Strategy

The opportunity for telcos in the coming platform revolution

The telco industry has been engaged in or impacted by the platform revolution on at least two occasions in the past. During both these phases, platform upstarts upstaged the traditional telco business model. The third phase of the platform revolution is now becoming increasingly relevant to the telco industry, and through this article, I propose that this time around, the opportunity is potentially much more favourable for telcos.

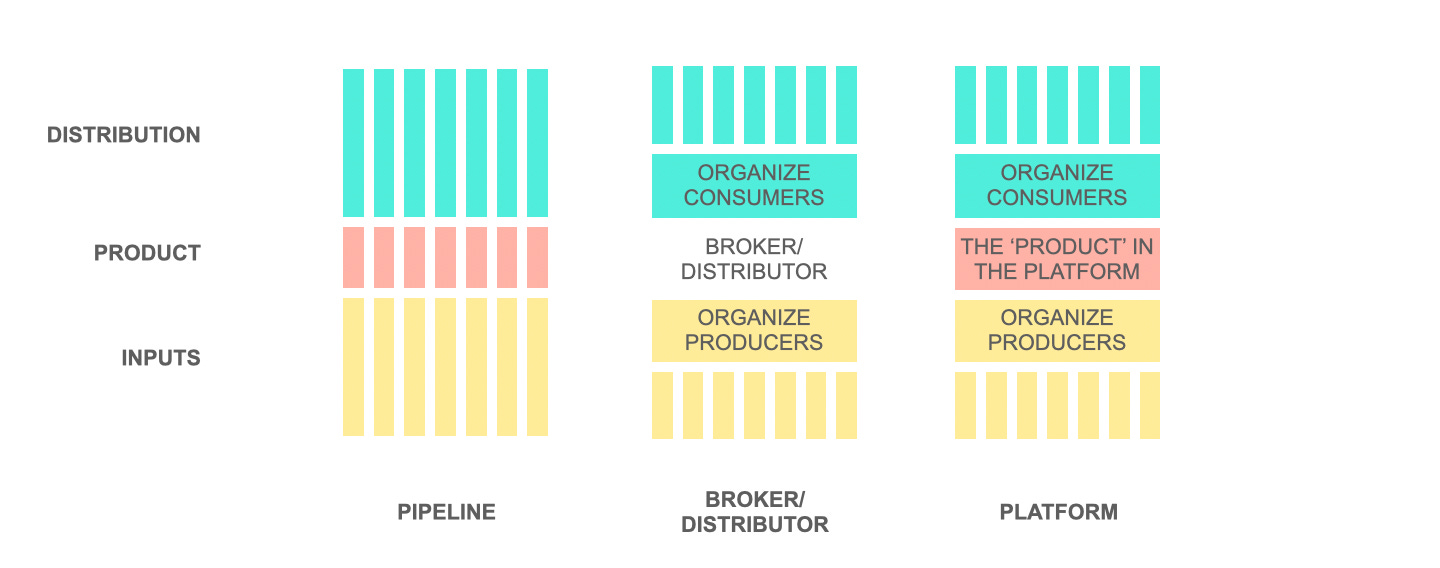

In the first phase, the pipeline model of traditional telcos was disrupted by the platform model of Apple and Android, both of which fought the monolithic telcos with vibrant ecosystems of app developers. In the second phase, a slew of platform startups created consumer communication ecosystems on top of the telcos. While telcos invested in the underlying infrastructure, hoping to capture value in the traffic flow that ensued on top of it, these upstarts, without legacy infrastructure costs, and funded by venture capital and subsequently advertising driven business models, gained control of these consumer communication ecosystems. Messaging platforms like WhatsApp, Skype, Viber, as well as other communication platforms like Instagram and Snapchat captured the voice, text, and media transfer use cases that the telcos were monetizing. Both these above phases of the platform revolution worked against the traditional telco business model.

However, in the coming third phase of the platform revolution, I believe that telcos may be well-positioned to benefit if they spot the opportunity early and migrate from their traditional legacy business models. While telcos have lost the opportunity to gain control of consumer communication ecosystems, the platform revolution is now impacting other parts of the economy which telcos may very well play a role in.

However, instead of gaining control of these ecosystems, the opportunity for telcos is to provide the picks and shovels for this coming gold rush.

There are at least six such different ecosystems, with different potential opportunity sizes, that telcos can enable.

Digitization of heavy industry: The digitization of heavy industry is a significant opportunity. Companies like GE, Siemens, and Bosch have already invested heavily in this direction. With digitization, heavy industry players are moving towards creating ecosystems of connected things. These ecosystems involve heavy data flow, better measurement of outcomes, and an opportunity to move towards new business models. But this shift requires an underlying sensor-network infrastructure. Providing robust implementations of this infrastructure, especially as these heavy industry players start building open ecosystems, is a significant opportunity for telcos.

Scale is achieved by making repeatable processes more efficient (faster/cheaper) and effective (accurate).

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

B2B supplier ecosystems: Even as heavy industry players move towards more digitised interactions, supplier ecosystems across industries will start becoming more networked, allowing new opportunities for platform business models. This, again, is a significant opportunity for telcos to provide an enabling sensor-network infrastructure to supplier ecosystems in different industries.

Smart city infrastructure: Governments have always been big customers of technology infrastructure, and with the shift toward smart cities there is an important opportunity for telcos to provide not just the enabling infrastructure, but in partnership with other city services, own the end to end stack across services, infrastructure, and data.

Industrial communication: We noted early on that the opportunity to own consumer communication ecosystems has already been squandered, but there is a large opportunity in enabling industrial communication ecosystems. Industrial communication values security, privacy, uptime, and performance, all of which telcos are much better positioned to serve. Ease of usage that we have now become accustomed to on consumer communication platforms will also need to be there, and the telcos that want to be competitive can ill-afford to ignore that.

Healthcare ecosystems: There are many data-driven ecosystems even among consumers, which need better sensor-network infrastructure than is currently available. Depending on the nature of requirements, these could serve as a possible opportunity for telcos as well.

Consumer-retailer networks: Finally, consumer-retailer networks present a large opportunity for telcos as well. Short range networks can help with in-store and around-the-store tracking of consumers, allowing retailers better information on targeting these consumers at the point of purchase. These use cases cannot rely on the accuracy of GPS tracking alone. As a result, telcos that are well positioned to enable these use cases have an opportunity to serve these markets.

As we note from the examples above, there are many opportunities for telcos to benefit from the coming phase of the platform revolution. To succeed, telcos will have to themselves think beyond merely being infrastructure providers to becoming ecosystem enablers. This will require a change in operating model, a change of metrics, and a change in business model. The players that successfully make this transition will be the ones that benefit most from the coming phase of the platform revolution.

Note: I will be delivering the keynote address at Huawei’s Operations Transformation Summit held on the eve of the Mobile World Congress 2017 in Barcelona on the 26th of February. If you are in town, do join the event which will explore implications of the platform revolution for telcos, and I look forward to meeting you in Barcelona to discuss further on platforms.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter