Concepts

How to win at Generative AI

A couple of weeks back, I wrote a post on How to lose at Generative AI.

Which raises the counter-question, how do you win at Generative AI?

Of the many GenAI copycats emerging, which are the few that win?

This post is about winning at Generative AI.

It’s long.

Let’s grab that skinny latte before we get into this one.

…

Let’s do this!

How to win at Gen AI – The Abstract

The devil lies in the details.

But let’s soar at 30,000 feet for a bit before we sky-dive into the details.

Every shift in technology creates an opportunity for value migration.

The current hype in Gen AI – fuelled largely by the all-knowingness of ChatGPT – is largely focused on the foundation model layer. Foundation models, however, are context-agnostic – a feature, and not a bug, of the all-knowingness that they come with.

I believe that we will see new value plays in Gen AI as value migrates away from the foundational model layer.

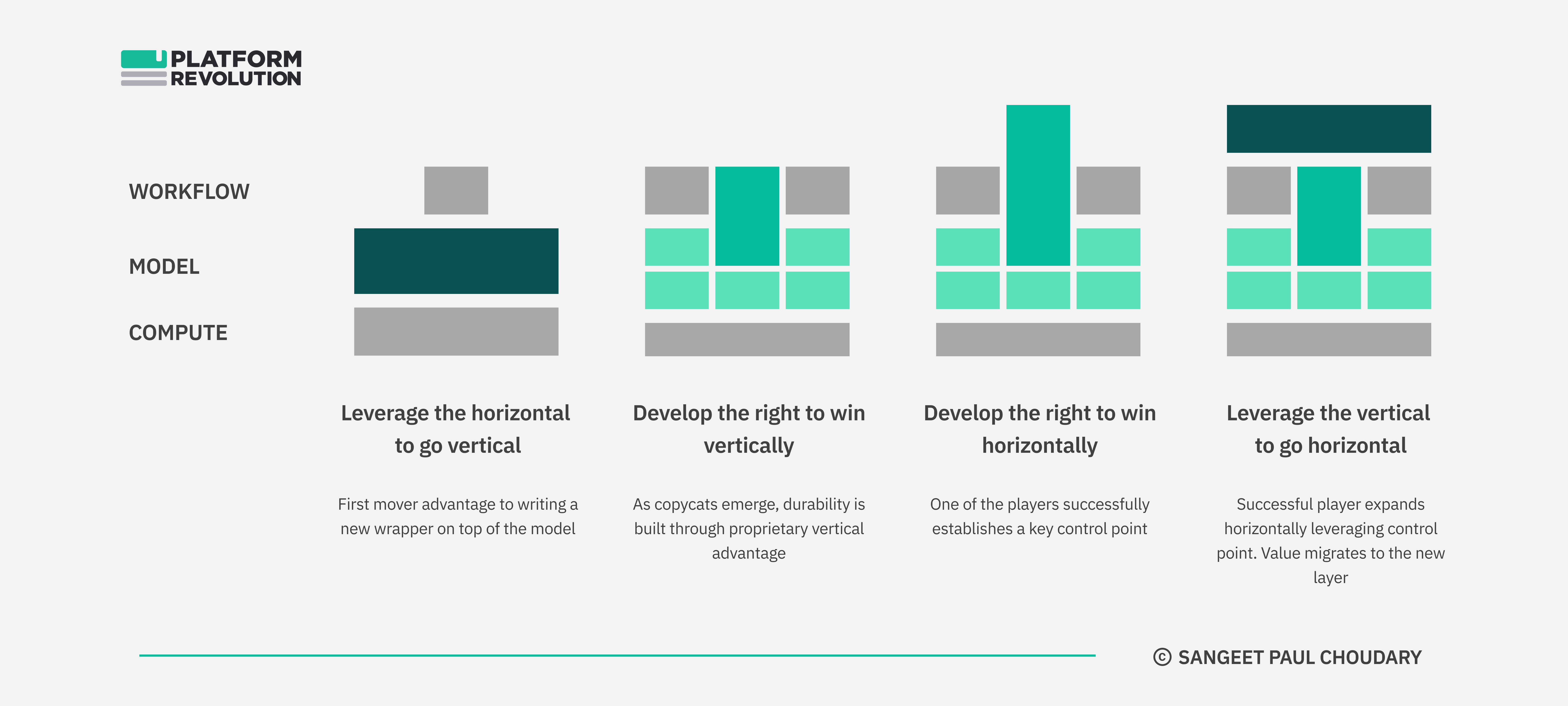

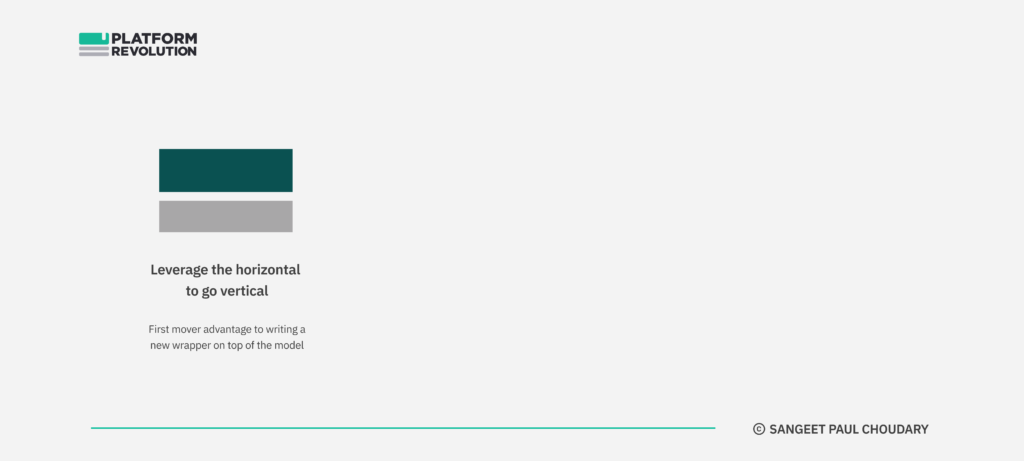

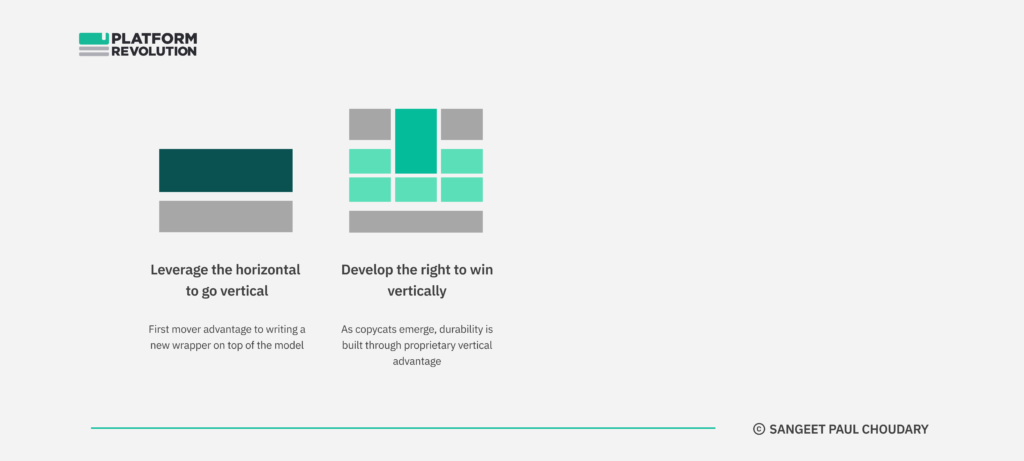

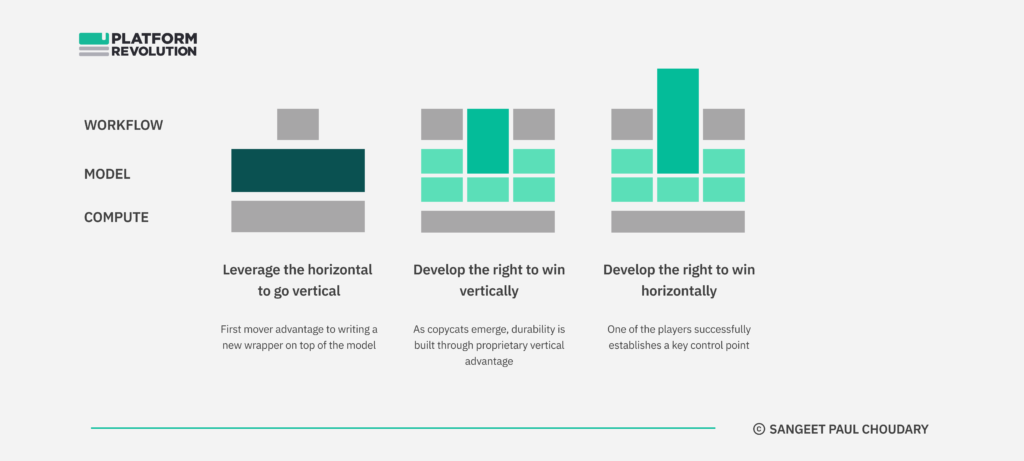

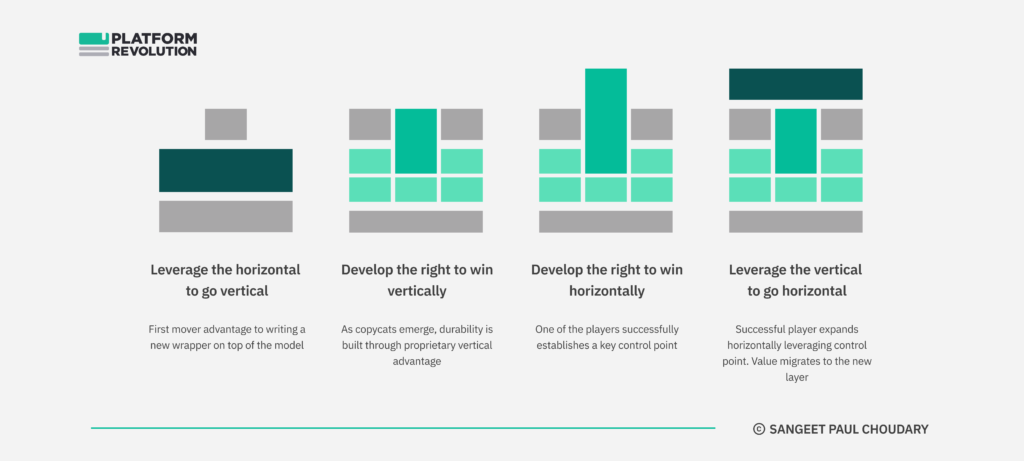

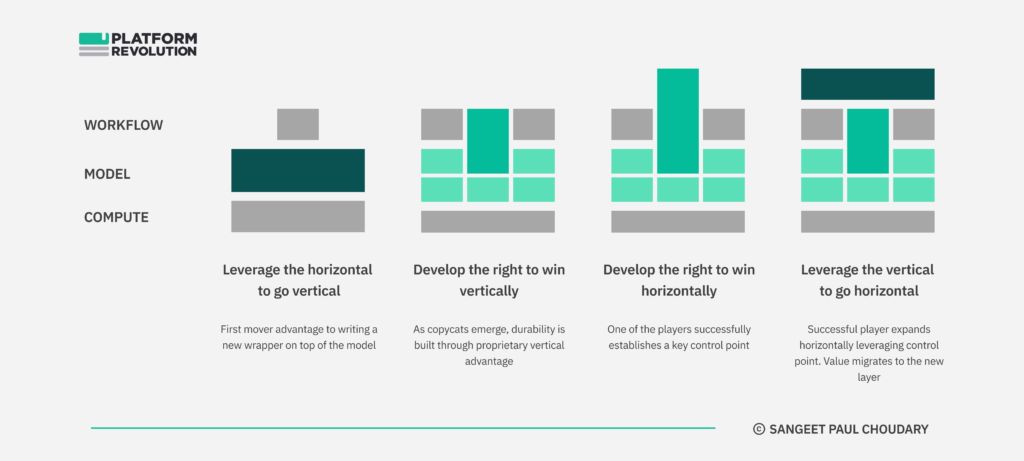

Firms that exploit this value migration to their advantage will need to follow a four-step process:

- Leverage the horizontal to go vertical (Unbundling starts)

- Develop the right to win vertically (Unbundling successful)

- Develop the right to win horizontally (Rebundling starts)

- Leverage the vertical to go horizontal (Rebundling successful)

Here’s how this evolution plays out across the value chain.

Step 1: Leverage the horizontal to go vertical

A foundational model takes the market by storm and establishes horizontal dominance at the model layer.

At this stage, a range of ‘startups’ emerge at the workflow layer to verticalize this horizontal model. We’ve seen this play out over the past year as a whole host of AI ‘wrapper’ copycats emerge. The value continues to sit entirely at the model ‘horizontal’ during this step.

Unbundling starts:At this point, these ‘startups’ have started making their first feeble attempts at unbundling a horizontal foundational model into a vertical use case.

Step 2: Develop the right to win vertically

A few of these ‘startups’ may develop some sort of vertical advantage (a proprietary fine-tuned model, access to vertical data sets, a vertical-specific UX advantage, or some combination of all the above) and leverage that advantage to pull value into a vertical play.

Successful unbundling: At this point, a few successful unbundlers emerge with the right to play and win vertically. The other AI ‘wrapper’ unbundlers rapidly get commoditized if they rely largely on the foundational model, without any proprietary advantage of their own.

Step 3: Develop the right to win horizontally

This is the key step.

Having developed vertical advantage, a very small number of the firms that succeed in Step 2 will find themselves owning a key control point through their vertical specialization – an advantage that gives them primacy of user relationship in that vertical. I’ll get into the nature of these control points and how to build one.

These few firms will leverage this newly developed control point to start rebundling ‘over the top’.

Rebundling starts: At this point, a select few ‘startups’ emerge laying claims to the right to rebundle value at a higher (workflow) layer.

Step 4: Leverage the vertical to go horizontal

As rebundling progresses around the control point, this ‘startup’ now emerges as the hub into which other players connect. It successfully creates an ‘over-the-top’ layer coordinating across multiple capabilities.

Successful rebundling: And with that, we have the new winner. Value is successfully rebundled and migrates to this new layer (and player).

This inevitable cycle of unbundling and rebundling is key to value migration when a new tech like Gen AI comes in. I’ll explain shortly how this cycle determines winners and losers and how to use it to your advantage.

As you’d have figured, this post is about going from wrapper to winner; we’re not talking about value at other layers of GenAI tooling. There will be winners in LLMOps and Compute, determined largely by engineering, scale, and talent advantages. But this post is about winning while delivering GenAI into a product.

Let’s now dive into the juicy details.

The mediocrity of wrapper unbundling

What exactly do wrappers do?

They try to unbundle. And they’re pretty mediocre at it!

Foundational models are horizontal. User needs are vertical.

Foundational models claim to have a probabilistic answer to just about everything.

They’re fascinating to the casual user as they seem to have an opinion on everything. This partly explains why ChatGPT was the fastest ever to get to 100M users and why lazy conversations at weekend dinner parties have shifted from discussing Sam Bankman-Fried’s wardrobe choices to ‘Is ChatGPT going to eat your job?”.

Yet, foundational models are not as useful to the specialized user. Getting them to produce the specific output that is most useful to you requires a very specific set of prompts.

Enter the world of prompt engineering – a fancy term to stumble your way (often through trial and error) to a prompt that works best for delivering the most useful and usable output.

A well-structured prompt unbundles a foundational model into an end user use case.

A wrapper essentially packages this unbundling in a user-friendly interface.

So wrappers verticalize a horizontal foundational model.

But this verticalization doesn’t really amount to successful unbundling unless the wrapper creates a proprietary vertical advantage.

GenAI wrappers: Developing vertical advantage

So how do wrappers actually develop proprietary vertical advantage?

Here’s the simple GenAI wrapper playbook for developing vertical advantage:

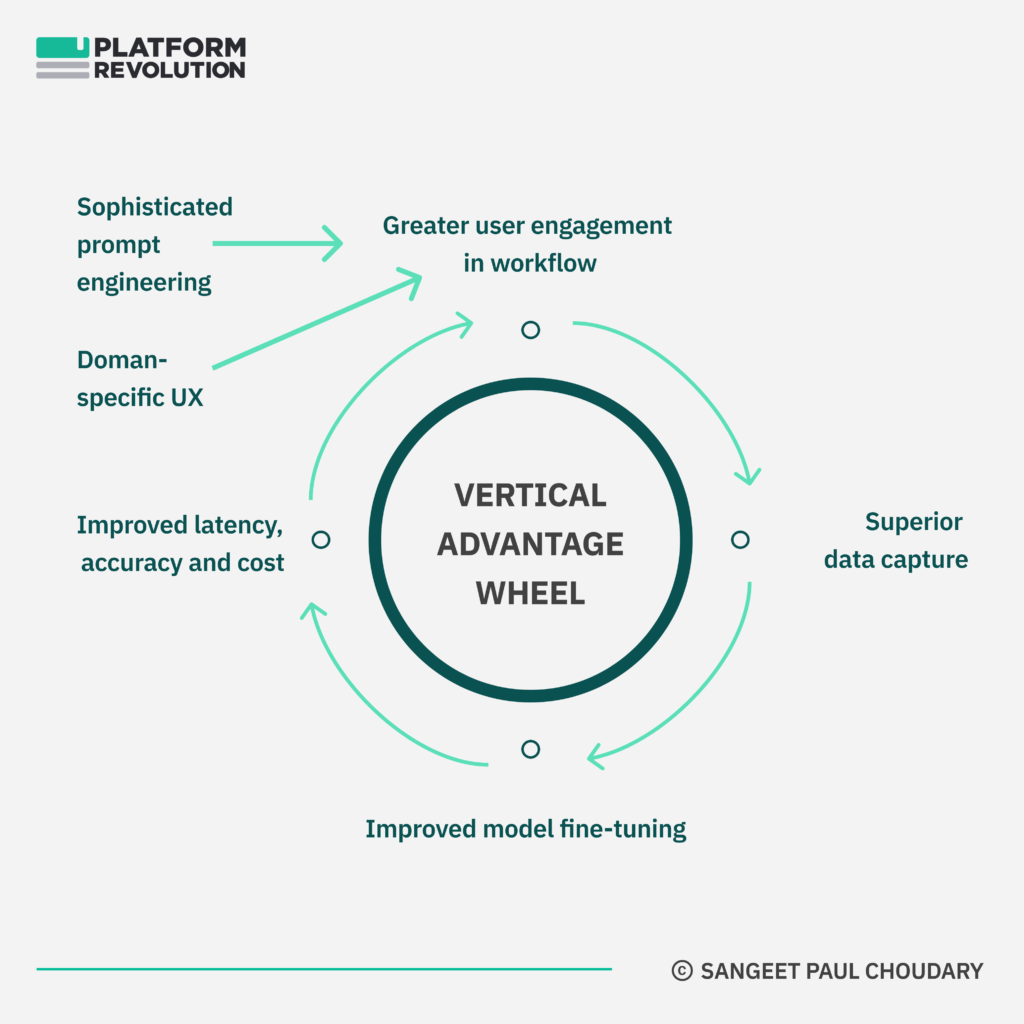

- Sophisticated prompt engineering + Well-crafted UX drives Workflow engagement

- Workflow engagement drives rich data capture

- Data capture aids model fine-tuning

- A fine-tuned model drives greater workflow engagement

Here’s a simple flywheel explaining this:

Prompt engineering + well-crafted UX help drive initial adoption. A wrapper turns the end-user’s non-sophisticated input into a well-defined prompt (largely collapsing end user costs of iterating to the right prompt through trial and error), which helps generate a highly useful and usable output.

Vertical solutions like Harvey, Ironclad, and Bloomberg GPT largely follow this playbook to build vertical advantage around their initial ‘wrapper’ unbundling.

Model fine-tuning helps build proprietary vertical advantage around what started as a basic wrapper by:

- Improving model performance for that specific use case

- Reducing model size/costs and improving model economics

Smaller models, trained on domain-specific data deliver better performance on latency, accuracy, and cost than larger foundational models. This verticalization has its own reinforcing feedback effect. The more you develop vertical advantage, the more competitive you get on all parameters.

To deliver the most compelling vertical solution over time, the more the model is fine-tuned, the more deeply coupled future UX changes should be with the model in order to deliver the benefits of that model into the user workflow.

And this brings us to an interesting conundrum in developing vertical advantage with Gen AI.

The organizational impediment to developing strong vertical advantage in Gen AI

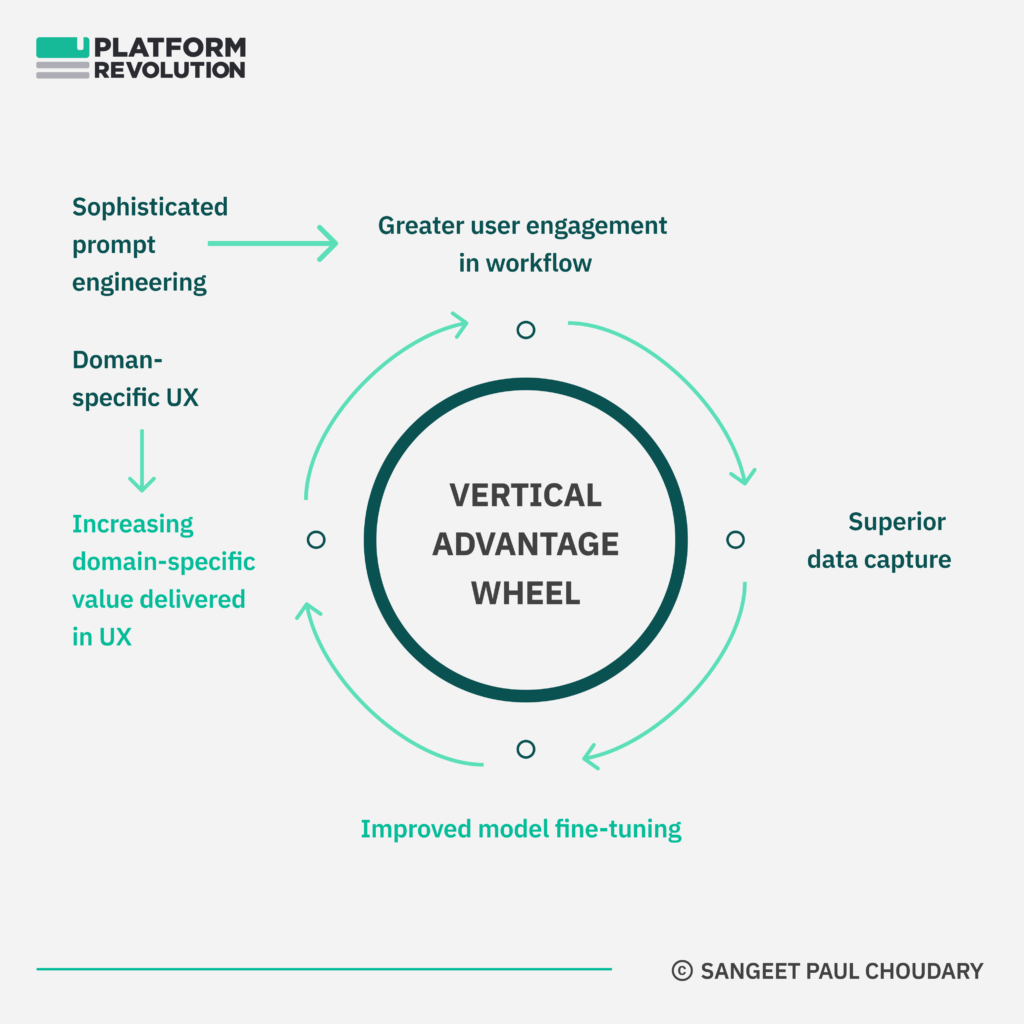

The solutions that will truly differentiate through vertical advantage are the ones which will deeply couple model improvements into UX innovation.

Late followers that lack model fine-tuning will struggle to deliver the same UX innovation without a fine-tuned model backing it.

This coupling sounds easy but can be very difficult to deliver. And therein lies a hidden source of advantage that separates the losers from the winners in vertical solutions.

But why will companies struggle to deliver model improvements into UX? Why is this a source of advantage at all?

Organizationally, model wizards are fairly removed from UX designers. The vast majority of really good model engineers and data scientists are horizontally oriented. They focus on building models that deliver on scale and scope. This is an advantage while building foundational models. But this is orthogonal to developing deep empathy for a customer pain point, which is required to deliver model fine-tuning advantages into the UX.

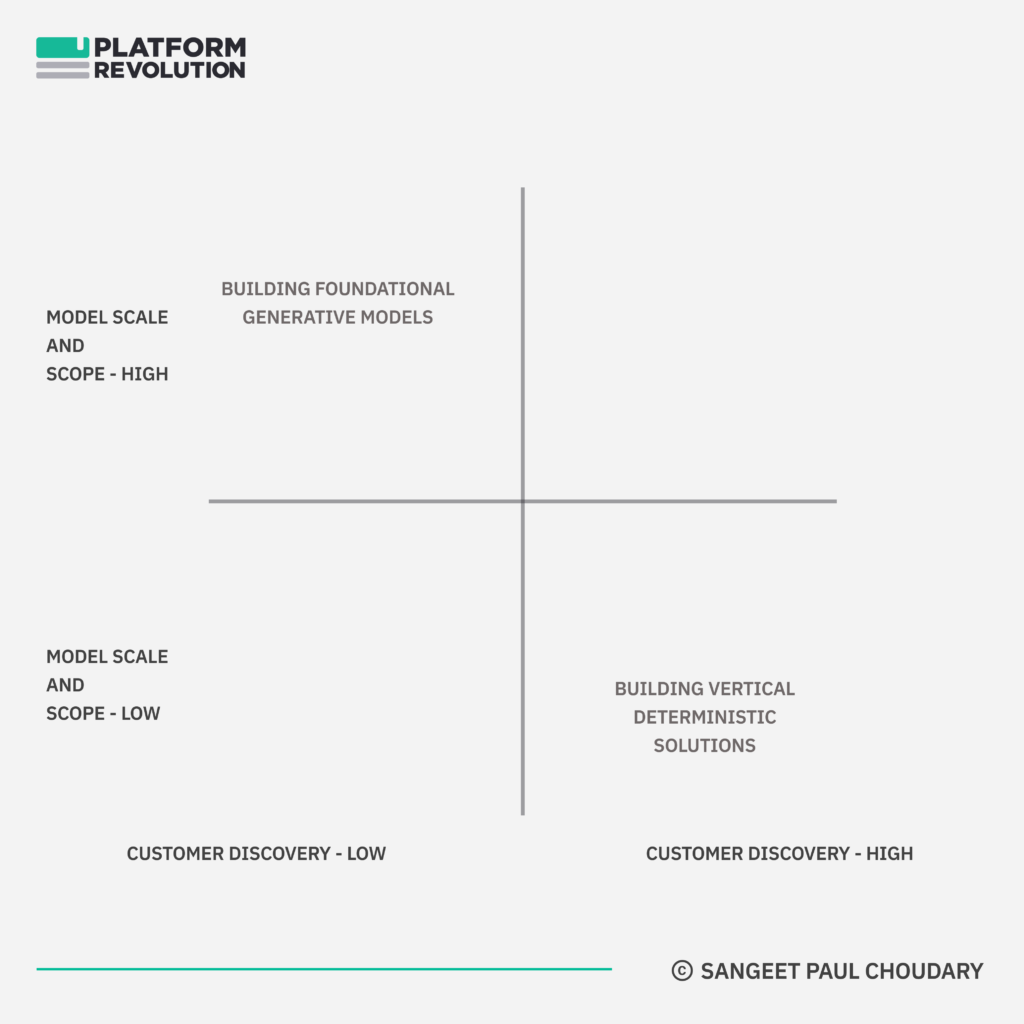

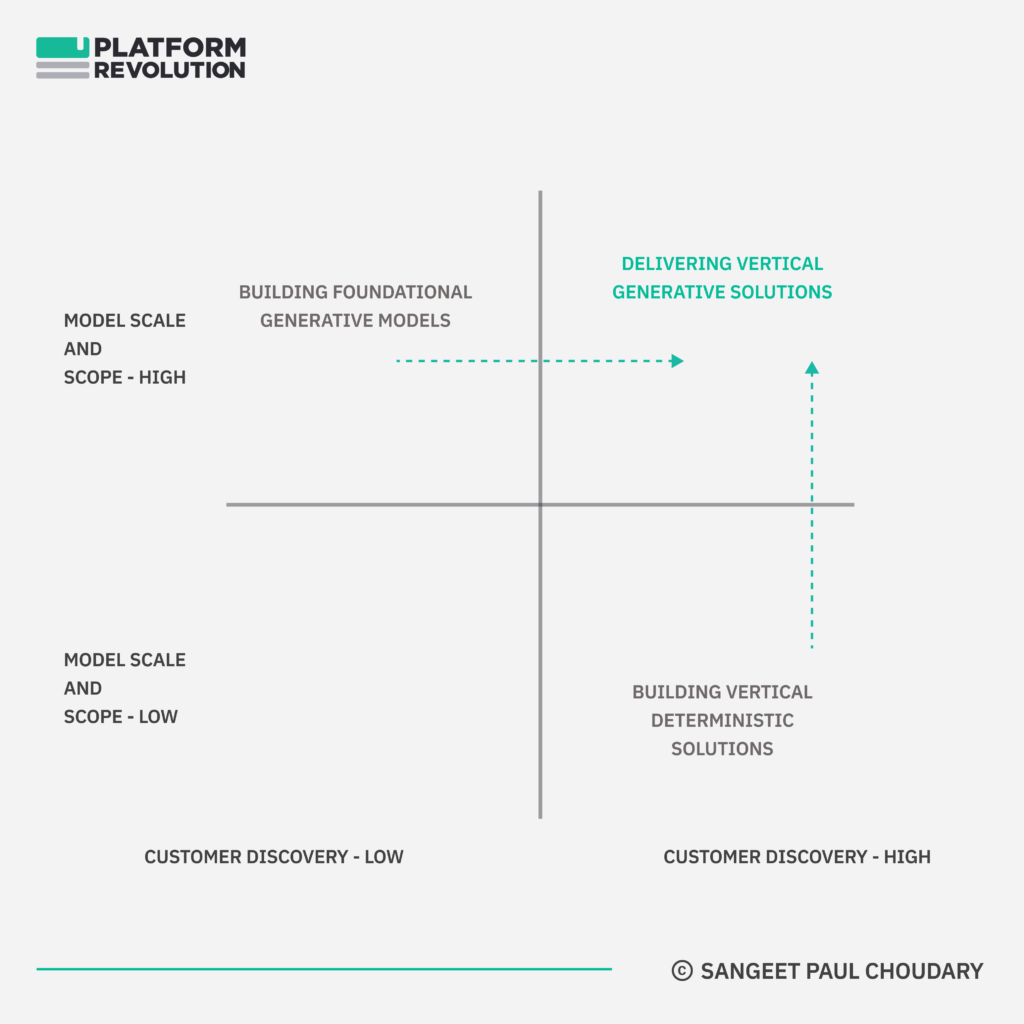

This is what this orthogonality looks like.

What’s more – most model engineers have cut their teeth building foundational models, far removed from use cases that require deep customer empathy to win. These model engineers are increasingly going to be hired into companies looking to develop vertical advantage. A minority will succeed at engaging deeply with UX designers to create a tight coupling between the two layers.

In order to develop strong vertical advantage in Gen AI (and all forms of AI in general), you will need to deliver an org model that ensures rapid development cycles in teams comprising model engineers and UX designers.

So that’s how you win as a Gen AI wrapper… by developing true vertical advantage.

But you’re still not winning at Gen AI!

Developing vertical advantage as a point solution is only the second step towards establishing a winning position with Gen AI.

The magic lies in what follows an advantageous vertical position…

To understand that, we first need to look at rebundling

Unbundling disrupts, rebundling delivers venture returns

As a vertical, point solution, you’ve now delivered successful unbundling.

Most ‘disruption’ of the status quo happens through unbundling. But most venture returns are realized through rebundling.

Fintechs specializing in one activity unbundle banks, Healthtech firms specializing in one aspect unbundle healthcare providers, and specialized energy startups unbundle utilities.

Yet, there is no sustainable value capture in unbundling. Unbundling unseats incumbents but doesn’t create scalable and defensible value pools.

That is achieved through rebundling. Rebundling involves bundling multiple unbundled capabilities into a cohesive customer-centric offering.

Most important, the successful ‘rebundlers’ establish a hub position and gain primacy of user relationship.

Venture capital chases unbundling because unbundlers hold the promise of rebundling and capturing value. Yet, most venture money is lost because a tiny handful rebundle.

Square, Plaid, Stripe are a few of the unbundling fintechs that successfully rebundled and dominated one or more horizontal layers in the value chain. Most others fell by the wayside.

The winners in Gen AI will likewise need a path to successful rebundling.

So how exactly does rebundling work in Gen AI?

The current hype in Gen AI - fuelled largely by the all-knowingness of ChatGPT - is largely focused on the foundation model layer. Foundation models, however, are context-agnostic - a feature, and not a bug, of the all-knowingness that they come with.

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

The WeChat Playbook – Unbundling and rebundling mobile app

Before we move further, it’s worth looking at where this has happened before.

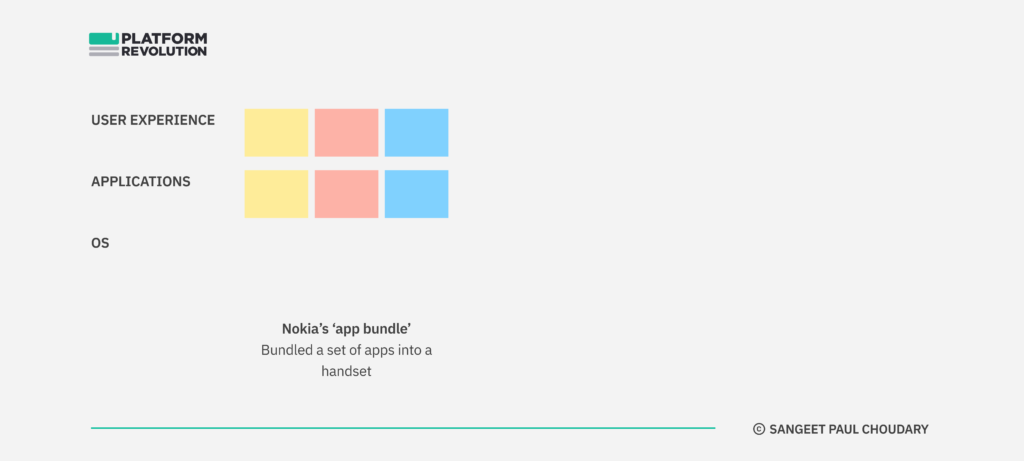

Back at the start of my career – at Yahoo – in 2006, we’d go about striking deals with Nokia and other handset manufacturers to preload our apps and take them to market. Nokia bundled different combinations of apps to create a phone and then took a portfolio of such ‘app bundle’ phones to market

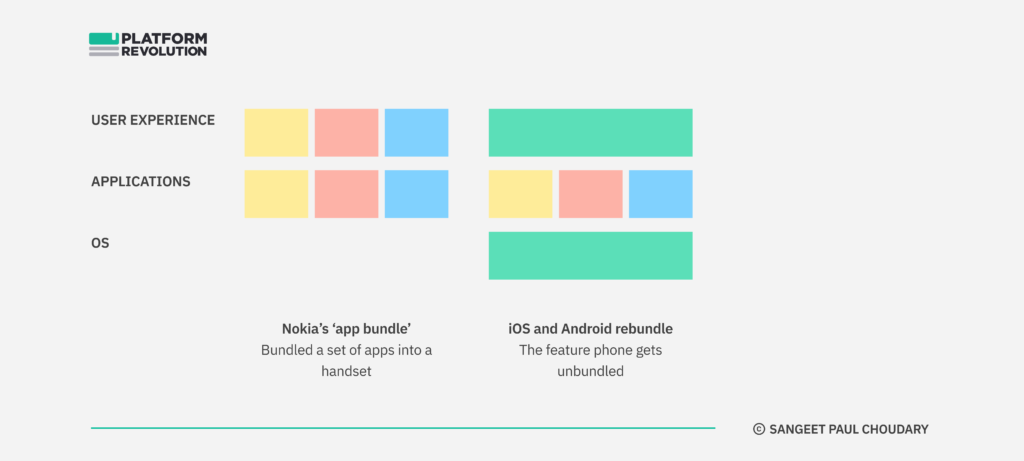

The following year, Apple launched the iPhone – and subsequently the App Store – and unbundled this ‘phone-based app bundle’ and rebundled apps through the OS and App Store. You could buy a one-size-fits-all iPhone (instead of working through Nokia’s 50+ product catalog) and create your own ‘app bundle’ to suit your specific needs

iOS and Android established themselves as the new purveyors of bundling.

Meanwhile, some – indeed most – mobile apps started out as ‘wrappers’ on underlying iOS and Android functionality, and eventually developed vertical advantage.

- Foursquare and Uber started as a wrapper on Google Maps, but developed a proprietary vertical advantage in user location data and driver supply.

- Wellness apps started as wrappers on the iPhone’s accelerometer before they captured sufficient data to build proprietary analytics.

iOS and Android served as the performance bottleneck for a lot of mobile apps (much like a model does for Gen AI wrappers). With every update to the underlying OS, the performance of the apps could be improved and extended.

But most successful apps developed proprietary advantage through data, and eventually, business models around it.

But none of them ever used this vertical advantage to create a new horizontal rebundling layer above the App Store.

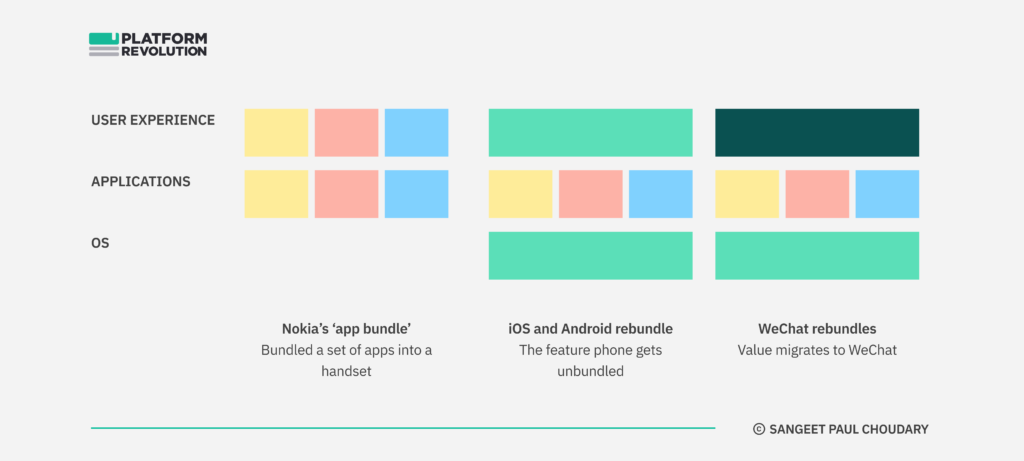

That is, until, WeChat flipped the unbundling-rebundling playbook in China.

WeChat started as an individual app with vertical advantage in gaming and communication. However, it moved on to use its dominance in communication to establish primacy of user relationship as the default communication channel. It then integrated communication with payments to control the two most important horizontal capabilities that allowed it to establish a new layer on top of the underlying OS.

Users spent most of their time inside WeChat. This enabled WeChat to rebundle the apps at a layer above the OS layer. Apps for e-commerce, gaming, media etc. could now sit inside WeChat. Users never left the WeChat workflow because of its all-in-one connective workflow of communication and payments across apps.

At one point, WeChat had such primacy of the user relationship that new OS updates from Apple and Google had no impact on the user experience unless WeChat implemented those updates into its UX.

Rebundling enables value to migrate to another part of the value chain.

WeChat is a case study in value migration where a player at another position in the value chain rebundles so successfully that previous leaders (Apple, Google) become effectively commoditized.

As long as users were running their apps within WeChat, the UX on an Apple phone wasn’t all that different from the UX on an Android phone.

The right to rebundle had migrated from the OS and App Store layers to the communication and payments layer managed by WeChat.

There are many apps that call themselves super-apps but none of them can lay claim to creating an entirely new default workflow layer on top of the underlying OS.

The key to rebundling

So who’s the WeChat of GenAI? – you’d be tempted to ask. Who gets to win at Gen AI.

First order thinkers would jump up with “Perhaps it’s Slack – owning that communication layer. Perhaps Salesforce’s acquisition makes sense after all.”

But the answer is more nuanced.

We’re not looking for the communication layer. We’re looking for the right to rebundle.

It just happens to be the communication layer in the case of WeChat but could be something else with Gen AI.

— — —

There’s a secret to rebundling. It’s widely visible and yet largely hidden.

Everyone wants to rebundle. Everyone wants to be the hub.

Yet few actually manage to.

You can’t seat yourself at the centre of an ecosystem just because you want to.

Here’s the key to successful rebundling:

You need to own the key control point that delivers primacy of user relationship

Why was WeChat so successful at rebundling. It owned the two key control points – communications and payments – that enabled it to mediate all social and economic interactions between the user and third party apps.

This brings us to the second key step in ‘How to win with Generative AI’.

Creating control points in Gen AI

Let’s look at AI; specifically at predictive AI and generative AI.

Predictive AI collapses the cost of prediction.

Generative AI collapses the cost of creation.

By absorbing the task (and associated costs) of prediction or creation, AI tools empower users with decisions and creative actions in their workflow.

A user’s workflow comprises a vast range of decisions and creative actions. Yet, there are one or two core decisions and creative actions that empower the rest of the workflow.

To create a control point using AI, you need to ensure that your AI empowers the core decision and/or the core creative action in a workflow.

That control point gives you the right to set up a hub position with AI.

The core decision… and the core creative action

What’s the one decision that’s central to your users’ workflow such that all upstream activities funnel into that decision and all downstream activities feed off that decision?

Start with that core decision!

What’s the one creative action that’s central to your users’ workflow such that all upstream activities funnel into that creative action and all downstream activities feed off that creative action?

Start with that core creative action!

Let’s look at two examples

Consider the role of AI in medicine. The core decision relates to diagnosis. For a radiologist, the core decision may relate to interpreting imaging data from a radiograph. For a physician, the core decision may involve interpreting information from an electronic health record.

Owing this core decision is a key control point. The tool that owns the core decision gains the right to primacy of user (physician/radiologist) relationship. Upstream tools (e.g. tools that convert unstructured conversations into structured EHR data) plug into this tool. Downstream tools (e.g. a remote health monitoring app that delivers feedback to the user) integrate into this tool. This tool sits in the hub position.

Or consider role of AI in publishing. The core creative action relates to substantiation of facts and editing. Owning this core creative action is a key control point. Other tools that feed inputs or leverage this source of truth and edited output plug into this hub position.

Unless you own the core decision or core creative action, and unless your fine-tuned model powers it, you are unlikely to gain a hub position in the workflow.

Going back to the Salesforce-Slack example above, you could own the horizontal communication layer and yet get commoditized by an app that operates on the layer if that app empowers the core decision and/or core creative action.

Establishing a hub position

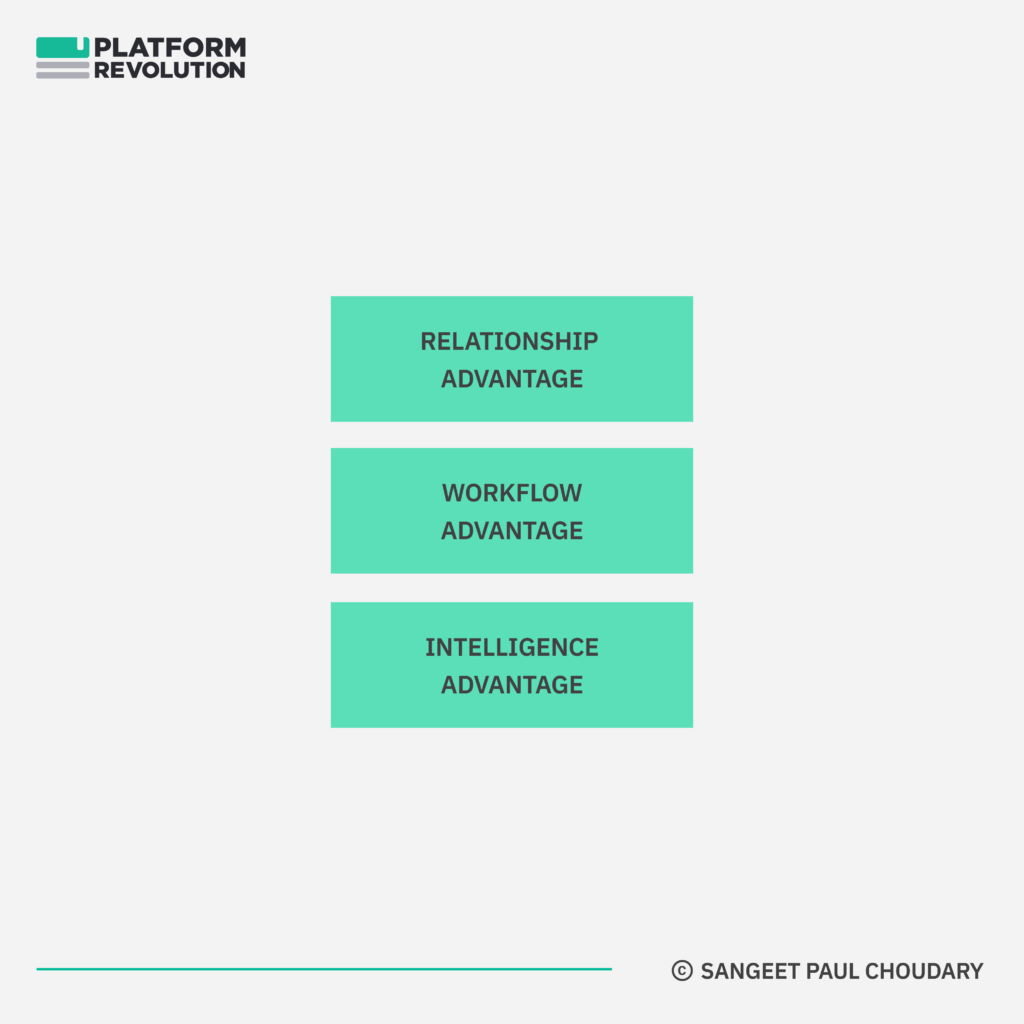

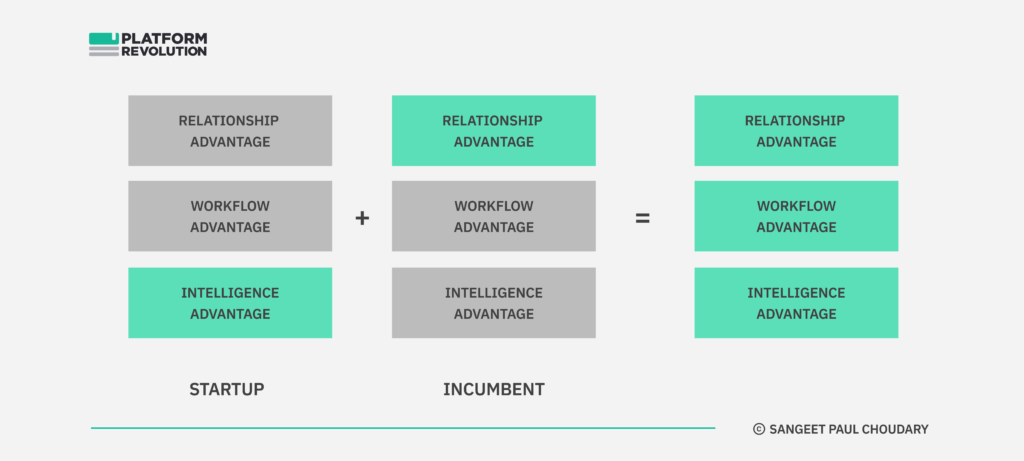

There are three key sources of advantage for a hub position. Most players vying for the AI-enabled hub position will need a combination of one or more sources of such advantage.

In predictive AI:

- Decision workflow advantage: Do you own the workflow within which the core decision sits?

- Decision intelligence advantage: Do you own proprietary models that empower the core decision?

- Decision relationship advantage: Do you have primacy of relationship with the decision maker?

Similarly, in generative AI:

- Creative workflow advantage: Do you own the workflow within which the core creation activity sits?

- Creation intelligence advantage: Do you own proprietary models that empower a unique critical (part or all of the) core creative activity?

- Creator relationship advantage: Do you have primacy of relationship with the creator?

Ideally, you need all three.

Let’s unpack this further!

Key advantage #1: Workflow advantage

Do you own the workflow within which the core decision/creation sits?

A hub position may be built around a component of the workflow that other workflows need to plug-in to, because they lie either upstream or downstream from this core decision/creation ‘bottleneck’ and feed into or feed from it.

Owing to this, the decision hub establishes superior integration value and the right to cross-sell (and possibly even bundle cross-subsidize) upstream and downstream activities and the tools that enable them.

Decision hubs typically have primacy of engagement as they own the most important decision. Creation hubs similarly have primacy of engagement as they own the most important part of the creative process.

Owing to this workflow advantage, a hub position increasingly absorbs and seamlessly integrates with adjacent workflow providers.

Let’s take Autodesk as a possible example. (Note: This is purely illustrative and not a verdict on whether they win or lose with Gen AI)

In the construction industry, Autodesk sits at such a position across the Design-Plan-Build-Operate lifecycle of a building. Autodesk has an advantageous position in the Design phase of the lifecycle and could leverage that workflow advantage to act as a lifecycle hub.

This position could be further strengthened through a second source of advantage.

Key advantage #2: Intelligence advantage

Do you own proprietary models that empower a unique critical (part or all of the) core decisions and/or creative activity?

A hub position is built around some proprietary model advantage.

This typically involves the ability to proprietarily fine-tune a model, through access to proprietary data flows, associated with the core decision or core creative action.

This, in turn, creates a positive feedback loop.

As a hub position is established, other data flows from other tools start integrating with it (especially if the position also has a workflow and/or relationship advantage). As more data flows plug in, the hub position’s intelligence advantage improves and its control point over the core decision or core creative action becomes ever stronger.

Taking Autodesk’s example again, Autodesk’s acquisitions of companies operating across the building lifecycle (to create the Autodesk Construction Cloud) provides access to datasets across the lifecycle, further improving its bid for a hub position through building an Intelligence Advantage, in addition to a Workflow Advantage.

Key advantage #3: Relationship advantage

Do you have primacy of relationship with the decision maker and/or creator?

Owning the core user relationship (the core decision maker or the core creator) is key. This is especially true for enterprise software where an incumbent’s relationship with the core user (not necessarily the customer but the user who owns the core decision or the core creative action in the company’s value chain – e.g. a radiologist) is going to be key.

Upstarts with a workflow and/or intelligence advantage may still hit a wall if an incumbent has a relationship advantage and may have to end up partnering with the incumbent.

Wrapping this up with our Autodesk example, Autodesk owns the relationship with key creators (building designers in the design phase) and to a lesser but still significant extent with the key decision makers (building planners in the plan phase).

Combining these three sources of competitive advantage – workflow, intelligence, and relationship – may position it very well as a Gen AI hub in construction.

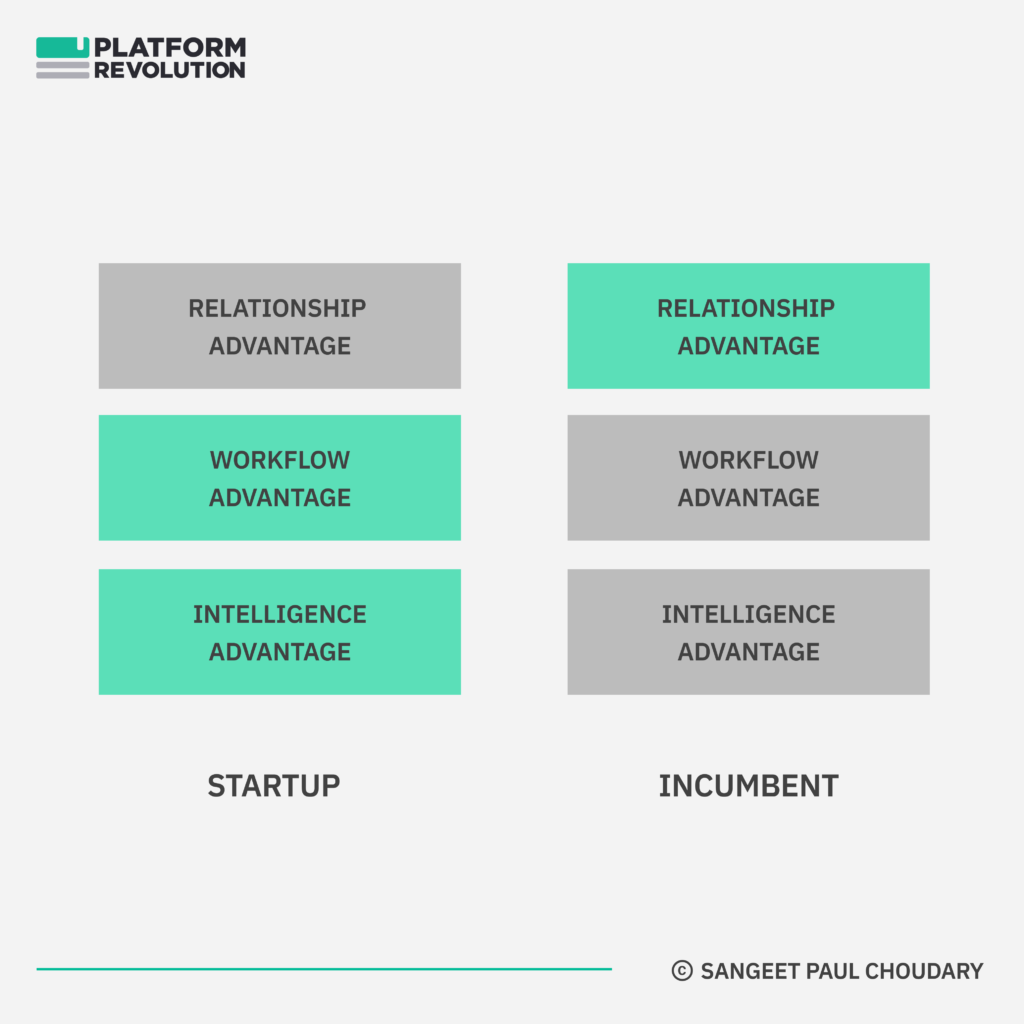

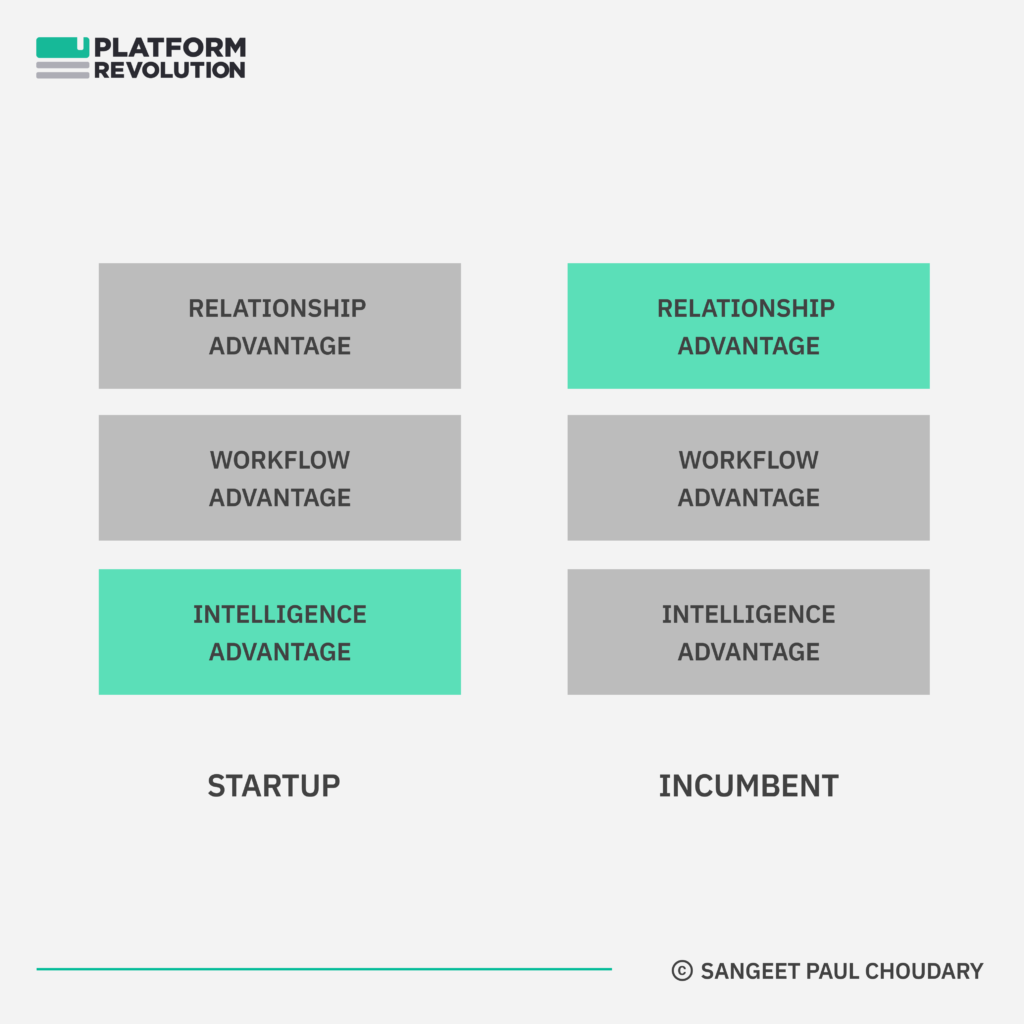

Who wins the hub position?

Let’s look at a few scenarios to see how this may play out as startups and incumbents fight it out for Gen AI leadership.

Scenario 1: Upstart with workflow + intelligence advantage vs Incumbent with relationship advantage

If the incumbent boasts little more than customer access, the incumbent likely doesn’t have sufficient advantage to win. Upstarts may be better positioned to displace incumbents in such a scenario.

Scenario 2: Upstart with intelligence advantage vs Incumbent with relationship advantage

This is a very interesting and likely scenario, and yet, one that most startups will miss acting on.

The right strategic move here is determined by the market structure of the incumbent.

- If the market is dominated by a single incumbent, the upstart should look to partner deeply with the incumbent (exclusive/JV).

- If the incumbent market is fragmented across multiple players, the startup is better positioned to provide model-as-a-service across multiple incumbents and look at potentially gaining an intelligence advantage by embedding itself across incumbents who serve the customer.

Scenario 3: Incumbent with relationship advantage builds/buys intelligence and/or workflow advantage

This is the most powerful incumbent move. Incumbents lacking the model and/or UX chops will be waiting on the sidelines for such opportunities.

What’s next?

This is the longest and most detailed post I’ve ever written on this newsletter.

If you’ve made it this far, you’ve hopefully had as much fun reading it as I had noodling around with these ideas and writing this article.

If these are issues you’re thinking through, I’d love to hear from you.

Just leave a comment, hit reply, or drop me a line at [email protected].

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter