Competition

The lego-blocks for the future of healthcare

BigTech platform strategies in new industries

When every company becomes a tech company, every industry will stack up like a tower of lego blocks.

BigTech platforms are setting up their own set of lego blocks to create control points across the healthcare value chain.

These lego blocks extend across data infrastructure, data acquisition plays, and patient-facing services.

Think of the overall data value chain as data – insight – prediction – automation. Google, for one, is setting up its lego blocks across every layer of this data value chain.

This issue of the newsletter dives into Google’s strategy to illustrate this shift.

But first, to understand the platform economy in the 2020s, get your copy of the Platform Economy report:

Get the 90-page report here

When software eats the world, the world takes the shape of software

Modularity is inherent to code. Right from functions and objects, all the way up to micro-services and APIs, every abstraction of software allows for modularity.

Modularity is a fascinating concept. Modularity enables specialization. By making code modular, teams of programmers can work and coordinate their activities.

More importantly, modularity enables recombination. This is the real lego-like advantage. By setting up the basic building blocks modularly, programmers benefit from reusability and recombination.

What started with software is now shaping the real world as our organizations digitally transform. First, organizations that were built monolithically (much like 1980s software) operated in silos. As they transform to cloud-based infrastructure, firms can now more easily open to external participants and recombine internal and external resources.

But more importantly, as firms across the value chain move to the cloud and start communicating and coordinating through APIs, this modularity starts playing out across the entire value chain.

As a result, firms can specialize and can recombine towards new business models. Vertical integration can be much more selective. Data can enable new forms of horizontal integration where a single firm may capture market access (e.g. Amazon Marketplace or Google Search) or set the standard for entire industries (e.g. Google’s SEO, Chromium Engine, Android, and others).

Over the next 5-8 years, we’ll see this play out in healthcare.

The new lego blocks of healthcare

Healthcare is no stranger to digitization. Electronic health records (EHRs) were originally set up to create greater transparency and interoperability. Ironically, they ended up mirroring the architecture of the power structure rather than the underlying technology, rapidly developing into closed systems centered around a few key EHR providers. There are many reasons why this went wrong, best explained in this March 2019 Fortune article.

But that’s beginning to change now, as I explain in detail in Theme #4 of the Platform Economy Report. This shift is driven primarily by two factors – increasing data interoperability and improvements in AI and machine learning – as I elaborate further in the segment below.

The first shift – increasing data interoperability – is being driven through the adoption of FHIRs or (Faster Healthcare Interoperability Resources), which create standards for data exchange, allowing developers to build APIs to access datasets across different systems.

The second shift – improvements in artificial intelligence (AI) and machine learning (ML) – changes the economics of healthcare production and delivery.

Incorporating AI into healthcare platforms takes on two broad forms. First, machine learning (ML) models that analyze structured data – imaging, genetic, EMR data etc – may be employed to study patient groups or perform diagnosis for specific patients. ML models can also be used to improve quality of medical data. Second, natural language processing (NLP) techniques process unstructured data – clinical notes, voice recordings etc – to create, enhance and enrich machine-readable, structured data. The NLP procedures turn texts to machine-readable structured data, which can then be analyzed by ML techniques.

Let’s first consider the impact of AI and ML on diagnosis. Advances in AI and ML have commoditized prediction – the ability to anticipate future outcomes based on available data. Improvements in computational speed (using superior GPUs and TPUs) as well as data processing and analysis techniques over the past decade have worked together to bring down the cost of predictions based on machine learning, thereby commoditizing them.

At the same time, greater investment and regulatory push towards data interoperability increases the availability and accessibility of data, making predictions more accurate as well as more applicable across a wider scope of diseases.

The commoditization of predictions reduces the cost of medical diagnosis, which can now be increasingly performed by machines. This, in turn, makes it feasible to perform diagnosis more frequently and easily. For chronic diseases, in particular, cheaper diagnosis, allowing for wider testing, may enable early detection and effective treatments. An increasing number of diagnoses may be performed as ongoing assessments to aid disease management outside the care facility, either self-administered by the patient or by an in-home care provider. Further, doctors and radiologists can now spend less time diagnosing, allowing their team to be freed up for other activities, in particular making more granular judgments on the appropriate intervention on the basis of these diagnoses.

Next, consider the impact of NLP techniques on extracting information from unstructured data. This, again, has important implications. For instance, a home-based voice assistant can better capture patient data without requiring the patient to visit a care facility. By commoditizing data capture, the frequency of data capture may be increased, allowing for superior disease monitoring. Extraction of data from voice also plays an important role in the effectiveness of telehealth, where data may now be extracted from remote patient consultations more easily, making telehealth interventions more effective. Finally, the ability to extract data from unstructured notes and voice records reduces operational overhead for doctors, allowing clinical staff to serve a larger number of patients.

Effectively, improvements in AI and machine learning, coupled with increasing data interoperability, further reduce coordination costs. These two shifts are driving the rise of platforms in healthcare.

Further, care is being unbundled from the physicality of the healthcare provider. Unbundled care may be provided remotely, may be self-administered, or may enable other combinations of organization architecture. Theme #4 of the Platform Economy Playbook explains this further.

First, the proliferation of sensor-enabled wearables has led to an increase in self-assessment by consumers as well as remote monitoring of patients by providers.

Next, urgent care clinics and retail medicine have also increasingly unbundled care from traditional institutions. As patients move to alternate channels, hospitals are increasingly shutting down, further driving specialization of actors.

The use of telehealth has further been accelerated by the pandemic as patients prefer avoiding visits to care facilities and payers extend their reimbursement policies to cover telemedicine.

Parts of primary and specialized medicine are also unbundling from large hospital networks and operating as specialized independent entities, driving further modularity in the healthcare delivery landscape.

On the other hand, remote monitoring solutions with integrated messaging and alert systems enable care providers to monitor patients remotely. Remote monitoring is particularly relevant for chronic disease management and for eldercare.

Overall, this unbundling enables a more multi-channel patient journey. This, again, is enabled by:

- Increasing data interoperability (enabling centralized data accumulation across distributed processes and channels), and

- Improvements in AI and ML (enabling centralized decision support across distributed processes and channels)

When software eats the world, the world behaves like lego

Feel Free to Share

Download

Download Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

Infrastructural plays

In a previous blog, we explained why value creation will increasingly from market access gatekeepers to infrastructure providers over the course of the 20s.

While the economics of aggregators encourages standardization of the transaction, the economics of infrastructures favours producers who scale up, and as a result, consume more infrastructure over time.

Healthcare is quite likely poised for such an infrastructure shift. As unbundling allows care to be delivered through many different sources and channels, new data infrastructure will be required to coordinate the patient journey across these various channels and sources.

This is possibly the biggest play for Google, Microsoft, and Amazon. Consider Google’s infrastructure-dominant play, as laid out in Theme #4 of the Platform Economy Report. A summarized extract below outlines several lego blocks at the infrastructure layer.

Google aims to provide data storage, processing, and management infrastructure to a wide range of actors in the healthcare production ecosystem.

- Data storage and management: Google’s G Suite for healthcare is a HIPAA-compliant cloud service which is positioned as an alternative way for healthcare firms to share files (X-rays, CT scans etc.) without being restricted by the constraints of EMRs.

- Data logistics and interoperability: The healthcare industry’s shift towards FHIRs (Faster Healthcare Interoperability Resources) enables greater interoperability and innovation around healthcare datasets. Apigee, an API management company acquired by Google, was one of the early movers in building FHIR-based APIs. Google Healthcare API enables health care providers to store and access healthcare data in Google Cloud. The API also enables connectivity between traditional care systems and applications hosted on Google Cloud.

- Data standardization and innovation: Google’s DeepMind enables access across diverse, siloed data from EMRs, devices, and clinic software in a standardized format. This standardization enables new innovation by allowing analysts and app developers to analyze different data elements in one standard format.

- Information indexing and querying: Google’s BigQuery enables healthcare providers to develop personalized therapies for patients by combining and analyzing multiple datasets – genomics data, insurance claims, public health data, and environmental data – with EMR/EHR records.

- Google’s DeepVariant provides an open-source deep learning tool for genomic analysis, aimed at the life sciences industry. As more researchers build on top of Google Cloud, Google becomes a more integral part of the healthcare infrastructure.

Data acquisition plays

Data sources are complements to data infrastructure. If you own the infrastructure in which data is processed and managed, you want to selectively extend your ownership to certain key data sources infrastructure customers will need. This selective vertical integration where you control the infrastructure and its data complements enables greater control across the value chain.

Google bundles data capture tools, which act as important complements to the data infrastructure platform.

Google’s MedicalDigitalAssist uses speech recognition to transcribe conversations and extract relevant notes by recognizing medical terminology and other relevant keywords in the discussion, with the goal of helping doctors with note-taking and paperwork.

Suki, another complement to Google Cloud – is a voice assistant capability to help physicians with administrative tasks like documentation or EHR information retrieval.

Google’s Study Watch, by Verily, is another important complement to its infrastructure and may be deployed in clinical studies to collect physiological data from volunteers, eventually stored in Google Cloud. These datasets may eventually be accessible to researchers using Google’s infrastructure. As Google expands, it is likely to further open up the platform to other dataset providers, particularly organizations that are already using Google Cloud to store their research datasets.

Stitching together the data value chain

With that, we have Google’s lego blocks set up across data, insight, prediction, and…

Google’s final set of lego blocks play in the automation space. A few highlights again from Theme #4 of the Platform Economy Report.

Surgical capabilities, enabled by robotics, also act as complements to Google’s infrastructure platform. Verb Surgical – created by Google’s Verily and Johnson & Johnson – is building out robotic surgery complements that aim to use machine learning capabilities in Google’s platform. These robotic surgery tools are aimed at augmenting surgeons’ abilities to perform surgery.

Google’s venture fund investments include Klara, a system to automate workflows across the patient’s care journey, including scheduling, pre-visit instructions, reminders and no-show engagement. It integrates with hospital EHR and practice management systems and may, in future, be bundled with Google’s infrastructure proposition to healthcare providers.

Nest – Google’s home automation subsidiary – is targeting assisted living facilities. and nursing homes in the eldercare market. For instance, Nest has indicated using its motion sensor to track movements and automatically turn on the lights when seniors get up in the middle of the night.

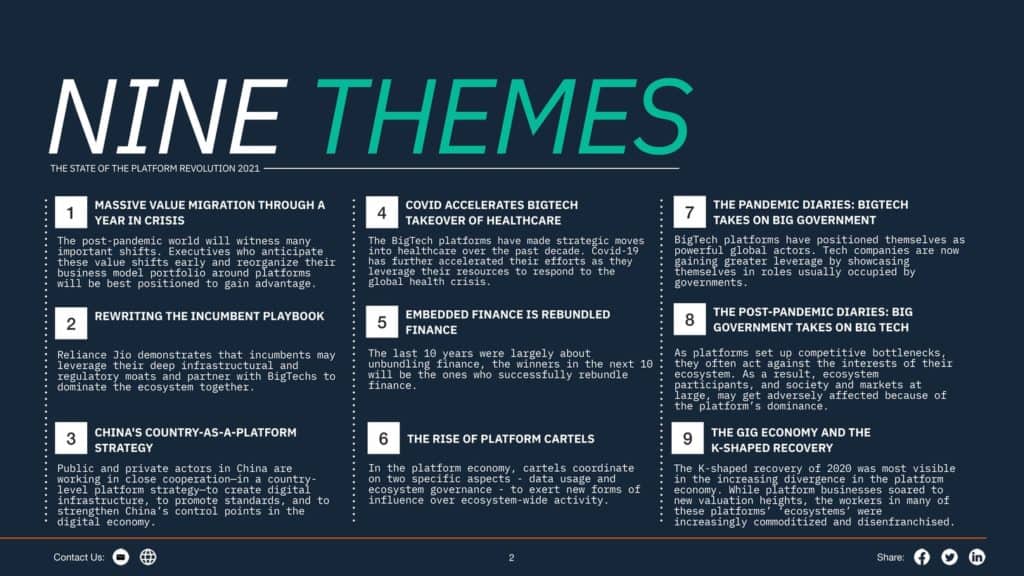

Nine big themes for the platform economy

If you enjoyed reading this analysis of the healthcare value chain, you should check out our in-depth analysis of big themes in the platform economy moving forward.

The report covers nine key themes that will define the platform revolution moving forward.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter