Strategy

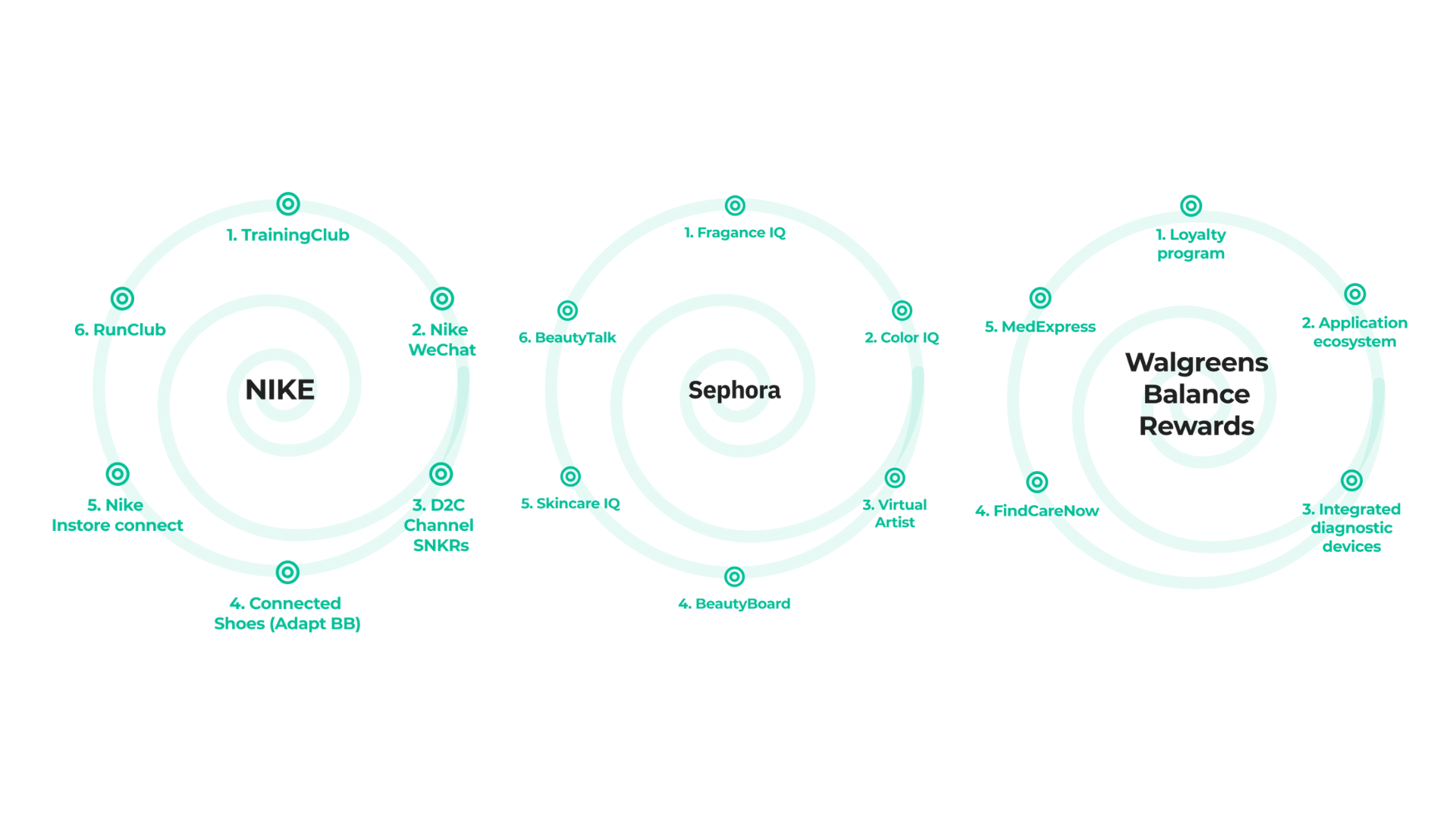

How consumer brands like Nike, Sephora, and Walgreens compete in ecosystems

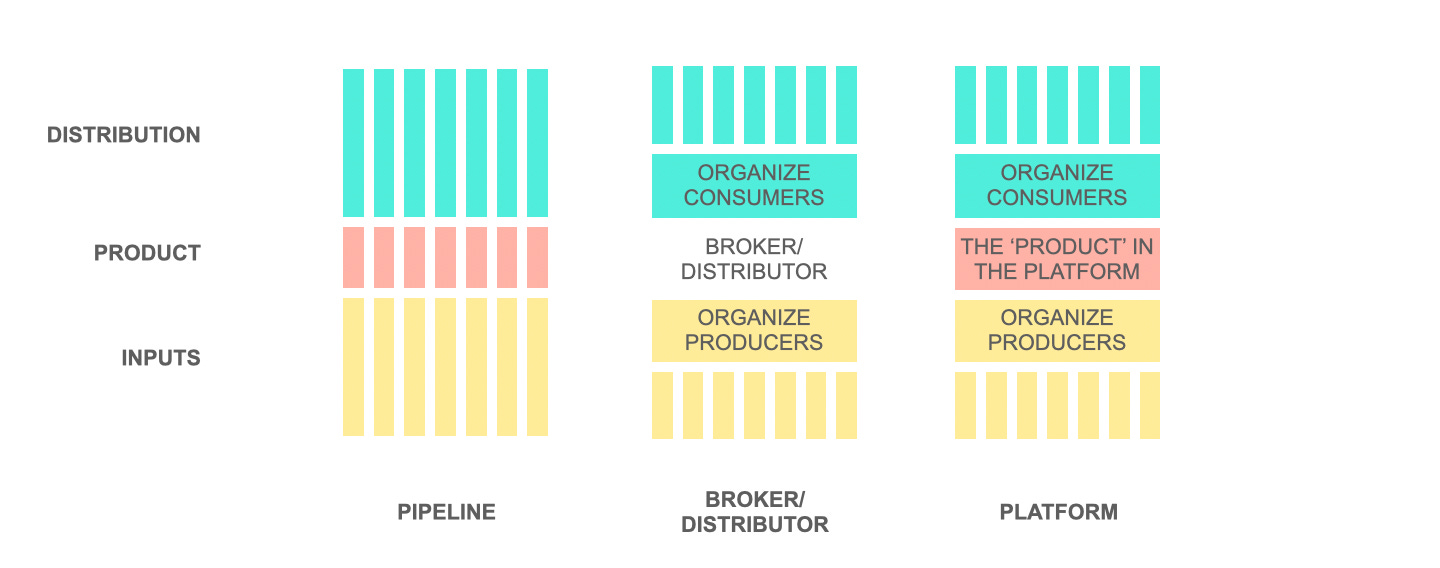

In an earlier edition of the newsletter, I introduced a new framework to explain the difference between different ecosystem positions.

Over the course of the next few editions of the newsletter, we dive deeper into each of these business models.

Let’s start by looking at aggregator business models and the specific strategy of playing in the primary demand.

And register for a full copy of our Ecosystem Innovation report

Ecosystem Innovation

Aggregators – B2C business models in ecosystems

Aggregators are consumer-facing business models, which

(1) aggregate consumer demand by

(2) building engagement and capturing data at scale through

(3) provisioning consumer-facing services.

Aggregators succeed through serving consumers at scale, capturing that demand, and then acting as a conduit (and consequently a bottleneck) allowing the rest of the ecosystem to serve these consumers.

Moving from secondary to primary demand with an aggregator play

Consumer brands offering integrated brand experiences across multiple channels and services are one of the best examples of aggregator strategies.

Consumer brands pursuing this strategy typically look to move from the secondary demand to the primary demand.

Consider the problems solved by brands like Nike and Sephora.

For Sephora, the primary demand for grooming and beauty drives the secondary demand for cosmetics.

For Nike, shoes constitute secondary demand, health and fitness are the primary demand.

By serving the primary demand of the customer, aggregators command right of customer relationship and can intermediate the customer’s relationship with third parties which serve this secondary demand

Sephora – Serving the primary demand

Sephora has invested heavily in facial feature recognition AI to track facial features and build augmented reality experiences using this capability. Its integrated brand experience includes virtual try-ons to enhance its digital commerce experience. Sephora has developed services to help consumers sample different scents and fragrances.

Sephora has invested heavily in facial feature recognition AI to track facial features and build augmented reality experiences using this capability. Its integrated brand experience includes virtual try-ons to enhance its digital commerce experience. Sephora has developed services to help consumers sample different scents and fragrances.

It also engages its user community through social networks like Beauty TIP (teach, inspire, play), an integrated experience workshop, where customers learn via group beauty classes, using Sephora’s Virtual Artist technology, Beauty Board, and its gallery of products.

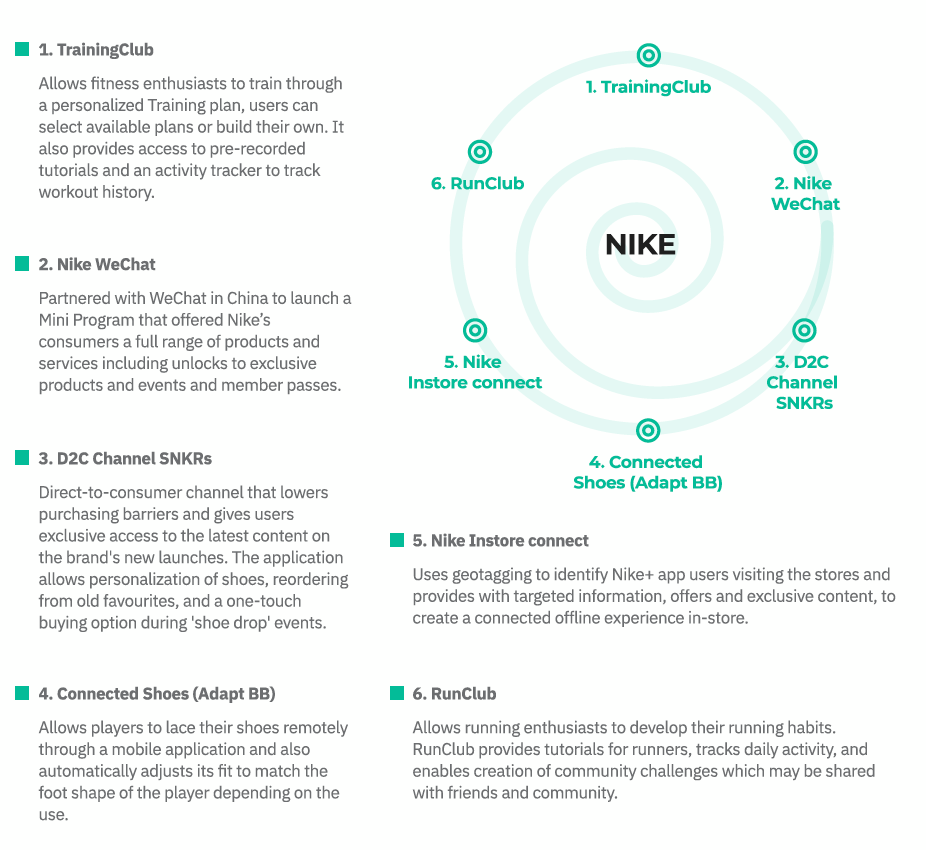

Nike – An integrated brand experience across primary demand

Nike’s first generation connected ecosystem involved the Nike+ iPod kit, launched in 2006, which allowed Nike+ compatible connected shoes to share data with the Apple iPod nano, allowing runners to receive audible alerts on their running statistics during the run.

Nike’s subsequent launches, including the Sportband kit and the “Nike+iPod for the Gym” were all launched as connected devices, primarily in partnership with Apple. In 2008, Apple added a native capability to receive Nike+ signals in the iPod and iPhone without requiring a receiver, further deepening the integration.

Nike subsequently launched several connected devices, some in partnership with other companies like Polar (Polar WearLink+). However, between 2014 and 2018, Nike has progressively moved away from connected devices and instead focused its integrated brand experience on membership-based services, including the Run Club and Training Club.

Nike creates same-sided network effects by allowing users to connect with other users and engage in competitive challenges. It also creates cross-sided network effects between master trainers and users on the TrainingClub, where trainers provide content to train and engage users.

Nike’s growing consumer engagement, through the integrated brand experience, increases consumer connect with the brand. It also drives direct transactions through D2C channels like SNKRS. The platform enables Nike to capture rich user data, ranging from sizes, fits, profiles, activity (use of footwear), preferences etc. This data enables recommendation of the most appropriate products and services to users. As of 2021, more than 30% of Nike’s revenue was driven by digital channels, which constitute an integral part of the integrated brand experience.

Internalizing decision support has a direct impact on design. Much of interface design is composed of decision support systems. When that gets taken away, UX will fundamentally change in the age of AI to include fewer decision support aids and place fewer decision points in a user's journey.

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

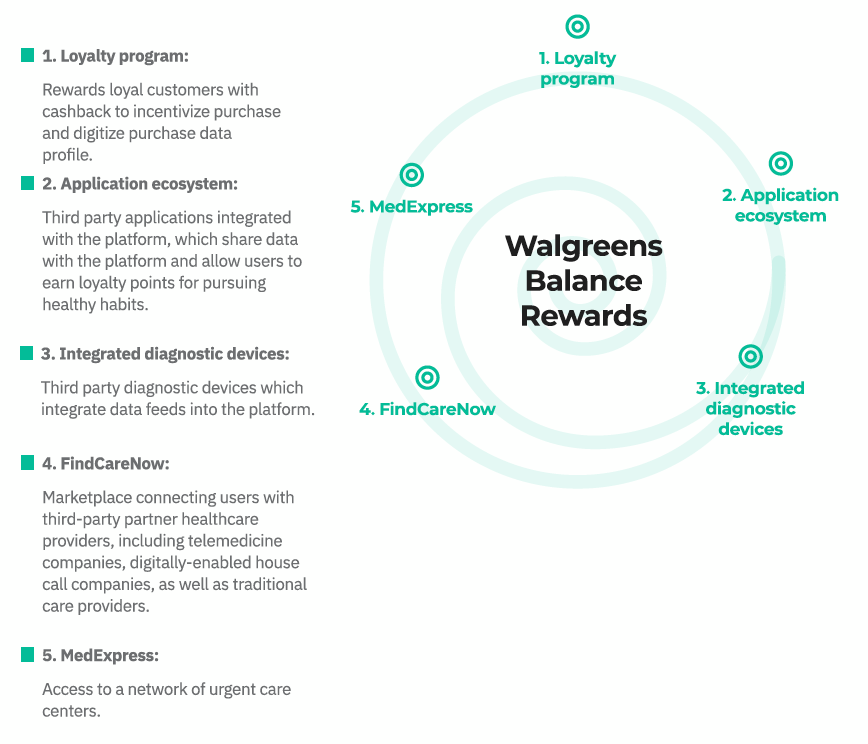

Walgreens – Organizing the ecosystem around primary demand

Retailers like Walgreens also similarly create a strong position in the ecosystem centred around an aggregator play.

Walgreens launched an aggregator business model by launching a digital loyalty program – the Balance Rewards program – across its pharmacy network. Users who signed up for the loyalty program, earned reward points not only for the purchases they made within the Walgreens pharmacy network but also across a larger partner ecosystem of fitness applications.

Walgreens used its existing retail footprint – its offline pharmacies with millions of footfalls every year – as the core asset around which it drove adoption of the platform. The digital loyalty program, rolled out through the pharmacy network, captures data about medicines (and other products) purchased. The more often users buy medicines, particularly users with chronic illnesses, the richer the data profile that can be created about their health condition.

As this loyalty program gained greater adoption, Walgreens opened up its platform to allow third party wearable devices and applications to integrate with the platform. Through an API developer program, the benefits of the loyalty program were extended to a larger ecosystem, increasing consumer reach and rewarding them for their healthy activities. This integration allows users to automatically earn points for healthy activities like walking, running and biking.

With an engaged consumer base, Walgreens has moved to creating a new layer of interaction by connecting these users to health coaches, nutritionists and other health experts, through a health coaching and tele-medicine platform. It also launched Find Care Now., a marketplace to connect customers to third-party partner healthcare providers, including telemedicine companies, digitally-enabled house call companies, as well as traditional care providers. Through the platform, patients can schedule appointments at partner clinics. It is also engaging in creating disease-specific innovations with partners, which all integrate into the central platform.

As we note with all three examples above, brands that aggregate consumer demand can effectively organize the entire ecosystem around that control point.

Consumer engagement remains the scarce resource in connected ecosystems and the few brands that effectively engage consumers will organize ecosystem partners around themselves.

For more on the role of consumer engagement and attention in ecosystems, check out my earlier essay on attention economies.

How to launch aggregators

In general, aggregators need a right to play as the consumer interface.

They typically achieve this by:

1. Informing an important consumer decision, or

2. Creating a high engagement service.

Incumbents with consumers-facing assets – e.g. leading consumer brands and retail businesses like the ones mentioned above – may leverage these assets to launch aggregator business models.

Nike leveraged its strong brand, its partnership with Apple, and its relationships in the sports and fitness space to launch a series of connected applications to engage users around running and fitness use cases. It also curates expert trainer content for training new fitness enthusiasts and provides community engagement tools to drive network effects.

Some aggregators may take off by creating a decision support layer on top of other providers and organising data captured across these providers to enable consumers to make better decisions. Personal finance tools like Mint.com take this approach.

Owning decision support is a key advantage for aggregators.

Aggregators with an AI advantage, in particular, are well positioned to deliver superior decision support.

As I explained in an earlier essay on TikTok’s AI advantage:

Recommendation systems and rating & review systems are decision support systems in ecosystems, aiding consumer decision making.

AI takes over decision making – it internalizes decision making – and effectively takes the decision on behalf of the user.

Internalizing decision support has a direct impact on design. Much of interface design is composed of decision support systems. When that gets taken away, UX will fundamentally change in the age of AI to include fewer decision support aids and place fewer decision points in a user’s journey.

This also has an impact on engagement and session length.

By removing the need to constantly shift from consumption to decision, it creates a longer and more engaged chain of consumption.

Internalizing decision making has a direct impact on the economics of ecosystem participation. If we view decisions as costs of participation, internalizing decisions increases participation, leading to higher engagement and more data creation, leading to stronger AI models.

How to monetize aggregators

Aggregators that facilitate a marketplace transaction may charge a transaction fee to producers and/or consumers.

Aggregators may charge producers for access to consumers and the ability to brand and promote themselves to consumers.

For instance, LinkedIn aggregates professionals through free access to its social network but monetizes enhanced access for recruiters and sales professionals as well as analytics and premium tools targeted at these users.

Aggregators may leverage engagement on consumer services to generate leads and drive sales of products and services in their traditional business.

Sephora’s social aggregator plays (BeautyTalk, BeautyBoard) are monetized though higher sales and lifetime value of users who opt-in to the ecosystem services. Sephora’s virtual try-on services, where users may test makeup application through an application, reduce barriers to transaction for users.

Aggregators may also charge advertising fees from third-party advertisers looking to target consumers.

Aggregators also have a significant data moat that may be monetized in the form of data products.

Strategize your ecosystem play

We’ve advised several leading consumer brands in beauty, wellness, pet care, furniture, and food in setting up and structuring integrated brand experiences through a platform strategy.

If you’re developing an ecosystem strategy and would like to explore our ecosystem mapping and strategy approach, please write in below for our advisory kit.

Request the Advisory Kit

Pursuing aggregator strategies as an incumbent

Aggregators are important business models as they provide primacy of customer relationship and engagement, while allowing products and services to be embedded into the aggregator’s core experience. There are a few factors, in particular, that help incumbents succeed with aggregator positions.

MOVE FROM SECONDARY DEMAND INTO PRIMARY DEMAND

Aggregators typically serve the primary demand of the customer – e.g. the need for housing or healthcare – and create a secondary demand for the associated products and services – e.g. a mortgage or a pill.

Arguably, bank and pharma manufacturers play in the secondary demand and will be increasingly commoditized by aggregators that own primary demand.

By serving the primary demand of the customer, aggregators command right of customer relationship and can intermediate the customer’s relationship with third parties which serve this secondary demand.

Incumbents which do not understand the importance of playing in the primary demand risk getting commoditised by aggregators who have not only a data advantage but also the trust to drive recommendations of ecosystem services.

BUILD A 360 PROFILE OF THE CONSUMER

Aggregators successfully serve consumers by creating a comprehensive user data profile. For instance, China’s WeChat creates a comprehensive data profile of the user using data captured across a large number of ‘mini programs’ created in its ecosystem.

B2C Incumbents seeking to serve the consumer will, similarly, need to create a comprehensive consumer profile. This involves capturing data across and aggregating it towards a common data profile. More importantly, this implies extending beyond capturing data that merely helps them sell more secondary demand products to capturing data that helps them deliver superior value in their primary demand.

LOCK-IN DISTRIBUTION THROUGH CO-INNOVATION

Not all companies can dominate as aggregators. Incumbents that find it difficult to set up aggregator positions will run the risk of being commoditized by aggregators. Partnering with aggregators as producers isn’t sufficient as producers will get increasingly commoditized owing to competitive bidding for the customer.

Instead, incumbents should hedge their bets by proactively partnering with aggregators to co-innovate new solutions and lock-in distribution of their products and services through these solutions.

The Ecosystem Innovation Playbook

Through the next two essays, we’ll unpack this framework further by looking at specific case studies for different ecosystem plays.

This series of essays eventually leads up to the launch of the Ecosystem Innovation Playbook in early September.

Sign up now for to be among the first to receive the playbook

SIGN UP FOR THE ECOSYSTEM PLAYBOOK

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter