Strategy

Switchboard strategy: Winning with API-based distribution

Integrator business model for platform success

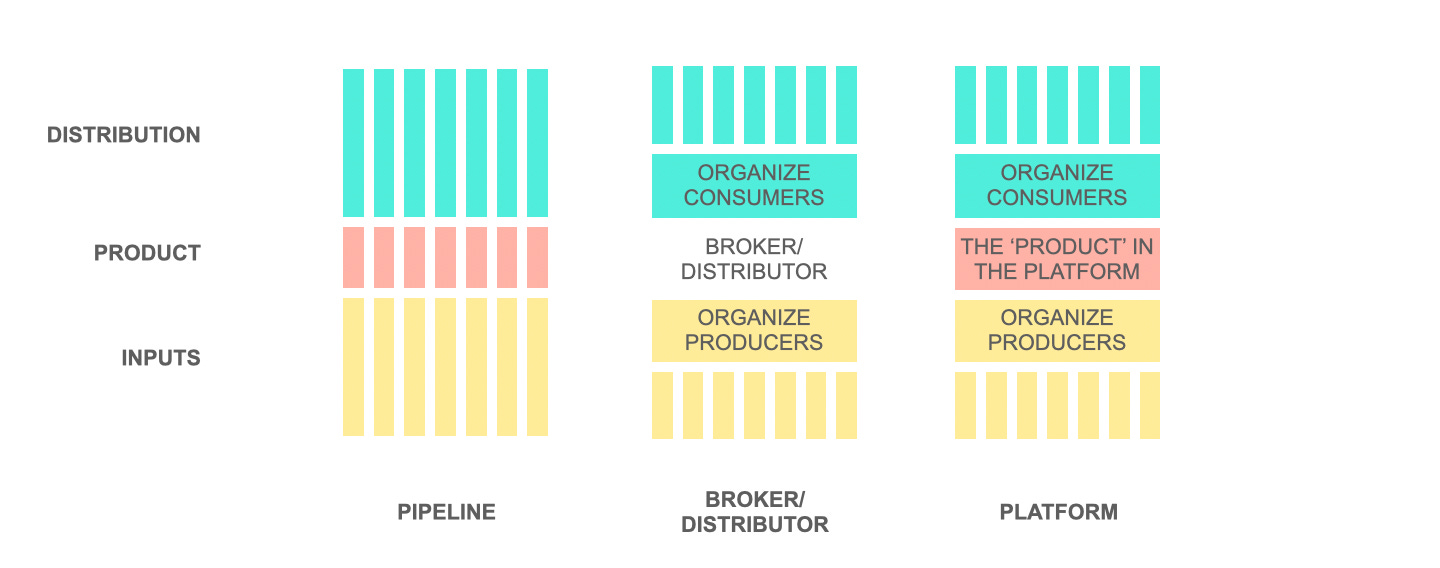

In an earlier edition of the newsletter, I introduced a new framework to explain the difference between different ecosystem positions.

The least understood of these is the Integrator business model. Through this issue, we dive deeper into how Integrators work.

And get the full copy of our Ecosystem Innovation Playbook at the link below:

Get the playbook now

API switchboards

APIs drive distribution and embedding of products, services, and capabilities across ecosystems.

As the number of APIs increase and API provisioning gets increasingly fragmented, Integrators act as API switchboards enabling one-stop standardized connectivity and interoperability across an increasingly fragmented API landscape.

On the supply/production side, an integrator aggregates product provisioning APIs across the production ecosystem, and on the demand/consumption side, it integrates across distribution environments (websites, apps, and other digital services) in the consumption ecosystem.

Integrators emerge in any API-based distribution landscape and create value by organizing access across the ecosystem.

Financial services, logistics, automotive, and travel are prominent examples involving mediation of APIs through integrator switchboards.

Stitching logistics APIs together

In logistics, for instance, EasyPost acts as an integrator connecting parcel shipping and logistics processes in the production ecosystem with eCommerce retailers, fulfilment centers, marketplaces, and enterprises in the consumption ecosystem.

It integrates a fragmented commerce and logistics landscape and provides a unified API exchange. It integrates with more than 60 shipping carriers on the supply side and allows online retailers on the demand side to access all these shipping options through a unified interface, allowing them to compare prices and delivery times.

EasyPost started out in 2012 by integrating USPS as its first logistics partner. Like most integrators, it built out demand using USPS and subsequently added more shipping companies like FedEx, UPS and other regional companies.

EasyPost has also built out central capabilities like marketplace price comparison, custom tracking engine, and an address verification engine on back of the data obtained from shippers and communication with the service provider APIs.

On the distribution side, EasyPost partners with ecommerce infrastructures like SellerActive and Linnworks, as well as inventory management systems like InFlow. All distribution partners provide EasyPost’s shipping APIs to their customers to enable shipping solutions.

Business development as competitive advantage

Business development and developer engagement is key to playing the integrator game.

Most successful integrators scale through developer adoption, by providing an easy to use SDK and structuring a well executed developer program.

Partnerships are key to integrator adoption across the ecosystem. This involves ensuring ease of embedding but also investing in business development to land and expand adoption with accounts.

A typical integrator business development approach involves four roles.

- The market lead is responsible for penetrating a particular vertical or geography.

- The sales manager focuses on identifying new prospects and in driving customer adoption by landing new accounts.

- The partner success manager is responsible for supporting existing accounts and expanding their usage.

- Finally, the operations manager monitors customer activity and usage and uses these inputs to inform future integration roadmap, to drive further adoption and usage.

Power games in switchboard strategies

Not all integrator switchboards gain a competitive advantage over the ecosystem. If either the supply side or the demand side is dominated by a few large players, power shifts away from the integrator even though the integrator may perform the same functions technically.

Otonomo, a vehicle data hub, powers an integrator business model, distributing data from across automotive OEMs to application developers. The automotive industry’s consolidated industry structure skews power away from Otonomo and in favour of the OEMs which act as production partners. As a result, even though Otonomo runs an integrator business model, it gets automotive OEMs on board as a data broker, managing their data and driving adoption of this data across the distribution ecosystem, which constitutes app developers who build connected car applications.

The more fragmented the production and distribution partner landscape, the more power skews in the integrator’s favor.

In the financial services ecosystem, the API provisioning landscape is much more fragmented. Hence, power moves away from API producers to API integrators.

Galileo FT, a financial services API integrator, scaled out its ecosystem through business development.

Galileo helps distribution partners access financial services. Its APIs offer capabilities like account set-up, funding, direct deposit, ACH transfer, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorization. Its API consumers / demand-side partners include Chime, Robinhood, Monzo, Revolut, Transferwise, and Varo.

On the production side, card issuers like Mastercard power Galileo with capabilities to enable new card launches. Its partnership with Plaid enables ACH transfers. Overall, it offers connection to more than 55 endpoints in the financial services ecosystem – to networks, issuing banks, KYC providers, and mobile wallets. Galileo empowers developers to write mashups and recipes by combining the functionalities across multiple APIs on its exchange.

The more value integrators like Galileo add beyond API integration, the greater the skew of power in their favor.

Integrators which merely serve as a switchboard connecting APIs from the production ecosystem to partners in the consumption ecosystem will see their margins erode over time and lose competitive advantage.

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

Launch strategies for integrators

Integrator business models typically start off by aggregating a curated set of production partners and distribution partners in a closed loop ecosystem. Over time they open out the ecosystem to enable new partners to join in, and scale the ecosystem by alternately scaling adoption across production partners and distribution partners.

Incumbent firms leverage their existing partner relationships with other value chain players to:

- Onboard them onto a closed loop ecosystem

- Demonstrate value in providing a one-stop exchange shopfront

- Enable industry-wide connectivity and standardization for access to suppliers.

Booking.com’s B2B integrator business leverages existing ecosystem relationships through travel agents as well as through hotel management software to integrate different parts of the ecosystem together.

Integrators may also be launched in consortium when a group of product creators and/or distributors work in consortium to drive activity across the integrator’s network.

In the travel industry, global distribution systems like Sabre set up integrator business models long before the dawn of the world wide web. Most of these global distribution systems were set up by industry players (e.g. top airline operators) coming together – often in consortium – to drive supply-side activity on the integrator, which in turn attracted travel distributors and agents on the demand side.

Monetization models for integrators

Integrators primarily monetize transactions between production and consumption partners by charging a transaction fee on distribution or by charging an API licensing fee (when reselling APIs of production partners to the consumption side).

Amadeus, like Sabre, runs a global distribution system in an integrator model in the travel industry. It primarily monetizes transaction activity by charging for ticket distribution and bookings management. It also monetizes anonymised data analytics by charging a fee to partners looking to get access to industry data.

As an API integrator in the connected car industry, Smartcar charges developers for standardized one-stop access to APIs carrying data across OEMs and other third party partners. The API Licensing fee depends on number of API calls made by developers, and includes volume discounts for high call volume.

Integrators may also charge partners for access to industry-wide analytics.

Finally, integrators may also extend to providing key capabilities to production as well as distribution partners (e.g. international payment capabilities, KYC capabilities etc.) and may charge a licensing fee for access to these capabilities.

Strategize your ecosystem play

If you’re developing an ecosystem strategy and would like to explore our ecosystem mapping and strategy approach, please write in below for our advisory kit.

Request Advisory Kit

Pursuing integrator strategies as an incumbent

Integrators will play an important role as products and services are increasingly served through API-based distribution and embedded across third-party destinations.

There are a few factors, in particular, that help incumbents succeed with integrator positions.

GAIN INDUSTRY-WIDE SCALE

Ecosystems which are unlikely to see the emergence of a winner-take-all aggregator, will instead allow the creation of a dominant position at the integrator layer.

Incumbents should consider pursuing integrator business models to gain distribution leadership for their in-house products as well as to scale across industry boundaries, where consumption will increasingly get fragmented across multiple players.

BUNDLE BASED ON CUSTOMER CONTEXT

Integrators capture data across the consumption ecosystem. This provides them a unique ecosystem position to create customer-relevant bundles. Integrators with the best bundles will eventually attract distribution partners.

Incumbents that build out integrator business models should actively use consumption data captured to curate API bundles and resell these bundles.

This also enables integrators to improve margins on the APIs that they serve to the consumption ecosystem as they can charge a premium for the higher value added through bundling and mash-ups.

BUNDLE CORE CAPABILITIES WITH INTEGRATOR POSITION

Integrators which merely serve as a switchboard connecting APIs from the production ecosystem to partners in the consumption ecosystem will see their margins erode over time and lose competitive advantage. To create and capture a larger value pool, integrators often bundle proprietary capabilities on top of ecosystem products.

Incumbents playing at the integrator position may bundle core capabilities, including KYC, fraud mitigation, AML checks, and credit scoring, to increase the margin captured. In the absence of core capabilities and/or value added through bundling, integrators may risk becoming commoditised as they may not add sufficient value as an intermediary beyond connecting the production and consumption ecosystems.

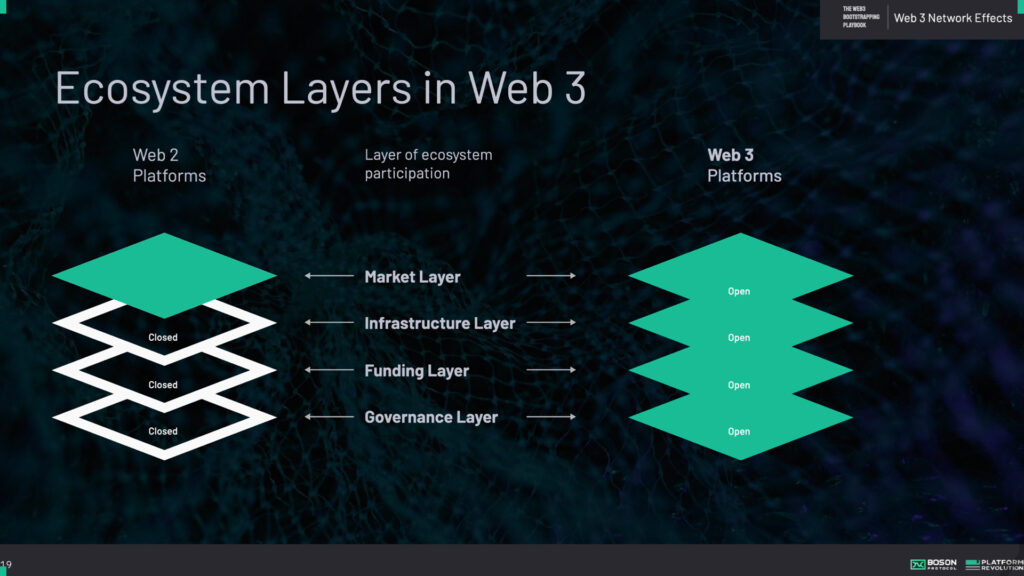

The Web3 Bootstrapping Playbook launches next week

We’re all set to launch our much awaited Web3 Bootstrapping Playbook next week. Stay tuned and sign up for the waiting list if you haven’t already. You’ll be the first to receive a copy.

SIGN UP NOW

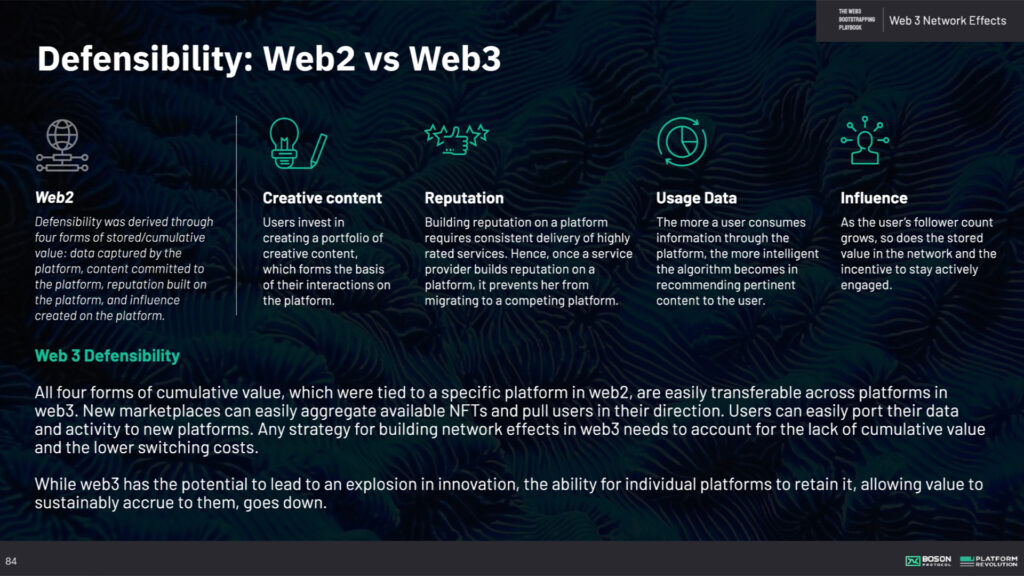

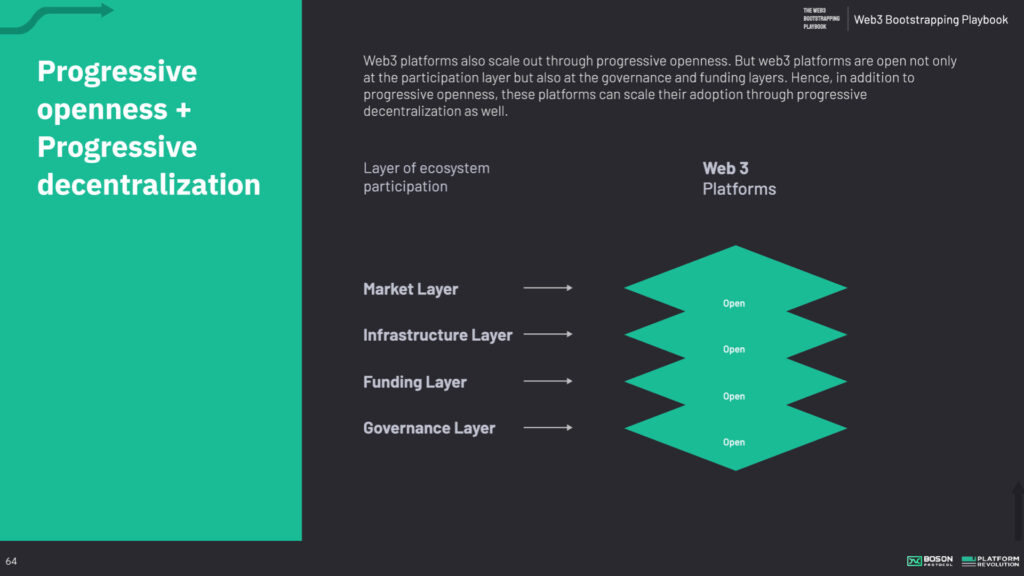

And here’s a sneak peek at the content launching in this playbook:

Stay tuned for the big launch next week!

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter