopamine hit, creating repeat usage through habit design, holding on to the user through infinite scrolls, and even baiting users using dark patterns.

Over the past decade, we’ve built a growing arsenal of tools to compete in the raging UX battlefield.

DX – The new competitive frontier

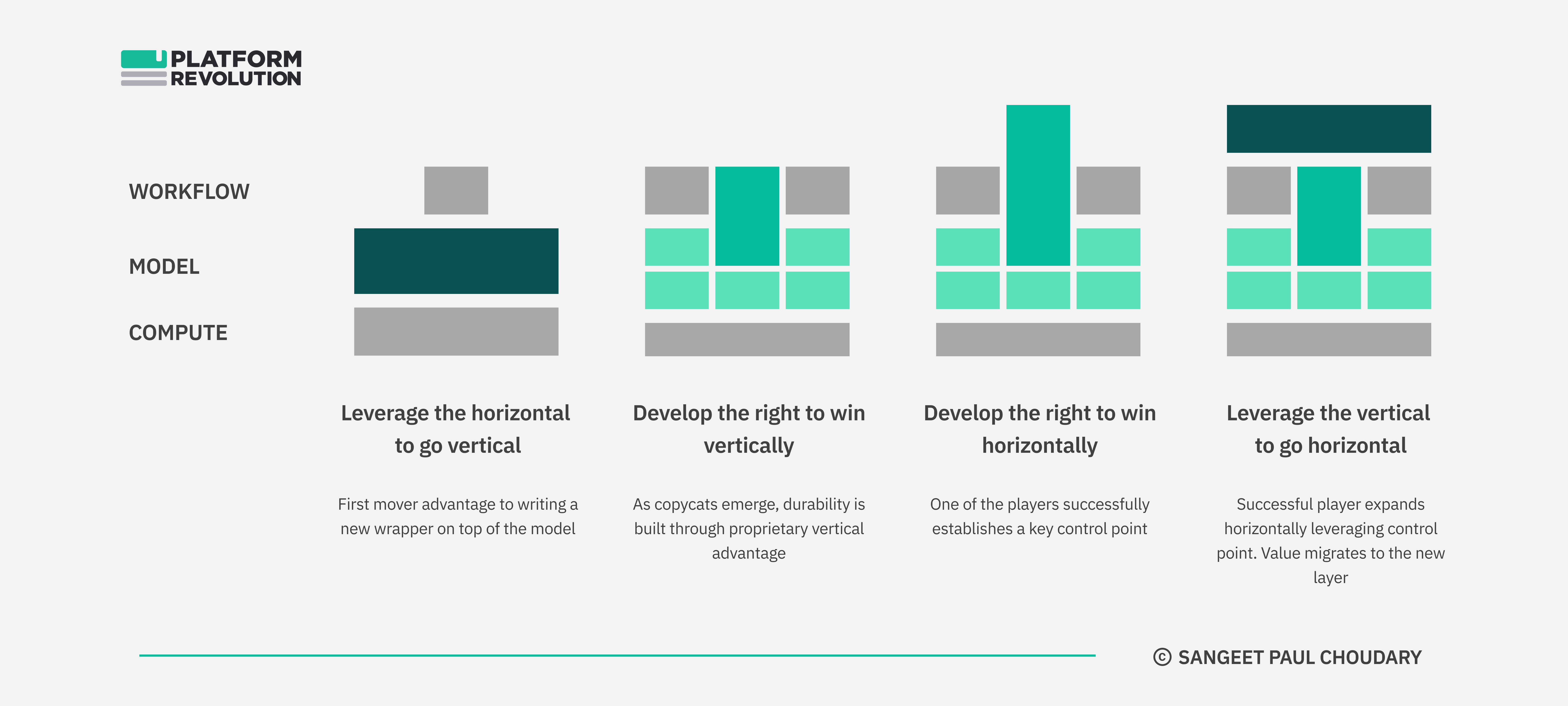

We’ve seen three other shifts emerge over the course of the past decade.

These shifts are increasingly driving the rise of developer-led platforms and positioning DX as the new frontier for competitive advantage.

First, the increasing adoption of cloud-hosted enterprise software is driving digitzation across the rest of the value chain, not just the consumer interface to business.

Back in 2010, digital transformation manifested primarily as digital marketing. Today, it involves transformation of every enterprise capability.

Digitization across the value chain drives unbundling of the value chain as I explain in an earlier analysis of the value stack:

As transaction costs fall with the adoption of enterprise Saas, the vertically integrated value chain starts to unbundle.

This unbundling of the vertically integrated industry architecture is creating a more modular, layered ecosystem where firms at every layer specialise in one specific value-creating activity.

This unbundling essentially implies that a business interface can now open out at any point across the entire value chain. While vertically integrated businesses were primarily concerned with solving for the end user (whether business or consumer), unbundling – and the ensuing modularity – require that a business participates as part of a much more connected ecosystem.

And developers play an increasingly important role in helping a business participate across such a connected ecosystem.

As the value chain gets unbundled and as businesses open out more interfaces tot he ecosystem, a second key shift has been accelerating: the increasing primacy of API-based business development.

An API provides an interface to a business process or capability, while also defining the contract for engaging at that interface. More here.

Business capabilities are increasingly being opened out through APIs for external consumption.

As I go on to explain in the article:

With the low costs of API-based coordination, firms can invest in specific capabilities in a particular part of the value chain, while integrating across larger business ecosystems.

As the value chain gets unbundled and as businesses open out more interfaces tot he ecosystem, a second key shift has been accelerating: the increasing primacy of API-based business development.

An API provides an interface to a business process or capability, while also defining the contract for engaging at that interface. More here.

Business capabilities are increasingly being opened out through APIs for external consumption.

As I go on to explain in the article:

With the low costs of API-based coordination, firms can invest in specific capabilities in a particular part of the value chain, while integrating across larger business ecosystems.

These three key shifts – unbundling of the value chain, growth in API-based business development, and the rise of protocols – are driving the rise of developer-led platforms and creating a new competitive frontier.

As these three shifts proliferate, developer commitment will emerge as a new value lever.

- Unbundled firms will need developers to integrate with other firms around themselves.

- As APIs proliferate, new innovation will require mashing up APIs rather than building ground-up, again, requiring developers.

- And, finally, value in protocol-based ecosystems will largely be created by external developers.

Developer commitment is the new scarcity as digitisation proceeds across the rest of the value chain, APIs abound, and protocols gain adoption.

As we see above, developer commitment is increasingly valuable in this landscape.

But developer commitment is also scarce, and hence, a source of competitive advantage:

Developer engagement and resource commitment involves high multihoming costs (costs to developers in simultaneously building for multiple platforms). By building and committing resources to a particular ecosystem, developers are implicitly opting out of committing their limited time and resources to other (competing and non-competing) ecosystems.

Consumer traction is the key source of competitive advantage for developer-extended platforms. The core product itself should be strong enough to gain consumer traction in its own right and build a moat

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

From demand aggregation to industry integration

There is a final nuance to the rise of DX.

Developer-extended platforms primarily created value for developers through demand aggregation.

By driving adoption of a core product, they created a market for developers.

Developer-led platforms primarily create value for developers through industry integration.

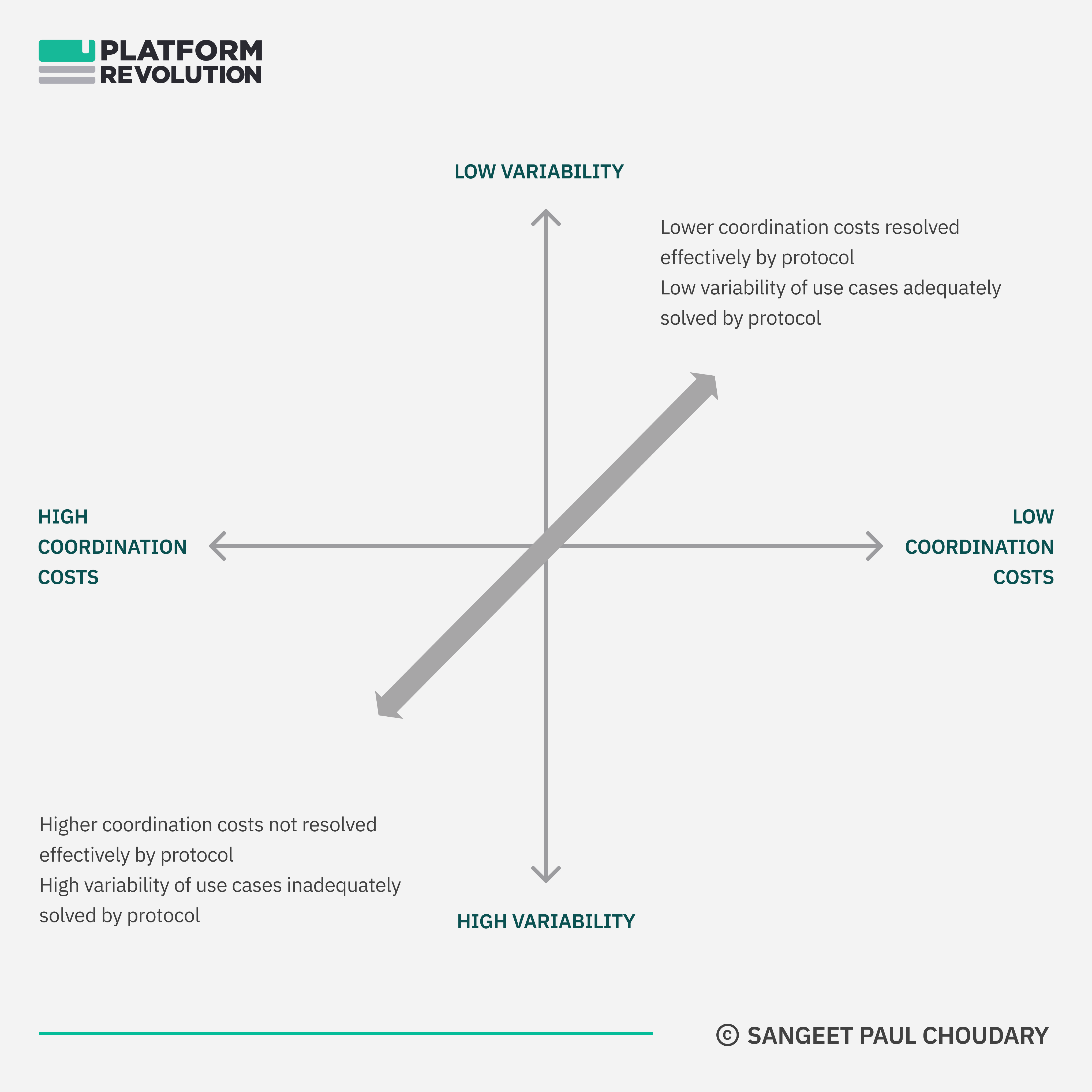

In an ever-growing API landscape, developers face high friction due to fragmentation of APIs. Because of the high multihoming costs in development, it doesn’t make sense for developers to devote resources to multiple APIs from multiple companies, with different policies and interfaces.

Developer-led platforms gain the right to attract developers by integrating across a fragmented landscape of APIs.

As I explain in an earlier post titled Switchboard Strategy:

As the number of APIs increase and API provisioning gets increasingly fragmented, Integrators (developer-led platforms) act as API switchboards enabling one-stop standardized connectivity and interoperability across an increasingly fragmented API landscape.

On the supply/production side, an integrator aggregates product provisioning APIs across the production ecosystem, and on the demand/consumption side, it integrates across distribution environments (websites, apps, and other digital services) in the consumption ecosystem.

Integrators emerge in any API-based distribution landscape and create value by organizing access across the ecosystem.

Financial services, logistics, automotive, and travel are prominent examples involving mediation of APIs through integrator switchboards.

We’ve already seen this with the rise of Twilio and Stripe. Unlike the iPhone (iOS), which took a developer-extended approach, these companies are developer-led platforms. They win through DX.

But they gain the right to engage developers by creating a common integration layer across multiple fragmented connectivity providers (in the case of Twilio) and payment providers (in the case of Stripe) respectively.

As APIs proliferate, we will see Stripe and Twilio like plays emerge across industries.

These platforms win through standardization and integration across a fragmented API landscape, thereby reducing the costs of innovation for developers.

In a growing landscape of APIs, the businesses that are best able to resolve coordination costs of working across these APIs will succeed at attracting developer commitment.

In logistics, for instance, EasyPost acts as an integrator connecting parcel shipping and logistics processes in the production ecosystem with eCommerce retailers, fulfilment centers, marketplaces, and enterprises in the consumption ecosystem.

It integrates a fragmented commerce and logistics landscape and provides a unified API exchange.

What does this mean for you?

If you’ve worked in the space of developer experience and relationship management, the value of your skills will increase merely because value is migrating to your position in the value chain, not because you got better at your job.

The fundamental tools of the trade have not really changed but value is increasingly migrating in your direction as DX becomes a key source of advantage.

Where developer-extended platforms engaged developers as an afterthought, largely to do edge innovation around a company’s core, the bulk of the value on developer-led platforms will now be created through engaging developers.

In every industry, a handful of companies who play the integrator role will be the ones best positioned to capture developer commitment.

Since developer commitment now directly translates to both topline and competitive advantage, DX roles will be some of the best compensated roles.

So if you work in developer experience, this is the time for you to actively scout for emerging integrator firms in your industry. Look for players that are resolving the coordination costs of developer experience and which understand the criticality of DX as a source of competitive advantage.

Building a developer-led platform?

As a business leader, building a developer-led platform comes with unique challenges.

In the absence of consumer market traction, how do you get developers to commit resources to your project? How do you structure incentives to align with platform value creation with different developers work across different components of the platform, some of which are core and some of which are edge capabilities?

And, most important – yet least understood…

How do you develop a partnership framework when your business can be offered as a modular stack of capabilities to your partners?

If you’re thinking through these issues, drop me a note at [email protected].

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter