Strategy

Unveiling New Value Pools in the Platform Economy

Maximizing Impact of massive value migration during the crisis period

The economic shock of the coronavirus pandemic had accelerated several pre-existing trends while also giving rise to entirely new ones. In the face of such rapid change, executives are piecing together the future landscape of value and the new rules of competitive advantage. New value shifts are being driven by shifting customer needs and behaviors on the demand side, increased value chain uncertainty on the supply side, and a reversal of many of the trends that have defined pre-pandemic globalization. Competitive positions, likewise, are more vulnerable during such shifts, spelling out both promise and peril for executives. Variously referred to as ‘the new normal’, ‘the big reset’, and with other such elaborate monikers, the emerging landscape will be characterized by the emergence of new value pools and the erosion of existing ones.

There is hope in the midst of such uncertainty. Migration of value to these new value pools can be predicted, prepared for, and harnessed. Indeed, executives who ‘take the tide at the flood’ and anticipate these value shifts will be best positioned to seize tomorrow. This essay provides a framework for executives to identify potential new value pools and realign their business portfolio to these new positions.

NEW VALUE POOLS, SHIFTING CONTROL POINTS

The keys to transformation beyond a crisis may often lie in new value pools created through the crisis. Times of crisis are accompanied by sudden changes in supply-side and demand-side dynamics. These changes lead to the migration of value from established business positions to new ones, enabling new players to emerge and new business models to be created. Such migration of value is also accompanied by a shift in value network control points. This value migration commoditizes some business positions and empowers others.

To understand this migration of value, we need to start by identifying key trends impacting a value space. These trends may be classified into demand-side and supply-side effects. A combination of demand-side and supply-side effects helps us determine the emergence of new value pools.

Next, we need to determine whether shifts in value will be accompanied by shifts in control points. Control points refer to control of key assets, relationships, and data flows in a value network. Firms that emerge stronger from a crisis are those that can respond swiftly to a shift in control points.

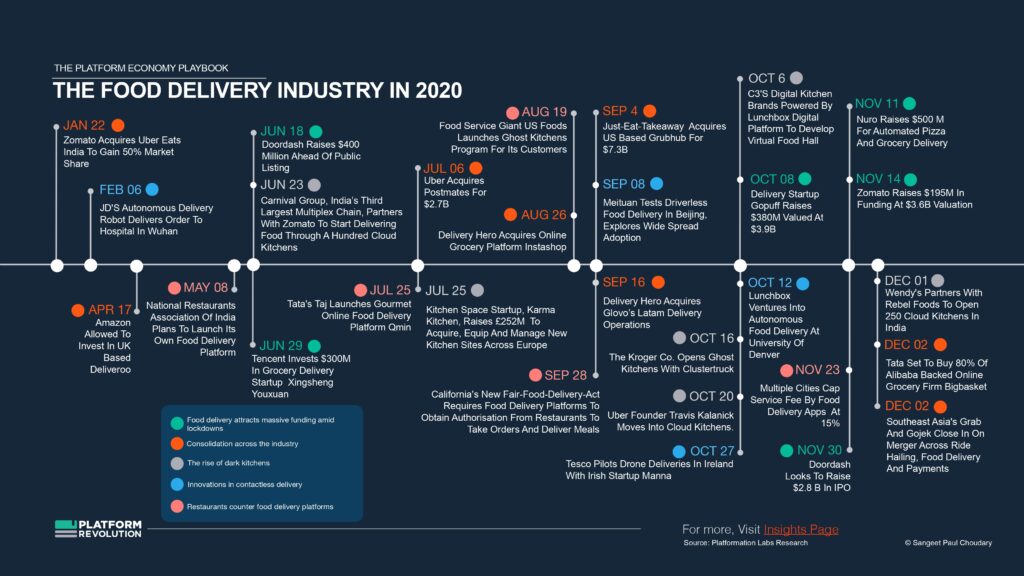

THE FOOD RETAIL INDUSTRY

To illustrate this further with an example, consider the food retail industry. Compared to other retail categories, food retail has been a relative laggard in moving to ecommerce. In emerging markets, in particular, the online food retail model never took off pre-pandemic. Grocery deliveries typically involve many more items per order than other ecommerce, leading to high costs of fulfilment. These models become profitable only at scale when fulfillment can move from the store to automated fulfillment centers. However, the convenience of informal neighborhood grocery stores, especially in emerging markets, never drove demand scale in online grocery.

However, the pandemic has driven massive value migration, through a combination of supply side and demand side effects, which is unlikely to be merely transitory.

Consider demand-side shifts in behavior. With many countries moving into lockdown during the pandemic, there’s been a significant shift towards ecommerce in food retail. In the US, more than 40% of grocery deliveries in the week ending March 13 were made to first-time customers. This is further reinforced by the disruption of food supply chains during the pandemic, a supply-side effect.

A combination of these demand-side and supply-side effects is leading to value migration towards online grocery retail.

In emerging markets, the situation is no different. Online grocery has accelerated at an unprecedented pace since the start of the pandemic. Neighborhood grocers are feeling the squeeze as they struggle with a lack of technology to take online orders and an over-reliance on informal supply chains that have been disrupted because of the pandemic. Many of these stores are going out of business owing to poor cash flow and high rents.

Control points over demand shift significantly in the midst of a crisis, leading to an aggregation of demand with a few large players. Aggregated demand, when combined with a shift in supply, allows these players to reconfigure the value network around their business. In this new value network, neighborhood stores may be relegated to serving as logistics providers to the larger players with relatively resilient supply chains. With centralized demand as a control point, large online grocery firms will best orchestrate the entire value network and might even leverage third party warehouses, delivery agents, and fulfilment centers to create strong network effects that further strengthens their position. As we note with further examples below, firms that orchestrate such ecosystems using digital platforms are the ones best positioned to harness value in these new value pools.

Meanwhile, demand is increasingly getting centralized with a few large online grocery providers who can use centralized demand data to better predict demand patterns, improve stocking of fulfilment centers and better inform their supply chain. Greater centralization of demand data also creates a machine learning advantage for large online grocery firms, further moving value away from smaller stores. In addition, a post-Covid 19 world is likely to feature supply chain inspections and quality control requirements that will also favor larger players. This combination of demand and supply side effects will strengthen large grocery players.

As we note with this example, a combination of demand-side and supply-side effects reinforce each other to move value away from small stores to large grocery retailers. This value migration is further reinforced through a combination of machine learning on demand-side data and scale advantages in a consolidated food supply chain. Smaller players, meanwhile, are increasingly commoditized.

“There is a tide in the affairs of men, Which taken at the flood, leads on to fortune... On such a full sea are we now afloat. And We must take the the current when it serves, or lose our ventures "

Feel Free to Share

Download

Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

BUT… THIS TIME IS DIFFERENT?

Value migration has happened during other periods of crisis in the past. The SARS crisis of 2003 forced consumption behavior to move online across China, enabling Alibaba move into B2C ecommerce. Alibaba launched the Taobao website in May 2003, in response to a self- imposed quarantine prompted by SARS. Consumers across China were staying home from work out of fear of contracting SARS, not very different from the lockdowns during Covid19. Chinese consumers, stuck at home, took to ecommerce. Duncan Clark, the author of “Alibaba: The House That Jack Ma Built” notes that the SARS outbreak “came to represent the turning point when the Internet emerged as a truly mass medium in China.”

Firms like Alibaba benefited from this period of intense change, building demand-side control points by aggregating online consumer demand, and strengthening this with a network effect by opening out the supply side to third party merchants. As more merchants came on board, the demand-side control point became even stronger.

As evidenced by the grocery example above, we’re seeing similar shifts in value pools during the coronavirus pandemic. However, these shifts are not specific to pandemics. In fact, they are not even specific only to times of crises. Shifts in control points and the creation of new value pools result from any combination of technological, market, or regulatory shifts.

TRANSIENT SHIFTS, PERMANENT EFFECTS

How much value is created in these new value pools depends on two factors. The first is the duration of value migration – the longer these shifts persist, the greater the value creation.

The second, often less visible, factor is the shift of control points. In fact, seemingly transient shifts may result in permanent effects, when accompanied by the shift of an important control point.

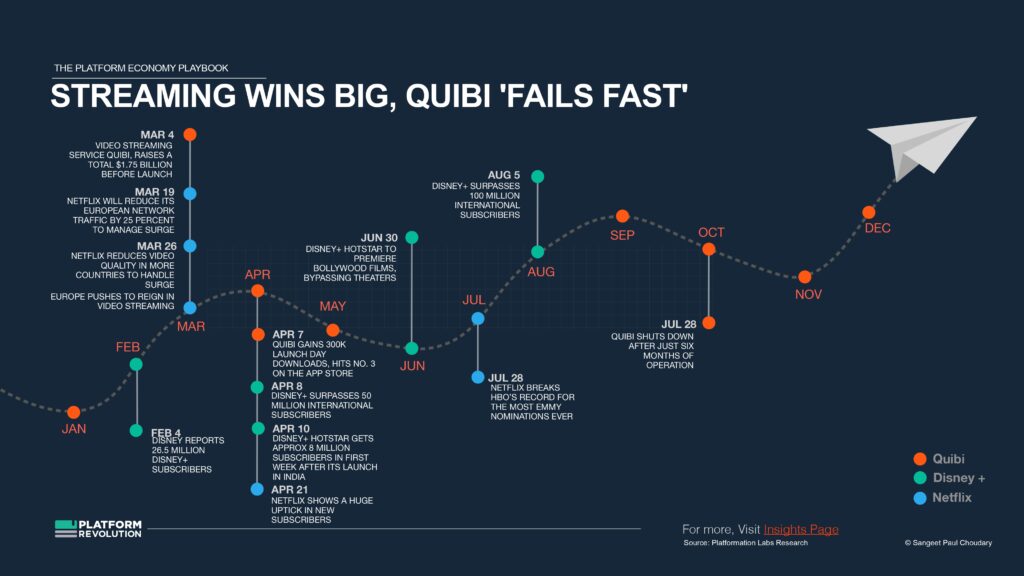

Since the start of the coronavirus pandemic, we’re seeing such a phenomenon play out in the movie distribution industry. Streaming platforms like Netflix and Amazon Prime have witnessed a surge in engagement during lockdown. However, this seemingly transient shift in demand-side behavior is reinforcing a much more permanent supply-side shift.

The closure of major theatre chains, owing to the pandemic, is driving studios to break what’s known in the industry as the “window” – the three-month period between when a movie hits the big screen, and when it’s offered for video on demand purchase or rental, and then on streaming devices. This “window” that movie theatres have to launch movies exclusively, is a moat protecting theatre revenues.

Since the start of the pandemic, studios have been launching directly on streaming channels, thereby eroding the “window”. Universal was the first studio to take these steps, announcing that it will make movies available at home on the same day as their global theatrical release, starting with “Trolls World Tour,” which had been scheduled to open April 10, 2020 in the U.S. In India, Amazon Prime secured rights to premiere several Bollywood movies on Prime Video. These movies were originally scheduled for a theatrical release.

We’re likely going to see new revenue models emerge as well. In China, Huanxi Media has partnered with Douyin, a streaming platform, to launch direct to streaming on a new business model. Under this agreement, Douyin’s parent ByteDance would pay Huanxi at least 630 million yuan (US$90.8 million) for new content to stream first on its streaming video platforms. With this deal, ByteDance gets exclusive access to a portfolio of Huanxi movies and TV shows. Huanxi gets a licensing deal and a share of the advertising revenues. Within two days of the deal, Lost in Russia – one of Huanxi’s movies – was released on ByteDance and gathered 600M views.

Studios will get to test the success of movie releases on streaming platforms and use that to negotiate post-lockdown. Though theatres won’t go away, their negotiating power may decrease, leading to a shift in value. The longer the lockdown, and the more the hits released away from the theatres, the more likely we are to see this shift.

Within the first three months of the WHO declaring Covid19 a global pandemic, we have already seen several permanent shifts. For one, AMC Studios blocked off Universal movies from ever launching a movie in their theatres after the studio went direct-to-streaming. With AMC Theaters struggling post-pandemic, Amazon is looking to acquire its assets, further driving the consolidation we see during such periods of value migration. In India, Amazon was already increasing its negotiating power against movie theaters pre-pandemic by getting into online sales of movie tickets. If Amazon gains enough control over ticket sales, it can negotiate windowing with movie theaters, leading to more fresh content launching first on Amazon Prime. With the pandemic, this balance has further tilted in Amazon’s favor.

We note with this example that a relatively transient demand-side shift can reconfigure bargaining power in the value network because of a massive shift in control points. A transient demand-side shift may lead to a permanent supply-side shift by changing bargaining power of players in the value network.

A BLUEPRINT FOR THE FUTURE

We’ve talked extensively about shifts resulting from the pandemic but there are many other equally important macro shifts that present opportunities for new value pools.

Technological shifts continue to accelerate and artificial intelligence is rapidly advancing across sectors. More importantly, traditional industry boundaries are disappearing, often leading to creation of new value pools and business models where none existed in the past. Geopolitically, the rise of China is reshaping the global economic order and the rise of stakeholder capitalism will further create new value pools as business priorities shift to embrace larger societal and environmental value. Finally, investor activism and regulatory shifts will also play an important role in determining future value pools.

The ability of executives to benefit from such shifts is dependent on three factors: how early they spot the shift, their ability to innovate and reconfigure their business model portfolio to position themselves in the new value pool, and the strength of the control point that consolidates their position in this new value pool.

Firms that develop a strong sense of market shifts and an ability to harness their value network towards these shifts will be best positioned to win. The importance of harnessing your value network makes agility and digitization ever-more important priorities for executives. More importantly, firms that compete through ecosystems will be best positioned to rearchitect their value network.

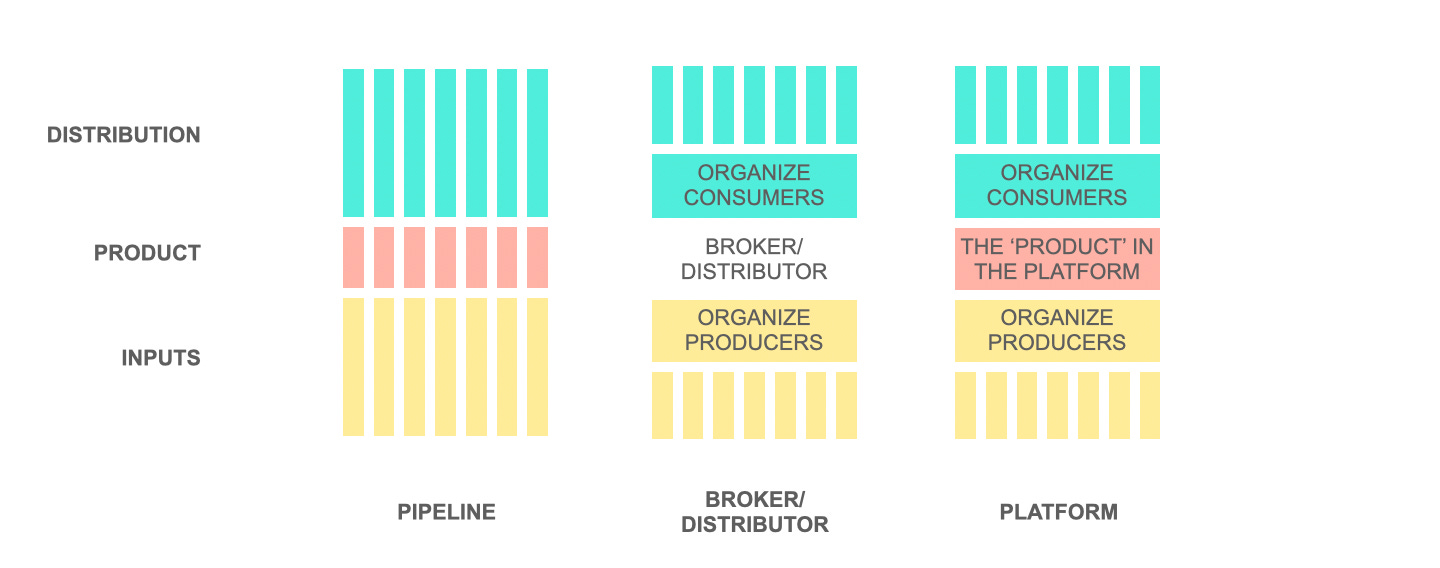

Ecosystems are fluid and dynamic, and the most successful orchestrators govern them through digital platforms. Businesses that orchestrate ecosystems can leverage external assets and benefit from demand-side economies of scale. They may also selectively capture supply-side control points by owning important assets of their own.

The post-pandemic world will witness many important shifts. Executives who ‘take the tide at the flood’ and anticipate these value shifts early, reorganize their business model portfolio, and consolidate their control points will be best positioned to seize tomorrow.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter