Concepts

How to lose at Generative AI!

Value capture in Generative AI is going to be a disappointment for most startups!

Some ‘platform shifts’ favour the disruptors, some favour the incumbents.

Generative AI looks overwhelmingly poised to favour incumbents. And, of course, why not – you’d say – incumbents have all the data advantage.

Now, that’s a good quick argument win the startup-incumbent debate at a dinner conversation. But the real reason incumbents win and startups lose with Gen AI is a lot more nuanced.

So where exactly do today’s tons of AI startups lose? And what are the few places where they win?

Let’s dive right in and unpack this further.

Getting Gen AI wrong!

The Generative AI hype is just about subsiding.

Dozens of newsletters helping you prompt better mushroomed over the past 6 months. Dozens others were set up for the sole purpose of recommending products with .ai domains, some of which were mere prompt engineering wrappers while others were rule-based automations hosted on .ai URLs.

But once we’re past this hype, where exactly is that pot of gold at the end of the GenAI hype rainbow?

To understand value capture in Gen AI, let’s look at a simple framework for value creation in Gen AI.

Value creation in Generative AI

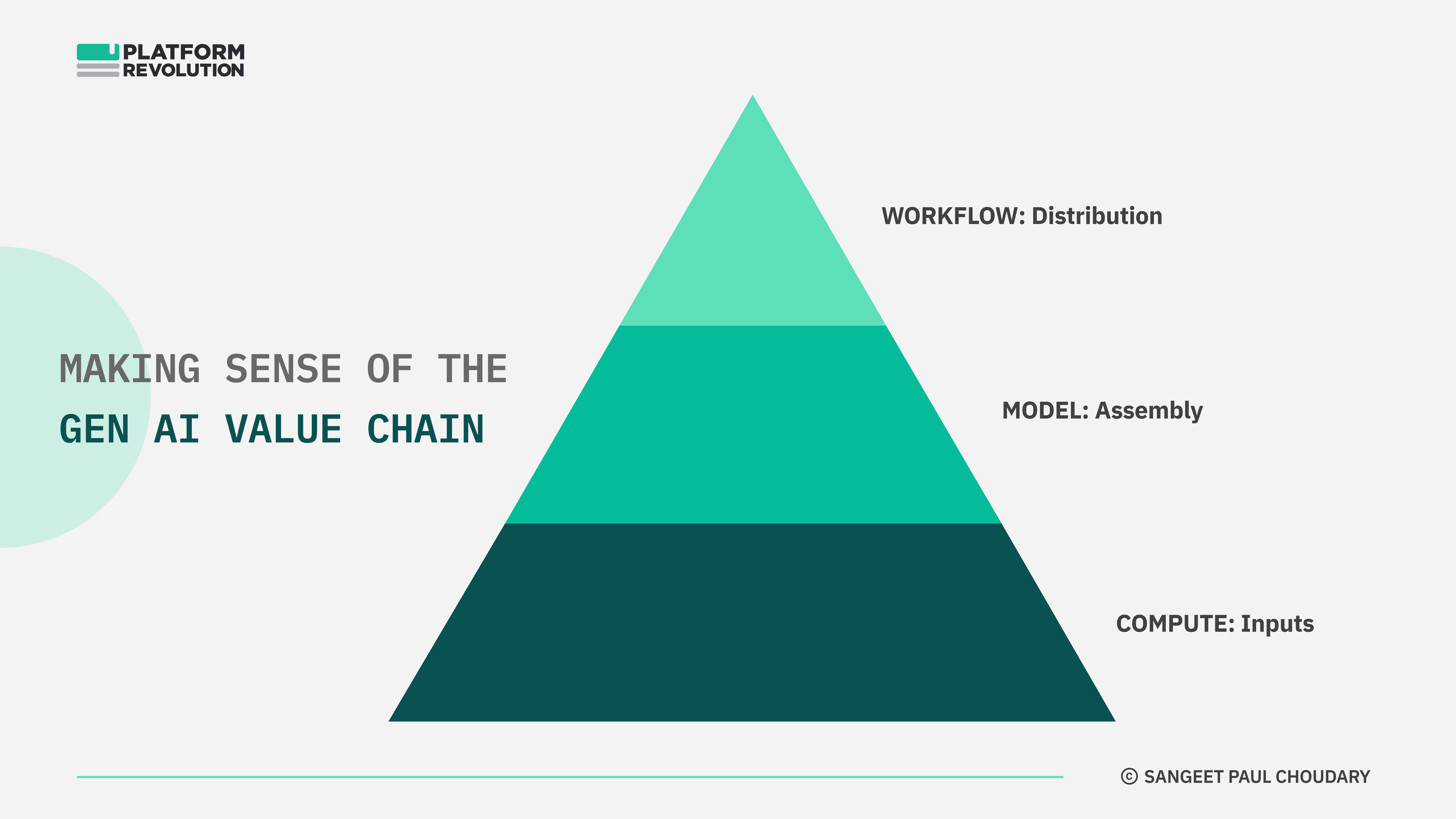

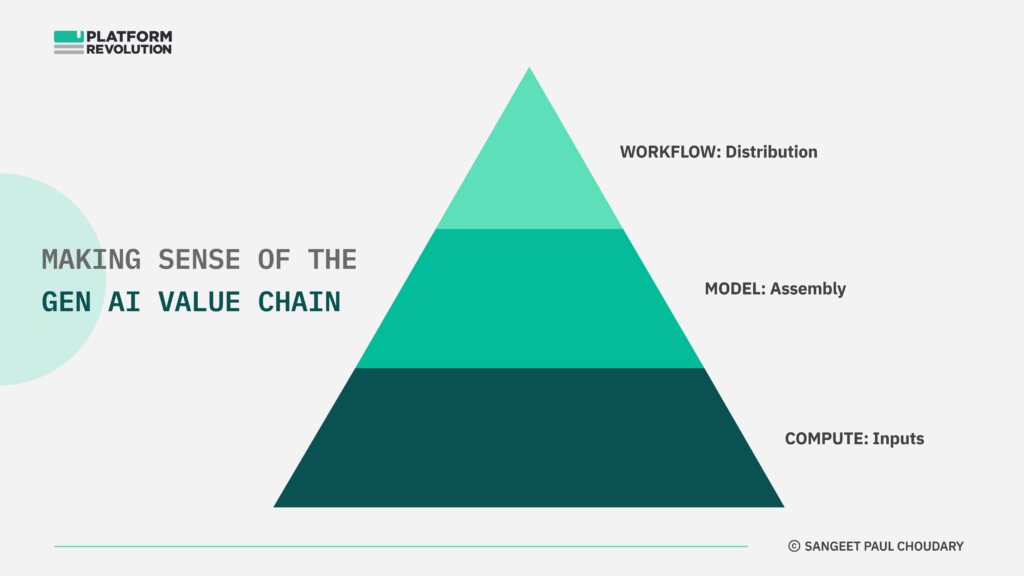

There are largely 3 key value drivers across the Generative AI value stack.

- Compute: The massive resources needed to run large language models (LLMs)

- Model: The learning and the memory powering GenAI

- Workflow: The context into which GenAI is served

The workflow vs application distinction is important. A lot of folks think about the model layer and the application layer as two distinct layers, but that distinction is not very precise.

An application could be workflow-only i.e. working with a third party model and serving AI integration into the workflow. Or an application could be model+workflow, meaning you back your AI integration into workflow with a proprietary contextually fine-tuned model.

A tale of two platform shifts

VC dollars are pouring into the GenAI gold rush.

Most Gen AI startups today are jumping in with the ‘cloud/saas’ hat on. There’s a new ‘platform shift’. Time to make hay building new applications.

Most value in the shift to Cloud was captured by new SaaS startups, not by on-premise incumbents.

Incumbents needed a full-stack rebuild:

1) There was no clear path from single-tenant DBs and desktop UX to multi-tenant DBs and browser-based Saas UX.

2) Cloud required the full software stack to be rearchitected.

3) Most importantly, a shift to subscriptions needed a completely different GTM model with low CAC and higher focus on churn management (vs. high-touch large upfront contracts).

4) Your CFO needed to understand all this.

As a result, incumbents lost out on the transition to cloud. A whole generation of Saas startups emerged to capture value at the application layer.

Today’s GenAI startups apply the same logic when they look to bundle some cute prompt engineering with UX improvements to create an AI-aided workflow, running on one of the LLMs.

But a lot of the four factors above DO NOT apply to Gen AI.

In fact, Generative AI overwhelmingly favors the incumbents:

1) The model API distribution approach jives well with cloud incumbents, who already have primacy of relationship with an installed base (especially in B2B) and, hence, access to workflow. Further, the proliferation of integrators like HuggingFace, means quick plug-and-play deployment without rearchitecting the stack.

2) In most cases, AI can be embedded into existing workflows, making incumbents’ workflow ownership a huge advantage.

Today’s incumbents are yesterday’s upstarts – Hubspot, Salesforce, ServiceNow etc. In fact, the very Saas players that scaled handsomely during the shift to Cloud are now best positioned to leverage their installed base and workflow dominance to capture value with Generative AI.

Clueless startups looking to capture value on connected services tried to subsidize their hardware and were left footing a huge manufacturing bill for subsidizing low quality hardware that took them nowhere.

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

Unfair advantage in GenAI

However, the greatest source of unfair advantage for incumbents lies in the business model itself.

Incumbents can subsidize AI by bundling it with an existing already-working profit pool. Startups, instead, need to charge for AI. Workflow-only startups that gain traction but don’t own a proprietary model may get stuck with a huge LLM API bill, making AI subsidization untenable even with heavy VC funding.

We’ve already seen this incumbent business model advantage play out in the shift to IoT.

Most incumbents – companies like Schneider, Johnson, and Honeywell – subsidized IoT services and bundled in the connected services with their existing profit pools where they charged for devices.

Clueless startups looking to capture value on connected services tried to subsidize their hardware and were left footing a huge manufacturing bill for subsidizing low quality hardware that took them nowhere.

Incumbents, instead, ‘commoditized the complement’ and increased the value of their devices by bundling in subsidized connected services – a huge business model advantage.

Effectively, startups footed the experimentation and customer discovery bill while incumbents captured all the value.

This is exactly what’s playing out in Generative AI. Startups focusing on innovation (largely prompt engineering and UX) at the workflow layer are merely footing the bill for finding product-market fit, while a well-positioned incumbent on the prowl can swoop in once early signs of product-market fit are visible.

We’ll need to burn a few hundred million VC dollars on cute prompt engineering startups to make sure that history may not repeat but almost certainly rhymes here.

BigTech advantage through vertical integration

Of all incumbents, the BigTech are best positioned to extend their dominance further.

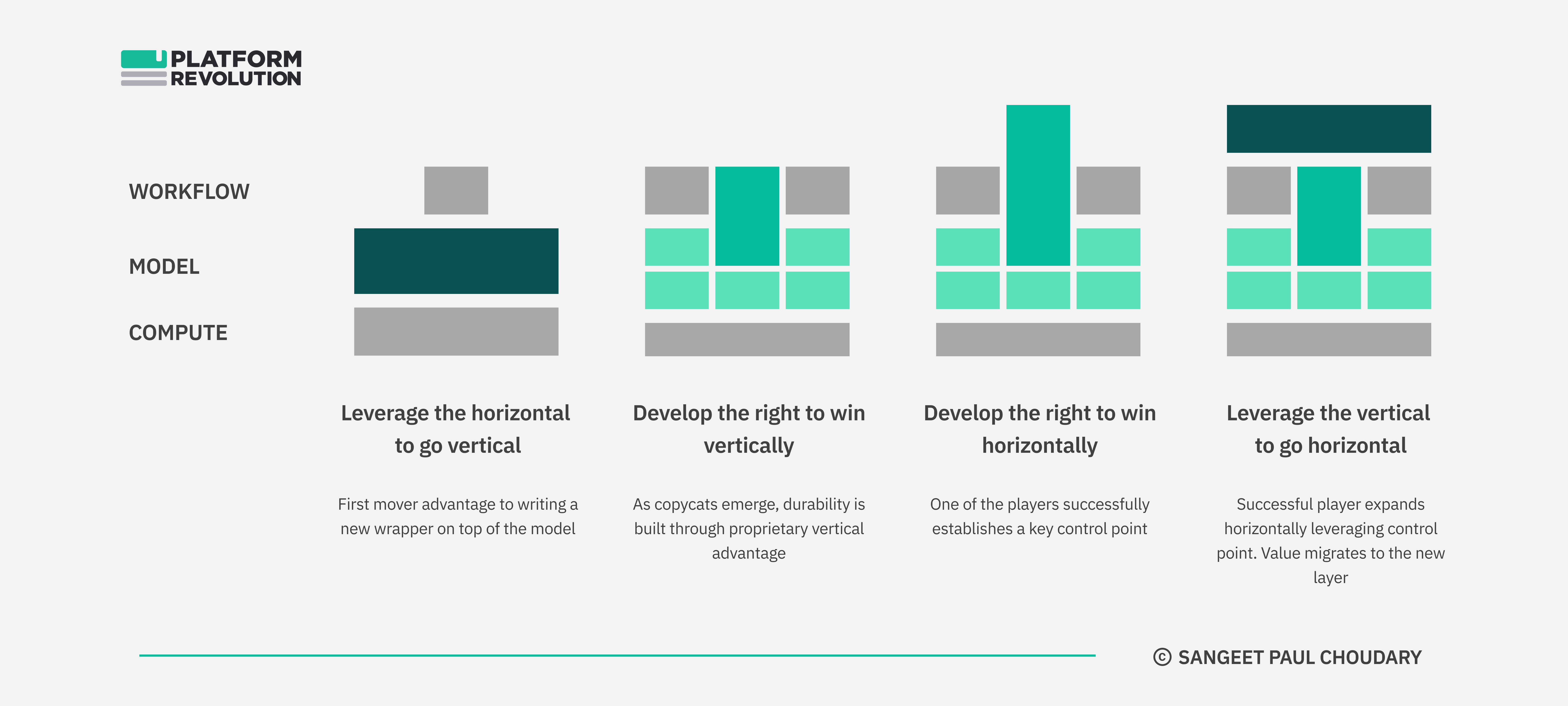

Revisiting the value chain above, the BigTech play across all layers of the value chain.

At the compute layer, Microsoft, Amazon, and Google benefit from undeniable scale advantages with their cloud computing capabilities.

At the workflow layer, Google’s search dominance and Microsoft’s Office suite are examples of large installed bases that become more sticky when AI-aid is bundled into the workflow.

Finally, all these players are leading investors at the model layer. Google with its in-house efforts and Microsoft with its investment in OpenAI.

By vertically integrating across all three, these players get significant advantages both in terms of economics (lowering the costs of inference) and negotiating power (by squeezing out profits from players sandwiched in between their dominant layers).

Startup gold in the Gen AI gold rush

So where do startups win in the GenAI gold rush?

Clearly, a way to fail fast (and I mean that pejoratively here) is to run a workflow-only startup. To win, startups will need to focus on model-only and workflow+model plays.

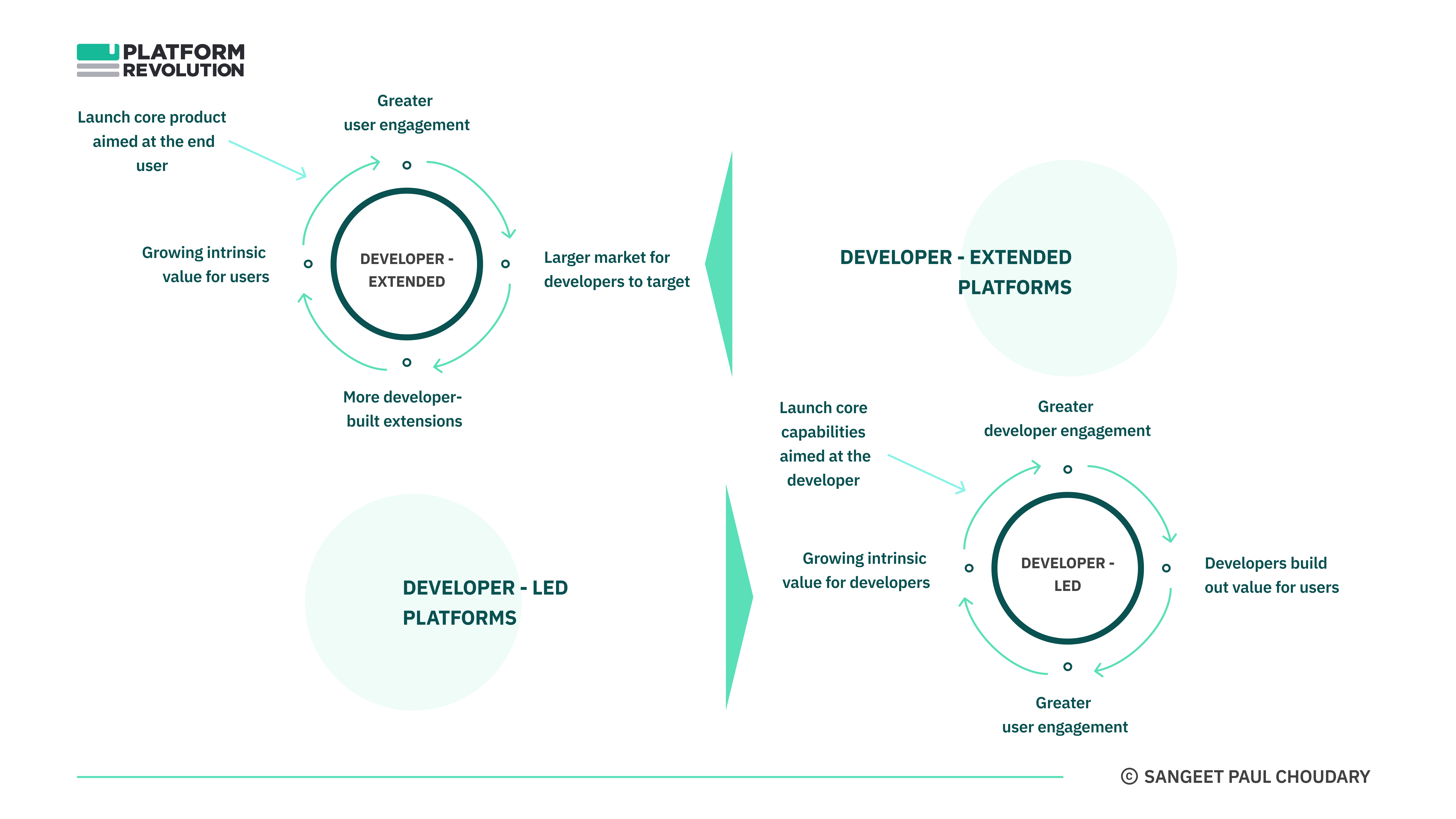

Model-only startups may go horizontal, particularly by specialising in a particular modality (e.g. MidJourney) or may go vertical by developing a highly context-specific model. For example, Harvey’s context-rich model specialises in legal questions and was built by inputing legal data sets into OpenAI’s GPT-3 and by testing and fine-tuning prompts that best generated legal documents.

In general, horizontal plays are a lot more difficult to get off the ground. The cost of activating a user on a horizontal play is much higher because of the lack of focus in an onboarding use case. Startups like Airtable still struggle with the conundrum of being everything for everyone and yet being nothing for anyone. Model-only startups may struggle with the same challenge if they go direct to consumer with a horizontal play.

Horizontal plays will more likely gain traction through a partner developer network where partner developers verticalize the model into their specific use case. This also poses a threat to horizontal model-one startups

Workflow+model startups will win by combining a fine-tuned model with deep customer insight to build an AI-native workflow. These startups will be particularly well-positioned to win in one of the following 3 scenarios:

- Incumbent saas players do not have legacy workflow dominance in that vertical

- An AI-native workflow solves the most critical creative use case (collapsing the cost of creation and gaining right to workflow away from incumbents)

- AI acts as a co-pilot empowering the user to coordinate across multiple existing Saas workflows. This is a particularly interesting category and could help create the next big super-app, especially in B2B.However, the majority of AI startups today fall outside these 3 opportunity areas.

The WeChat of B2B

Here’s possibly the biggest platform opportunity in AI.

WeChat created the world’s first (and most dominant till date) super app and gained advantage away from well-established incumbents. Today, a variety of players ranging from ride-hailing apps to e-commerce apps sit inside WeChat’s super-app. WeChat wrested away the primary customer relationship away from these individual apps into its super-app.

The most compelling Gen AI opportunity will involve achieving such a dominant position in B2B workflows. This, to me, is the biggest opportunity out there in the Generative AI space.

Watch out for my next post where I unpack the B2B Generative AI super-app playbook in detail. And if you haven’t already, sign up below to received the playbook once it’s out.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter