Strategy

Ecosystem strategy mapping - Playbook launch and detailed teardown

Analyzing the Components and Strategies of Successful Ecosystem Business Models

Traditional military strategy required an understanding of the terrain and a planning for various scenarios that opposing troops would engage in.

Ecosystem strategy development starts out with mapping the terrain as well. Ecosystem mapping involves identifying the different value levers that firms may employ to compete and proactively determining which traditional value levers get commoditized with technology shifts and which future value levers accrue more value.

We are delighted to announce the launch of the Ecosystem Business Model Innovation Playbook, a detailed teardown of business models that firms may pursue with an ecosystem strategy, and an analysis of more than 20 detailed case studies of firms that have successfully employed such strategies.

GET THE ECOSYSTEM PLAYBOOK

Ecosystem mapping – A framework

In an earlier issue of this newsletter, we looked at an overall framework to think about value creation in ecosystems.

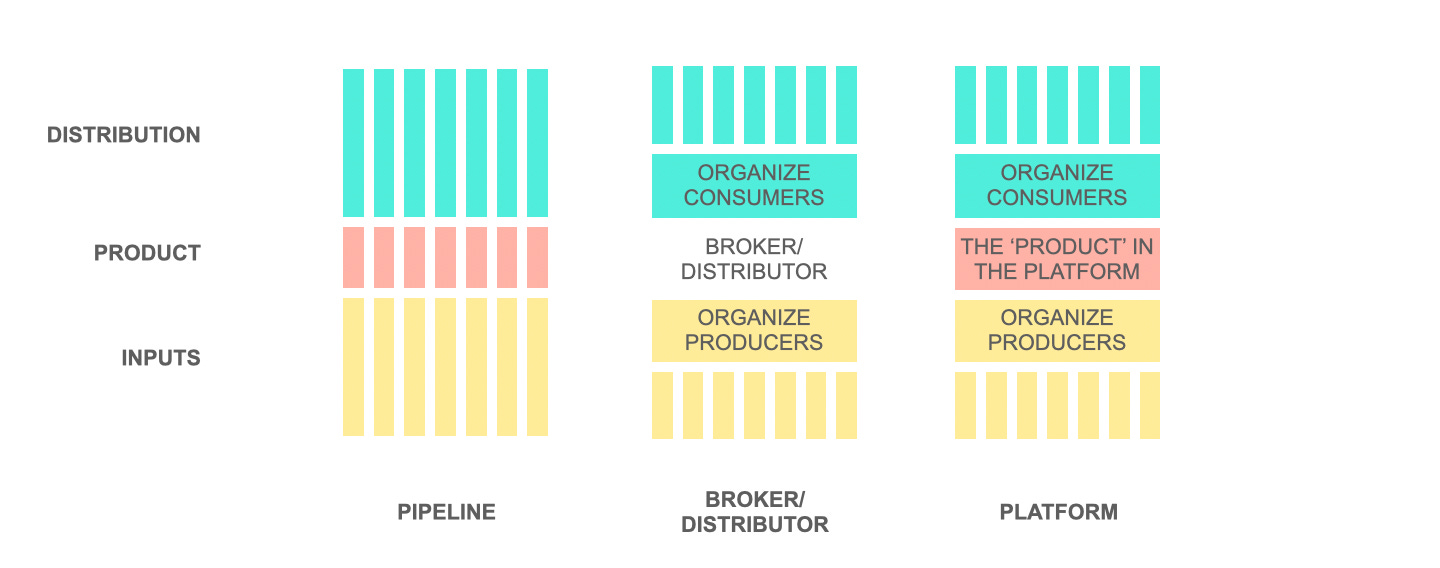

Three horizontal business models emerge which concentrate most of the value in modular ecosystems.

Aggregators aggregate consumer demand by building engagement through consumer-facing services. They leverage this control over consumer engagement (and data) to mediate interactions between consumers and third party producers.

Instagram, TikTok, Amazon Alexa, are all examples of aggregators.

Integrators manage interactions between production and consumption ecosystems through the use of APIs. On the supply/production side, an integrator aggregates product provisioning APIs across the production ecosystem, and on the demand/consumption side, it integrates across distribution environments (websites, apps, and other digital services) in the consumption ecosystem.

Booking.com’s B2B business in online travel distribution, as well as BAAS platforms like SolarisBank, are examples of integrator business models.

Infrastructures provide core production infrastructure, standards, information services, and data assets to inform, coordinate, and support production activities that firms engage in. Infrastructures coordinate the activities of ecosystem firms across a core production process, towards a common production output.

Infrastructures provide core production infrastructure, standards, information services, and data assets to inform, coordinate, and support production activities that firms engage in. Infrastructures coordinate the activities of ecosystem firms across a core production process, towards a common production output.Shopify, Unity’s Unreal engine, and Amazon Logistics are all examples of infrastructures serving larger ecosystems.

Additionally, firms must look to externalize capabilities – that they specialize in and can deliver at scale – for ecosystem-wide consumption.

Reliance Jio – strategy with a stack

As explained in an earlier essay unpacking Reliance Jio’s strategy:

Economic value is increasingly created not within individual firms but through the interactions among firms across the ecosystem. Understanding value creation at the level of the ecosystem is more important than merely understanding it at the level of a single firm. Competitive advantage, in turn, is no longer determined merely by a firm’s activities but by the layers those activities occupy in the value stack.

In this new landscape, power concentrates with players that dominate a specific layer. The strongest players leverage their dominance at one layer to occupy multiple positions across different layers without requiring traditional vertical integration. Firms can effectively excel at both innovation and efficiency by choosing a combination of such positions.

Reliance Jio demonstrates that incumbents may leverage their deep infrastructural and regulatory moats and partner with BigTechs to dominate the ecosystem together. It also demonstrates the sobering reality that such large ecosystem plays require a bold vision, an appetite for high-risk investment, and the execution chops to scale and dominate rapidly

In this new landscape, power concentrates with players that dominate a specific layer. The strongest players leverage their dominance at one layer to occupy multiple positions across different layers without requiring traditional vertical integration

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

Get your copy of the playbook now!

GET THE ECOSYSTEM PLAYBOOK

But what does this mean for firms looking to compete in ecosystems? Read on!

Strategic positions and movements in ecosystems

The ecosystem stack mapped out in this report lays out a central framework for developing strategy in modular ecosystems.

To strategize future positions in these ecosystems, firms must map out their overall ecosystem value stack and identify key positions and business models that grant them competitive advantage.

To strategize across the stack, firms must follow a four-step approach:

- Determine current positions across the value stack where they continue to play and current positions they abandon because of impending commoditization.

- Select future positions that provide competitive advantage which they wish to migrate to, and map out build-partner-buy options to aid that migration.

- With this portfolio of future positions across the stack, identify factors that reinforce value and defensibility across these future positions by developing business models that integrate multiple positions.

- Develop a reliable, self-learning mechanism to continuously monitor competitor moves, particularly moves by non-traditional competitors moving in adjacent stack positions.

Partnering across the ecosystem

Ecosystem partnerships are also pursued through a careful consideration of these business models. Firms that play really well at one of these positions will seek partnerships with firms in other value chain positions in order to compete with other businesses that dominate the value chain across multiple positions.

For instance, Amazon plays across the e-commerce value chain, with Marketplace, Prime and Alexa as aggregator plays and Fulfilment and Logistics as infrastructure plays. To compete, Shopify – largely an infrastructure play – regularly seeks partnerships with other aggregators like Facebook and Tiktok to gain greater leverage across the value chain.

Winning in ecosystems

Winning across these three positions requires fundamentally different competencies.

Aggregator positions, closer to the consumer, win through superior consumer experience and data-driven innovation.

Firms that engage in a n integrator play win through superior business development and partner success.

Finally, firms that play as infrastructures succeed through scalable technology and through standards development.

We’ve advised more than 40 of the Fortune 500 firms on their ecosystem mapping and strategy. Request our advisory kit below.

Request Advisory Kit

The ecosystem strategy spectrum

Occupying traditional production and distribution positions is no longer sufficient for competing in modular ecosystems. Incumbents will need to strategize for shifting industry economics. These strategies will span both offensive and defensive moves to proactively defend current positions of value and take up new value stack positions.

Let’s consider the financial services industry as an example.

First, firms may pursue horizontal dominance at the aggregator, infrastructure, or integrator layers.

Traditional financial institutions like Spain’s BBVA and Italy’s Banca Sella, as well as challengers like SolarisBank and Galileo have set up integrator positions with Banking-as-a-service API integrators.

South Africa’s Discovery and India’s SBI Bank have set up strong aggregator positions with Discovery Vitality and SBI Yono respectively.

Second, firms may collaborate with other incumbents to gain scale at one of these three layers.

The top six banks in Sweden collaborated to launch the payments service Swish, in cooperation with the Central Bank. Swish is used by over 70% of the Swedish banking population. This collaborative scale has helped Swedish banks resist moves by international payments providers.

Third, firms may develop a portfolio of capabilities and embed themselves across the ecosystem.

Santander’s OnePayFX is a cross-border payments blockchain-based system, developed in partnership with Ripple. It has the potential, as a first mover, to be licensed to other players across the ecosystem.

Finally, firms may continue to produce and/or distribute at scale through strategic partnerships that enable movement into new products and new customer segments.

The US-based financial institution Union Club partnered with Lending Club, a P2P lending platform, to buy LendingClub’s personal loans and co-create new credit products.

Want to discuss your ecosystem strategy and see how we can help? Get in touch to discuss further.

Request Advisory Kit

Get your copy of the Ecosystem Innovation Playbook!

And here it is again. Get your copy of the playbook now!

GET THE ECOSYSTEM PLAYBOOK

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter