Competition

Online grocery platforms: Facebook, Reliance, and the post-pandemic platform economy

Covid-19 is driving value migration across industries. As I’ve explained in my previous articles on the food delivery industry and the entertainment industry, these shifts gain permanence when a combination of demand-side and supply-side effects reinforce each other.

We’re currently seeing that combination of effects in the online grocery shopping industry.

This issue of the newsletter explores these demand-side and supply-side effects. In particular, it looks at:

- The shift to online grocery shopping is driving the rise of super-apps across emerging markets. Online grocery is the killer app driving the next phase of platform penetration in these markets.

- WhatsApp is applying the WeChat playbook to non-China markets – combining payments with communication to create the platform that rules them all.

- China, again, is interesting: A combination of demand-side and supply-side effects have kept online grocery going over there.

- Retailers are reinventing defunct stores as dark stores and fulfilment centers.

- Mid-sized chain retailers stand to lose the most. They’re too large for the aggregators but too small to become one themselves.

In this context, Facebook’s moves in India, Brazil, and Indonesia, are particularly interesting. All three moves have been waiting to happen.

But the pandemic has created the perfect petri dish for this massive online grocery experiment that Facebook is banking on to unlock the next level of growth.

Let’s get started!

And if you’d like to discuss the ideas in this post further, please join the discussion on LinkedIn at this link.

Online grocery shopping in the midst of a massive shift

Grocery has stayed relatively resistant to the rise of e-commerce owing to several factors.

- The economics of fulfilment for non-standard picking-and-packing orders is very different from the economics of fulfilment for standardised package orders.

- Many grocery use cases involve perishable inventory which requires different supply chain considerations and involves supply chain waste costs which need to be managed.

- Pre-pandemic, and especially in emerging markets, the presence of the local neighbourhood store – sometime with home delivery – ensured immediate access to grocery.

All that changed with the pandemic.

I’ve had a ringside view on the rise of online grocery during the pandemic – I’ve advised several online grocery firms and serve on the Statutory Committee on Digital Transformation and Innovation at Grupo Pao De Acucar, the largest grocery retailer in Latin America.

There are a combination of multiple demand-side and supply-side shifts that are playing out which will result in a long-term shift in consumer behaviour and value chain bargaining power.

Let’s look at each of these in turn.

Demand-side effect:

Online grocery will drive the rise of super-apps globally

WeChat was the first – and till date, the most credible – super-app (even as Grab and Gojek catch up).

But with the increasing demand for online grocery, we’re going to see a shift towards super-apps across emerging markets, starting particularly with India, Brazil, and Indonesia. Facebook and Google both want to be part of unlocking this huge market and have mirrored each other’s investments in India and Indonesia.

Facebook has always maintained that WhatsApp has WeChat-like potential as a super-app. Now that Whatsapp’s founders have moved on, it’s making more aggressive movement in that direction.

Let’s look at India first.

Facebook and Google realise that online grocery shopping holds the key to expansion in emerging markets.

Feel Free to Share

Download

Download Our Insights Pack!

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

Indian online grocery gets its own version of Shopify

Facebook’s investment in Reliance Jio is essentially aimed at creating a Shopify-style infrastructure platform for India’s unorganised retail (or ‘kirana’ stores). At the core of this Shopify-style infrastructure platform are two key assets: Facebook’s WhatsApp and Reliance’s JioMart.

WhatsApp is a messenger service with 2 billion users worldwide, with 400 million Monthly Active Users (MAU) of that user-base residing in India, making it by-far the largest market – Brazil, lags behind a distant second with only 120 million MAUs.

JioMart, on the other end of the spectrum, is a joint venture between Reliance Retail, India’s largest retail chain, and Reliance Jio Platform, the biggest telecom network in India with over 385 million subscribers. The joining of these platforms – WhatsApp and JioMart – will create great potential to enhance business opportunity in India.

Whatsapp will essentially host storefronts and manage payments. JioMart manages fulfilment by assigning a neighbourhood store to every WhatsApp order and managing order fulfilment, invoicing, and dispatch.

Smaller delivery companies – Grofers and BigBasket, two pure-play online grocery companies, will also be targets of acquisition or will have to partner with the larger players. BigBasket has started accepting orders on WhatsApp.

WhatsApp Pay holds the key

WhatsApp’s payments play holds the key to Facebook’s growth in emerging markets and to capitalising on the shift to online grocery.

WhatsApp is the leading messaging app in India, Brazil, and Indonesia. Getting approval for WhatsApp Pay will allow Facebook to own the end-to-end tech stack for enabling online grocery for small retailers.

Facebook launched WhatsApp payments for Brazil in June. Brazil’s top banks came together to oppose this and the payments system is temporarily suspended. Meanwhile, in India, WhatsApp’s efforts to launch UPI-based payments finally received the nod in February 2020, after being held up for a couple of years.

Facebook, Google, and WeChat’s parent Tencent have all invested in Gojek, Indonesia’s leading super-app.

Facebook and Google realise that online grocery shopping holds the key to expansion in emerging markets. As this space consolidates, power will increasingly shift away from the smaller stores towards large central platforms.

Supply-side and demand-side effects:

Online grocery shopping in China

As with Facebook’s WhatsApp push, the importance of chat-based communication as the underlying layer for a super-app play is becoming all the more evident during the pandemic.

Nowhere is this more evident than in China. Again, it’s helpful to identify the supply-side and demand-side effects at play.

On the supply side, superior AI-backed supply chain management enabled China’s delivery systems to remain resilient during lockdown:

Alibaba’s Cainiao network, for example, supports the supply chains of the merchants it serves via an AI-enabled digital inventory system that links the online and offline shopping worlds, in which merchants’ physical stores serve an extended distribution network. As a result, almost as soon as the lockdown was declared in Wuhan, Alibaba was shipping medical and food supplies into the province.

On the demand side, chat-based super-apps have served as a mechanism for demand-side coordination to manage last-mile delivery.

In the gated communities and neighborhoods that characterize Beijing, for example, residents have organized small groups of volunteers via group chat apps to receive supplies at the gate for the whole community, box them for each household, and deliver them to people’s doorsteps.

Supply-side effect:

The Walmart online grocery revival = Automation + Dark Stores

As the demand for online grocery increases, incumbents will invest in new innovations – both in technology and in business model.

Walmart is investing in automation of delivery and in redesigning delivery models.

Walmart will have Brain Corp’s self-driving robots in 1,860 of its more than 4,700 US stores by the end of the year. It will also have robots that scan shelf inventory at 1,000 stores and bots at 1,700 stores that automatically scan boxes as they come off delivery trucks and sort them by department onto conveyer belts by the end of the year.

Brick-and-mortar retailers are increasingly implementing solutions like curb-side pick-up, to ensure safe distancing, while re-purposing their stores as fulfilment centers. Whole Foods converted stores in LA and NY to dark stores. In other industries, Bed Bath & Beyond also plans to transition a quarter of its stores into regional fulfillment centers.

Meanwhile, other incumbents are looking to partner with platforms to make quick moves when their internal transformation efforts are too slow.

Retailers are partnering with delivery platforms – for instance, Carrefour partnered with Uber Eats to strengthen its grocery home deliveries.

At the other end of the spectrum – the small and independent stores –Instacart has partnered with C&S Wholesale Grocers— a grocery supply company that represents more than 3,000 independent stores. This allows participating C&S stores to avail of Instacart’s same-day delivery service.

Even as the large incumbents transform and the smaller incumbents partner with platforms, the ones in the middle may end up being the biggest losers.

The real losers from the swing toward digital grocery shopping are likely to be the regional grocery chains such as Ingles Markets Inc. or Publix that have already suffered in recent years as customers have shifted their grocery dollars away from supermarkets to warehouse clubs, discounters such as Aldi or even Dollar General Corp. Smaller, traditional grocers simply don’t have the massive capital.

Further reading:

- Read how dark stores and dark kitchens will accelerate post-pandemic, leading to greater consolidation across the value chain as aggregators integrate backwards.

- Read about the shifts in the entertainment value-chain as a result of Covid-19. Interesting issues at play here. As Covid19 forces reimagination of both retail assets and the movie-watching experience, Walmart is looking to capitalise on both by converting its parking lots into drive-in theatres. More on this in the next issue.

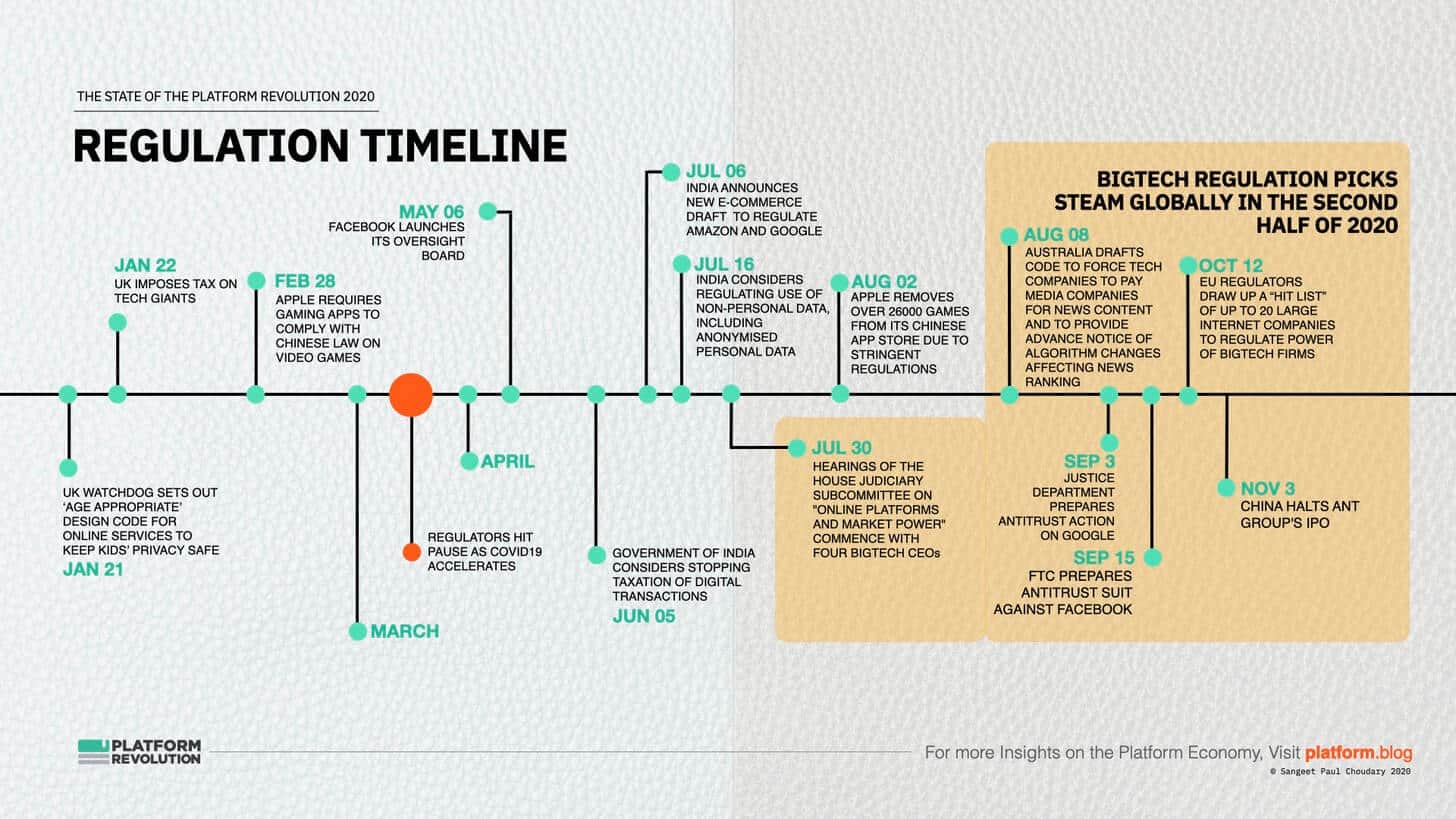

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter