Strategy

The reintermediation of markets

Exploring the Impact of Digital Platforms on Intermediaries and Market Reintermediation

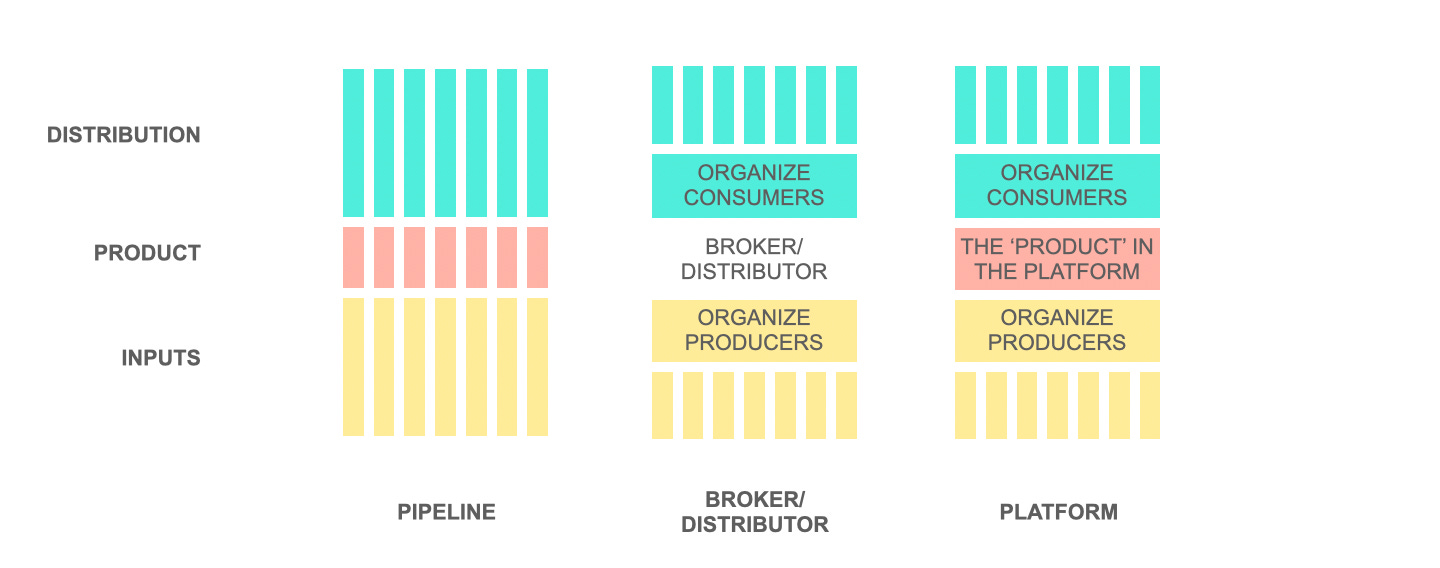

One of the most widespread narratives around the impact of the internet centers around the belief that the internet disintermediates markets. In the truest sense of the word, the internet never disintermediates. Instead, digital platforms reintermediate markets in much more efficient ways. There are a few common themes that recur when digital platforms come in and reintermediate markets.

BETTER DATA SIGNALS

Platforms rely on better data signals to determine matching of supply and demand. Platforms like Amazon Kindle Publishing behave more efficiently than traditional publishing houses, leveraging algorithms and social feedback to determine exposure of books and authors.

Implications for Pipes:

This has important implications for pipeline companies, many of whom are intermediaries. Banks, for example, need to start employing better data signals to perform their roles as intermediaries. Credit scoring towards lending still follows an archaic data model with limited static set of fields that are used as inputs. Insurance premiums also work on an inefficient data model. In an age where both automobiles and health trackers are getting connected to the internet, insurance firms need to actively rethink their roles as intermediaries or risk having platforms come in with more compelling models

BETTER ECOSYSTEM ECONOMICS

Efficient reintermediation of markets often involves better economics for all parties involved. We’ve seen this play out in the handset and telecom industry where app developers would get 30% or less of sales while selling through traditional telcos. Apple and Google Play flipped the economics, allowing developers to pocket 70% of sales. Platforms scale with far better economics and are often well-placed to transfer economic value back to the ecosystem.

Implications for Pipes:

Intermediaries that have benefited as rent-seekers will start feeling pressure from competitors who will pass on better economics to the ecosystem. In some cases, better economics will be artificially created and subsidized by venture capital. The ecommerce markets in India and Indonesia are seeing this play out at the moment with marketplaces subsidizing both buyers and sellers. These are unlikely to be sustainable in the long run but may still kill a few incumbents while the startups burn venture capital money. However, as Amazon has already demonstrated in the US, and may demonstrate in India as well, new platform intermediaries may benefit from superior fundamentals that allows them to pass on benefits to the ecosystem without having to artificially deflate prices or incentivize suppliers.

When platforms disrupted media, telecom, and other information-intensive industries, the efficiency of the new intermediaries and the resulting network effects were so strong that incumbent pipes had very little opportunity to react.

Feel Free to Share

Download

Download Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

BETTER INTERMEDIARY ECONOMICS

Emerging platform intermediaries go beyond better ecosystem economics. They benefit from better intermediary economics as they scale their capabilities by leveraging artificial intelligence to improve their ability to intermediate. Airbnb, for example, can better determine trust models after learning from the behaviors of millions of guests and hosts and predict future behavior in the ecosystem. This improves its ability to intermediate interactions at lower costs of intermediation.

Implications for Pipes:

Traditional intermediaries need to improve the economics of their own intermediation. If much of the intermediation is dependent on human capital and unscalable processes, the intermediary tends to be slow and expensive. Professional services firms will increasingly feel the pressure from more networked enterprises that leverage machine learning and a more fluid networked workforce to compete with a traditional service delivery model. Machine learning will enable services firms, especially those in information-intensive businesses like law and consulting, to scale their capabilities, while a networked workforce will allow these emerging firms to perform with lower fixed costs.

THE OPPORTUNITY FOR PIPES

When platforms disrupted media, telecom, and other information-intensive industries, the efficiency of the new intermediaries and the resulting network effects were so strong that incumbent pipes had very little opportunity to react. We’re seeing a longer disruption cycle with more resource-intensive industries (like B2B supply chains), with more regulated industries (like banking) and with information-intensive services (like law or consulting). Pipe businesses in these industries still have an opportunity to start benefiting from the superior technology (e.g. machine learning) and better ecosystem incentive design that the platforms entering these industries benefit from. This is where pipes may still hold an ounce of advantage and where some of them may end up reinventing themselves successfully as platforms.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter