Strategy

Web3 Network Effects: Five Mental Models

Network effects powered the rise and dominance of Web2 platforms and captured the imagination of builders and investors over the past decade. Some believe that network effects will be even more powerful in Web3 while others believe that Web3 will kill network effects.

In the midst of all the hype and buzzword soup that plagues Web3 discourse today, the answer to this lies in reshaping our mental models about network effects. What we’ve learnt in a Web2 world (covered in my book Platform Revolution) may not apply as directly in a Web3 world. To understand network effects in a Web3 world, it’s helpful to rethink network effects from first principles and understand what changes as we move from Web2 to Web3.

This article dives into five mental models, whose implications we subsequently unpack through forthcoming articles over the coming weeks.

Network effects in Web2 vs Web 3: Four key differences

To understand network effects in Web3 ecosystems, we need to first qualify the differences between Web2 and Web3 ecosystems and understand how these differences impact the creation of network effects.

First, in Web2 ecosystems, market infrastructure is created by the platform provider. In Web3 ecosystems, on the other hand, market infrastructure isn’t provisioned by the platform provider, but needs to be built out by the ecosystem, both through resource commitment (e.g. commitment of storage capacity) and through infrastructure development. As a result, creating and scaling network effects poses a unique challenge in Web3 ecosystems, which need to orchestrate not just market activity (as web2 platforms do) but also market infrastructure development.

Second, token value provides an additional value lever to kickstart and scale network effects. Market activity is managed through tokens. Producers may be incentivized to bring supply to the platform early on in exchange for tokens whose value appreciates as market activity increases. Likewise, developers responsible for building out market infrastructure may be incentivized to create core infrastructural components in exchange for tokens. Tokens provide a new incentive mechanism, absent in Web2 ecosystems.

Third, data and reputation portability, combined with technology interoperability, makes network effects much less defensible in Web3. Even if Web3 ecosystems rapidly build out network effects, they cannot lock-in their users (or the supply from producers) or extract surplus value from user data the way their Web2 counterparts so effectively (and now infamously) did/do.

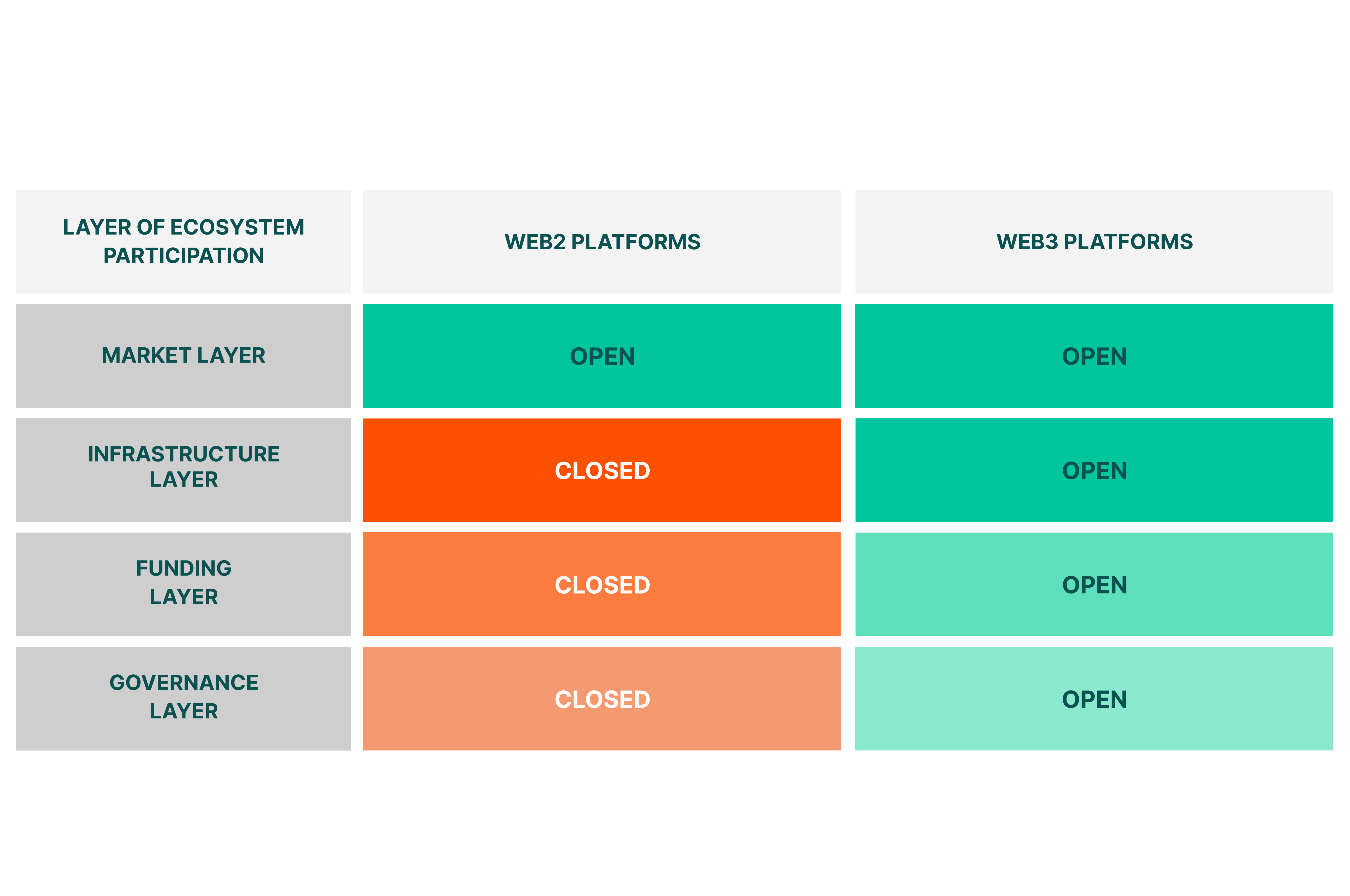

Finally, Web2 ecosystems primarily comprise market participants. Web3 ecosystems need to consider participants not just at the market layer but also at the infrastructure layer, the financing layer, and the governance layer. A Web 2 marketplace like Etsy is open to third party sellers but largely creates the core marketplace infrastructure internally, and manages funding and governance centrally. In contrast, a Web3 commerce protocol (e.g. Boson Protocol) needs to

- organize market infrastructure creation around the protocol at the infrastructure layer,

- manage token liquidity to drive funding as well as token value appreciation (which in turn incentivizes all participants) at the funding layer, and

- scale out governance to ecosystem participants, beyond the initial team, at the governance layer.

Let’s unpack these as we run through various mental models around Web3 network effects.

Let’s unpack these as we run through various mental models around Web3 network effects.

This is the first of a series of articles leading up to the Web3 Bootstrapping Playbook.

Get your copy of the Web3 playbook here

In the Web3 world, market infrastructure gets unbundled from market governance. While the core components of market governance are encoded into the protocol layer, components of market infrastructure may be built by the ecosystem around the protocol.

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

MENTAL MODEL #1: NATURE OF VALUE

Web2 networks primarily relied on two sources of value: Standalone/product value and network value. Web3 provides an additional value lever: Token value. This is a really important lever to design for, while planning for web3 network effects.

STANDALONE VALUE: The value that exists on a platform when no one uses it and is derived solely from the underlying product is called standalone/product value. This is the value that a user experiences on the platform which is independent of the usage of the platform by other users. The first user to come onboard the platform can benefit from this standalone value. The standalone value of a platform remains unchanged as more users come on board. Standalone value typically takes the form of value delivered by the technology of the platform.

NETWORK VALUE: The value that exists on the platform because of the usage by other users on the platform is called network value. This is the value created on the platform through the activity and usage of other users. When a platform starts out with no users, it has no network value. The first user to come onboard the platform does not benefit from network value. However, network value grows on the platform as the usage of the platform by other users increases.

On Web2 platforms, the community largely constitutes platform users (producers and consumers) only. On Web3 platforms, network value is turbocharged further as nearly all value creation in Web3 ecosystems is powered by the community of users.

There are many examples that illustrate the above difference. Instagram started out as a standalone app with beautiful filters before it turned on network value with a full-fledged social network. Square started out as a dongle that converted your phone into a credit card terminal before it started building out a network with the Square Cash app and other components of the Square ecosystem.

TOKEN VALUE: On Web3 platforms, value that accrues in a native token associated with the protocol is called token value.

As explained in our foundational piece Pipelines to platforms to protocols: Reconfiguring value and redesigning markets:

Protocols — more specifically, permissionless blockchain protocols — provide a new organizing and governance mechanism to organize actors in an ecosystem. Unlike platforms, protocols do not provide end-to-end market infrastructure nor do they internalize transaction policing and verification. Since protocols do not themselves provision market infrastructure or internalize transaction policing and verification, they need to set up the economic incentives for other ecosystem actors to provision these services. They achieve this by issuing tokens to reward desirable actions in the ecosystem. As the value of market activity in the ecosystem increases, the value of the token — tied to protocol usage — increases as well. As an example, Boson Protocol leverages commitment tokens to secure commitment of buyers and sellers to a transaction, thereby externalizing verification of the certainty of the transaction.

As usage around the protocol increases, the value of the token associated with the protocol grows as well. Early users (incentivized/rewarded with tokens) may come on board to benefit from appreciation in token value over time. Hence, token value provides an additional value lever to kickstart and scale network effects.

Tokens provide a compelling incentive to create network effects. However, as we will note in subsequent posts over the coming weeks, tokens are not a catch-all solution. Tokens need to be carefully designed to ensure they incentivize and disincentivize the core actions that impact network effects.

MENTAL MODEL #2: MANAGING MARKET ACTIVITY VS MARKET INFRASTRUCTURE

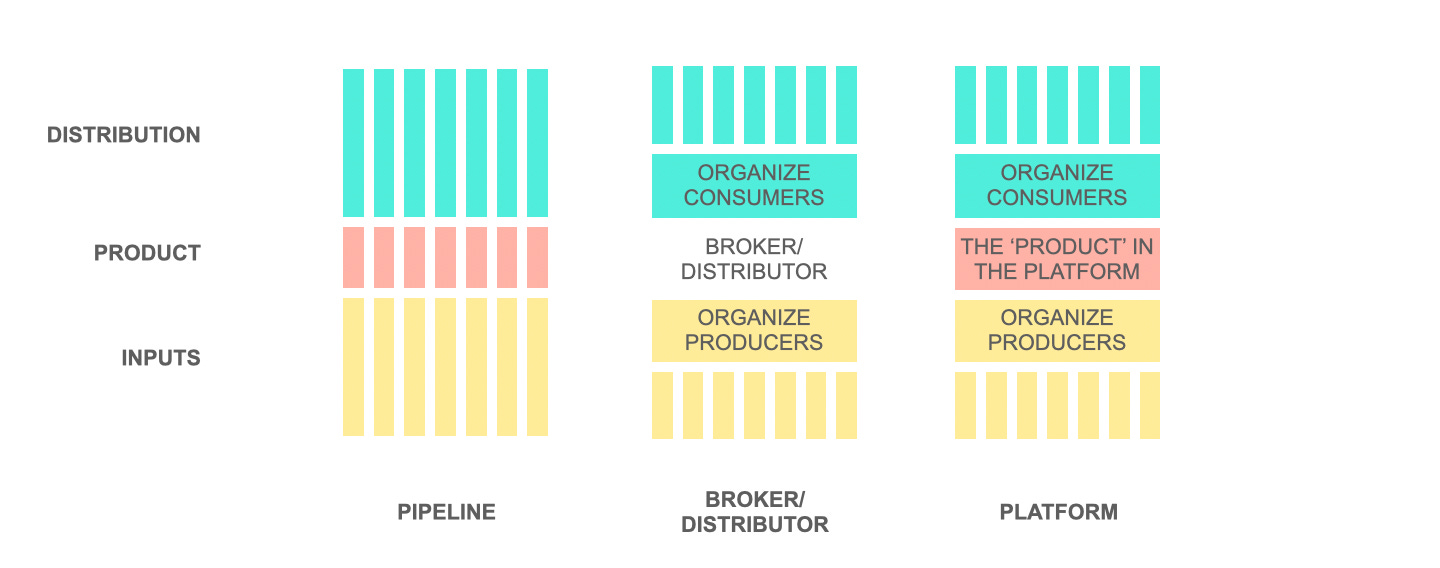

The next factor that’s different about Web3 networks is the definition of what constitutes the network. Web2 networks primarily comprise market actors involved in value creation and exchange: producers and consumers. While developers may extend Web2 platforms, core market infrastructure is provisioned by the platform owner. For instance, while ecosystem actors on web2 marketplaces participated in transactions, ecosystem actors in web3 also include those who provide the core market infrastructure to enable these transactions.

In Web3, market infrastructure is created by participants. Resources (e.g. compute, storage etc) may be committed by ecosystem actors instead of being set up centrally. Developers build market infrastructure around the protocol provisioning the functionality through which producers and consumers participate in the market.

As explained in Unbundling the unbundlers:

In the Web2 world, market infrastructure and market governance were bundled by platforms. Amazon, Ebay, Upwork, Uber, and other such marketplaces bundle both market infrastructure (in the case of Amazon, even physical infrastructure through FBA and Amazon Logistics) and market governance.

In the Web3 world, market infrastructure gets unbundled from market governance. While the core components of market governance are encoded into the protocol layer, components of market infrastructure may be built by the ecosystem around the protocol.

Since market infrastructure needs to be built out externally, buildout of market infrastructure needs to be managed in tandem with scaling of market activity.

In managing network effects on Web2 platforms, platform managers needed to manage the overlap between supply and demand. For instance, if all listings on Airbnb in its early days were in Denver but users were searching for listings in NYC, transactions wouldn’t ensue. While Web2 network effects required managing overlap between producers and consumers, Web3 network effects management requires additional coordination and overlap between market infrastructure being built out and market activity being supported. As an example, if users on a web3 platform seek a particular type of search interface the platform may need to incentivize innovation in the search interface that meets those requirements, by offering a bounty to attract developers towards that specific project.

In summary, managing Web3 network effects requires not just kickstarting and managing market activity but also managing its coordination with the scaling of market infrastructure. When Web3 ecosystems achieve this balance, they benefit from a positive feedback loop which amplifies these ecosystems further:

MENTAL MODEL #3: COUNTERING SWITCHING AND BUILDING FOR DEFENSIBILITY

One of the key differences between web2 and web3 is the relatively lower defensibility of network effects in web3.

Web2 defensibility was derived through four forms of stored/cumulative value: data captured by the platform, content committed to the platform, reputation built on the platform, and influence created on the platform.

As explained in one of my first articles back in 2012:

Creative content: Users invest in creating a portfolio of creative content, which forms the basis of their interactions on the platform.

Reputation: Building reputation on a platform requires consistent delivery of highly rated services and may also involve qualifying for some minimum criteria set forth by the platform. Hence, once a service provider builds reputation on a platform, it prevents her from migrating to a competing platform.

Usage Data: The more a user consumes information through the platform, the more intelligent the algorithm becomes in recommending pertinent content to the user.

Influence: As the user’s follower count grows, so does the stored value in the network and the incentive to stay actively engaged.

All four forms of cumulative value, which were tied to a specific platform in web2, are easily transferable across platforms in web3. New marketplaces can easily aggregate available NFTs and pull users in their direction. Users can easily port their data and activity to new platforms.

While web3 has the potential to lead to an explosion in innovation, the ability for individual platforms to retain it, allowing value to sustainably accrue to them, goes down.

Any strategy for building network effects in web3 needs to account for the lack of cumulative value and the lower switching costs. As we will note in forthcoming essays, Web3 requires a new set of factors to grant defensibility to network effects.

MENTAL MODEL #4: MANAGING EXTRACTION

Defensible network effects with high switching costs enabled Web2 platforms to indulge in (and benefit from) excessive extraction (whether take rates or data) and control (through bait and switch, lock-in, commoditization etc.). With collapsing switching costs, extraction will lead to network effects unraveling in reverse.

The creation and management of network effects in Web3 requires solving for easy switching, and hence solving for extraction. This is especially important because unlike Web2, market infrastructure and resources in Web3 are provisioned by the ecosystem. In order to provide its resources and innovation capabilities, ecosystem actors need to be assured of appropriate returns on their investment and sufficient agency to protect those returns against commoditization and policy changes.

Managing extraction is key to managing network effects in Web3 ecosystems. In a world of open-source protocols, excessive extraction will result in forking and ecosystem participants shift their activity away from the original protocol. Superior coordination mechanisms in Web3 also allow ecosystem participants to abandon a protocol and organize around a forked one.

MENTAL MODEL #5: MANAGING ACTOR AGENCY AND RISK

High switching costs also allowed Web2 platforms to bait and switch, change policies, and disempower ecosystem actors.

With low switching costs in Web3, managing actor agency will be key to managing and retaining network effects.

Managing the agency of actors is key to managing network effects. Managing agency will require structuring and distributing governance tokens to allocate agency, control, and management of the platform beyond the founding team (and other insiders).

As a protocol becomes more successful, the associated governance token will likely become more valuable, strengthening network effects further, as key contributors who hold the token do not just benefit from returns but also have the power to shape future development roadmap and organize resource allocation and participation incentives accordingly

Conclusion

Web3 network effects are different. They come with new coordination challenges, support new incentive mechanisms, and rewrite traditional rules of defensibility and extraction, restructuring the platform-vs-ecosystem power balance. As the 5 mental models above illustrate, Web3 network effects will require an entirely new playbook: New bootstrapping and scaling models, new governance mechanisms, new sources of competitive advantage, and new forms of value capture.

Over the coming weeks, we will unpack the Web3 bootstrapping playbook through a series of articles, culminating in the launch of the Web3 bootstrapping playbook later this summer.

If you’d like to dive deep into this topic, click here to get your copy of the Web3 bootstrapping playbook today

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter