Strategy

Platform failure: Why the mighty fail

Uncovering the Reasons Behind Platform Failure.

This article was originally published on the Harvard Business Review. This article was co-authored with Marshall Van Alstyne and Geoffrey Parker.

The success of platform businesses like Alibaba, Airbnb, and Uber is so remarkable that discussion about them often misses just how hard they are to build. For every successful platform, there are many more that struggle or simply don’t make it. Apple and Google, two of the world’s most valuable companies, have had their share of platform failures as we’ll show. Studying these successes and failures, we’ve identified half a dozen key reasons platforms fail, all of which boil down to managers’ misunderstanding of how platforms operate and compete.

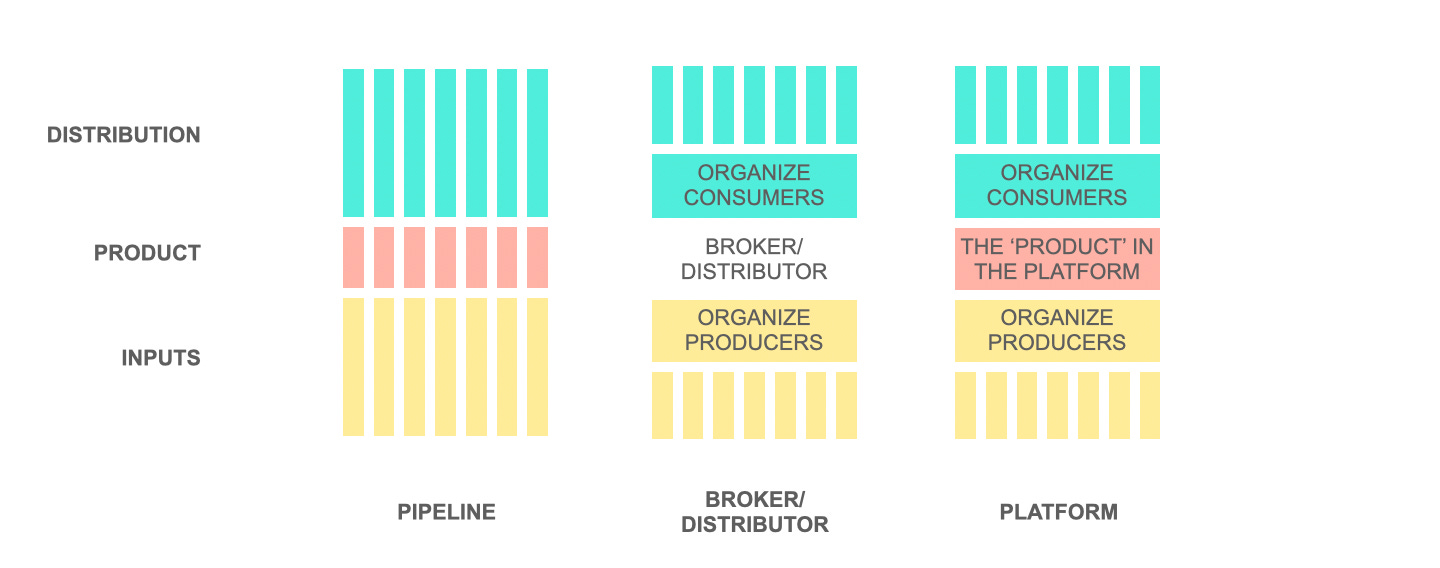

Platform businesses bring together producers and users in efficient exchanges of value – Uber, for example, connects drivers and passengers just as YouTube connects videographers and viewers. And, they leverage network effects – the more participants on the platform, the greater the value produced. Managerial mistakes that inhibit value exchange or network effects can kill a platform. Let’s look at the key errors.

1.Failure to optimize “openness”

Because platforms depend on the value created by participants, it’s critical to carefully manage the platform’s “openness” – the degree of access that consumers, producers, and others have to a platform, and what they’re allowed to do there. If platforms are too closed, keeping potentially desirable participants out, network effects stall; if they’re too open there can be other value-destroying effects, such as poor quality contributions or misbehavior of some participants that causes others to defect.

Steve Jobs failed miserably at managing openness at Apple in the 1980s. He charged developers for toolkits – inhibiting the very software producers he should have wanted on Apple’s platform. The result was that Apple struggled to create a robust platform connecting Apple customers and software producers. For years Apple’s market penetration hung in the single digits. Apple has since figured out this balance, of course, by opening the iOS platforms to app developers. By contrast, Bill Gates opened Windows to both software and hardware developers, making Windows the dominant desktop platform by virtue of its superior ability to connect software and hardware producers with consumers.

Yet platforms can become too open. They must retain enough control over core assets to maintain control of the ecosystem and to make money. Google learned this lesson when Amazon and Samsung fragmented (“forked” in tech lingo) the open Android platform to create their own open-source versions. Google Android quickly lost market share to the new versions. Reacting quickly, Google regained control of the Android system by restricting access to difficult-to-replicate services such as mapping and by shifting important application programming interfaces (APIs) to the proprietary Google Play Store. Android’s story demonstrates that platform openness is one of the key managerial decisions that can determine platform success or failure.

2. Failure to engage developers

Opening platforms the right amount is necessary but not sufficient. The platform owner must also show software developers what’s in it for them if they contribute. In 2013, Johnson Controls invited developers to help them build Panoptix, an energy efficiency platform for buildings and office space. But by early 2015 they stopped accepting new submissions to their open market and discontinued their API support for external developers. Panoptix had not attracted enough new apps to justify pouring resources into supporting this limited external development.

It’s not enough to open the door and set the table. Successful platforms engage in platform evangelism, providing developers with resources to innovate, feedback on design and performance, and rewards for participation. Think of it this way: To host a successful event you must plan carefully, invite the right people, have the right food, and manage competition with the party next door. If Android throws a Hawaiian luau with a five-course feast, free travel, and attendees get to meet Robert Downey Jr. and Sandra Bullock the same night that Johnson Controls offers crackers in Cleveland and asks attendees to cover their own costs, which party will developers attend?

3. Failure to share the surplus

Having valuable interactions is the reason to participate on a platform. The consumer, the producer, and the platform all win if the division of value works for everyone. But if one party gets insufficient value, then they have no reason to participate. Back in 2000, several automakers including Daimler-Chrysler, Ford, GM, Nissan and others invested in Covisint, an online marketplace intended to match buyers and suppliers of auto parts. Unfortunately, Covisint’s ownership structure and auction format heavily favored auto companies (the consumers on the platform) while forcing suppliers into fierce price competition, leaving them with little or no residual value. As a result, parts suppliers left the platform and the market never became sustainably profitable. In 2004, the residual assets were sold off for a mere $7 million, a tiny fraction of the $500 million auto manufacturers had invested.

A simple rule for platform managers is to take less value than you make, and share value fairly with all participants.

4. Failure to launch the right side

Platform managers have to carefully determine which side of the platform market to emphasize, and when. Sometimes at launch it’s important to focus on attracting consumers over producers, sometimes it’s the reverse, and sometime both sides need equal attention from the outset.

Despite huge fanfare and an experienced platform leader, Google Health failed. Google Health was intended to be the premier place for consumers to consolidate their health information. Google tried its preferred strategy of focusing first on the consumer side of the market, an approach that worked beautifully for search, email, and maps. But this time, Google needed to focus first on providers — the other side of the market. Consumers might have used the service if the doctors and insurers who held their information were willing to engage. But they didn’t welcome the scrutiny or the loss of control over data they already possessed. Securing their participation will be critical if health-information platforms are to succeed.

Factors that lead to failure of network effects

Feel Free to Share

Download

Download Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

5. Failure to put critical mass ahead of money

Do you remember Billpoint? It was the digital payment system eBay pushed before it gave up and acquired PayPal. As the insider on an established platform, Billpoint should have won. But where Billpoint emphasized fraud prevention, PayPal emphasized ease of use. While Billpoint charged higher transaction fees, PayPal gave away $5 and $10 payments to users who signed up other users. Fraud prevention can keep platform costs down over the long term but puts friction on user transactions, which dissuades value-creating activity. PayPal ate the costs of fraud and emphasized rapid growth by simplifying transactions and incenting participants to attract others. As a result, PayPal rapidly surpassed Billpoint as the payment system of choice on eBay. Conceding defeat in 2002, eBay bought PayPal for $1.4 billion and phased out Billpoint a year later. Billpoint made the mistake of emphasizing revenue generation at the start rather than, first, attracting a critical mass of participants.

Even after the subsidies end, platform monetization that comes at the expense of building network effects is rarely sustainable in the long run as it works against the core mechanism by which platforms create value at scale.

6. Failure of imagination

Perhaps the most egregious platform failure is to simply not see the platform play at all. It is also one of the hardest for traditional firms to avoid. Firms guilty of this oversight never get past the idea that they sell products when they could be building ecosystems. Sony, Hewlett Packard (HP), and Garmin all made the mistake of emphasizing products over platforms. Before the iPhone launched in 2007, HP dominated the handheld calculator space for science and finance. Yet today, consumers can purchase near perfect calculator apps on iTunes or on Google Play and at a fraction of the cost of a physical calculator. Apple and Google did not create these emulators; they merely enabled them by providing the platform that connects app producers and consumers who need calculators.

Sony has sold some of the best electronic products ever made: It once dominated the personal portable music space with the Walkman. It had the world’s first and best compact disc players. By 2011, its PlayStation had become the best-selling game console of all time. Yet, for all its technological prowess Sony focused too much on products and not enough on creating platforms. (What became of Sony’s players? A platform – iOS – ate them for lunch.) Garmin, as a tailored mapping device, suffered a similar fate. As of 2012, Garmin had sold 100 million units after 23 years in the market. By contrast, iPhone sold 700 million units after just eight years in the market. More people get directions from an iPhone than from a Garmin, not only because of Apple maps but also because of Google Maps and Waze. As platforms, iOS and Android have ecosystems of producers, consumers, and others that have helped them triumph over such products as the Cisco Flip camera, the Sony PSP, the Flickr photo service, the Olympus voice recorder, the Microsoft Zune, the Magnus flashlight, and the Fitbit fitness tracker.

When a platform enters the market, product managers who focus on features are not just measuring the wrong things, they’re thinking the wrong thoughts.

TWEETABLE TAKEAWAYS

Platform failure: why the mighty fail Share this

6 lessons in platform failure Share this

Factors that lead to failure of network effects Share this </a

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter