Metrics

The three forms of metrics that drive scale

Scaling for Success: Embracing KISS startup metrics to drive growth

Successful businesses are often not distracted by a hundred different metrics, but laser focused on one metric that is the best predictor of scale. How does a business identify such a metric?

Most businesses are in a relentless pursuit of scale. Most of business education is built around creating and understanding patterns in business scale. There is, however, a shift in the concept of scale in business today and not all companies seem to embrace it appropriately.

The traditional definition of scale

Let’s call this Scale v1. The key inputs for business, traditionally, have been land, capital stock, and labor. The business scales whenever one or more of these parameters scale. You hire more people, you get more resources and better machinery and the business scales. However, there is a cost associated with scaling each of these three variables. As a result, the primary focus while scaling is optimization. Optimization involves creating repeatable processes which can be cost-effectively repeated over and over again to grow the business. The two key aspects of scaling are:

A) Repeatability

B) Cost-effectiveness

A lot of business education is focused on strategies for optimization of these processes. An IT outsourcing shop, for example, optimizes processes surrounding the labor variable to create scale. A manufacturing business has to optimize processes involving all three variables (e.g. procurement, production, distribution).

The new definition of scale

Let’s call this Scale v2. This is where the internet comes in. The internet, by definition, brings with itself unlimited scale. Moreover, since networked businesses tend to deal more with bits than atoms, the inputs to business are no longer the three variables above. The new inputs to business are data and talent (intellectual capital, both internal and external).

Scale in a networked business is no longer dependent on processes within the business, it’s driven by network processes. By network processes, I mean interactions that users on the network have with the product. The business scales by scaling these interactions. Hence, the new counterpart of process optimization is actually interaction design, and this is partly why designers are so important in networked businesses because they directly contribute to scale much like MBAs did in traditional businesses.

Not every internet startup is all about Scale v2. e.g. an commerce company like Zappos has Scale v1 on the supply side and Scale v2 on the demand side. The same applies to any online media company which still has reporters sitting in a room and churning out stories. On the other hand, marketplaces and platforms like eBay, Facebook and Airbnb have Scale v2 on both sides.

Google was probably the first business that achieved Scale v2 on both the demand AND the supply side. The users are on self-serve, and so are the advertisers. This is why it is, even today, one of the most successful internet businesses ever.

On the contrary, Groupon has Scale V2 on the demand side but Scale V1 on the supply side. It maintains an ever-growing sales force to manage the merchant side of the business.

Amazon is one of those rare internet companies that did a fabulous job of mastering both Scale v1 (on the supply side) as well as Scale v2 (on the demand side).

The three forms of metrics that drive scale

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

So what metrics should your business use?

Here’s the one line answer:

A business should focus on those metrics which help it create repetitive processes (Scale v1) or repetitive interactions (Scale v2) that will ultimately build scale.

First, it’s important that a business knows which forms of scale it has on which sides. Second, most metrics fall into three categories:

- Per-unit economics of repeatable process OR interaction

- Time between repeatable process OR interaction

- % of inputs successfully being leveraged for repeatable process OR interaction

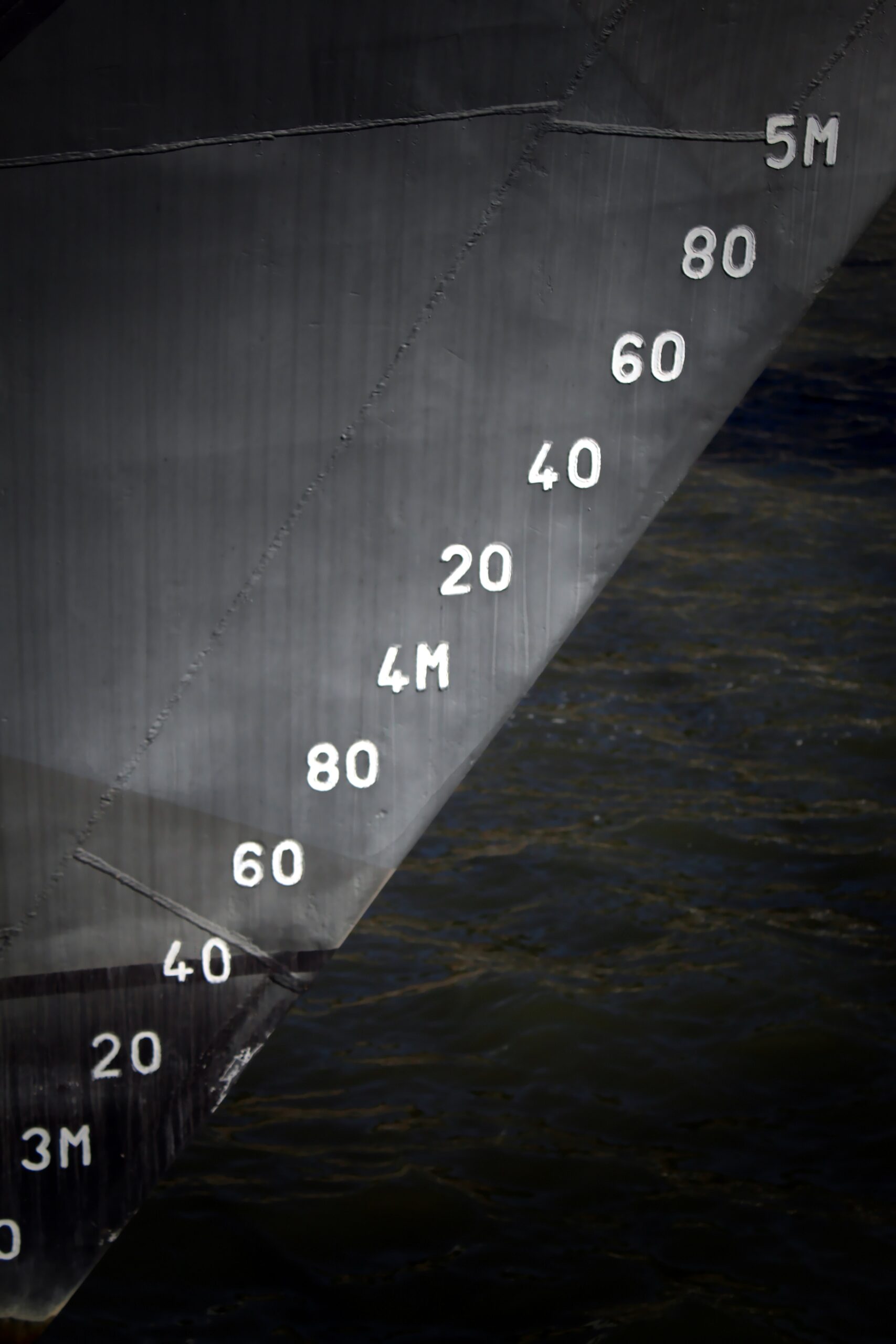

Scale v1: The metrics that determine scale are typically determinants of per-unit efficiency. These could be one or more of the following:

- Per-unit efficiency (Cost per input, per-unit production cost, Cost of moving a unit through a channel)

- Turnaround efficiency (time to source)

- Utilization efficiency (Inventory turnover)

Scale v2: The metrics that determine scale are typically determinants of engagement and repeat usage. These could be one or more of the following:

- Per interaction engagement (Length of visit etc.)

- Time between interactions (Time between contributions, time between visits)

- % Interacting (% active users, % of users who produce, etc.)

A business that has Scale v1 on one side (e.g. supply) and Scale v2 on the other side (demand) has to look at both types of metrics. This is typically the case with an e-commerce company which looks at improving time to source on the supply side and time between purchases on the demand side. A social network like Facebook needs users to interact with each other as often as possible and hence focuses on %interacting, more specifically DAU/MAU.

The governing principle is to understand the processes and interactions which drive scale and focus on the metric that decides how those processes and interactions can be made repeatable.

What do you feel? Does it help to connect business metrics to scale goals and has it helped while running your startup?

TWEETABLE TAKEAWAYS

The three forms of metrics that drive scale Share this

Platform metrics vs. pipeline metrics Share this

Pipe scale vs. platform scale Share this

Image Credits: Creative Commons, Flickr

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter