Strategy

Vimeo Vs. Megaupload Vs. Youtube: Contrasting strategies of competing platforms

Leveraging Producers to Bring in Consumers: A Case Study

Startups often believe that technical aspects of the product provide competitive advantages and that two products with similar technical aspects have little scope for differentiation. Hence, it is believed that a late mover with similar technology cannot get traction and that the early mover has a significant advantage. However, as we shall demonstrate with the cases below, late movers can compete effectively with a similar technical product by structuring an entirely different value proposition.

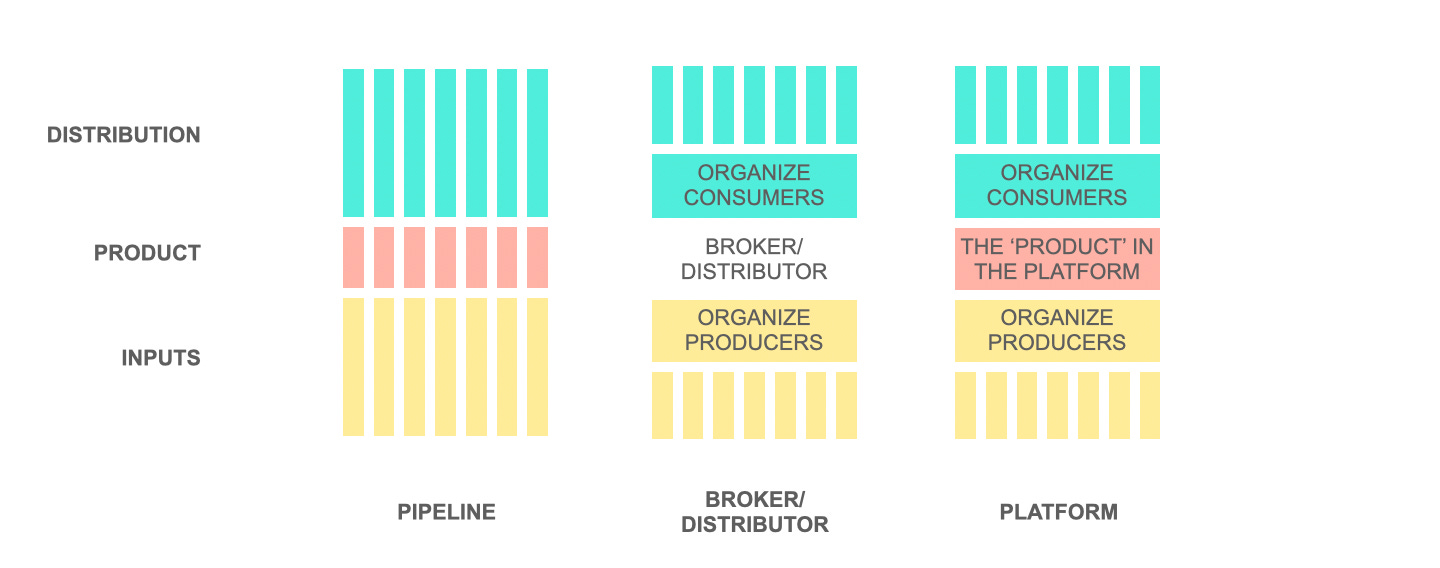

Multi-sided platforms typically face the mutual baiting challenge. The producers will not participate in a platform where they do not have access to consumers and consumers won’t show up at a platform where there is no activity from producers.

Targeting both sides together is extremely difficult, and a startup often grapples with the question: “How can I seed this one side at a time and which side do I get in first?” It would be tempting to theorize that there is a one-size-fits-all solution to the “Which side should I target first” problem but the reality is that there are too many factors that need to be taken into consideration while choosing a side to seed first.

Online Video Platforms

One might be tempted to generalize that what works for Platform A as a user acquisition strategy will work for its direct competitor Platform B since the two are serving the same market, solving the same pain point and delivering similar solutions.

Let’s look at three online video platforms which, for all practical purposes, are direct competitors. Online video platforms have two sides: content creators and content viewers. Which side would you target first?

YouTube: Producer-first focus

YouTube was the first democratic (anyone can upload) video hosting platform that gained mainstream traction. It gained traction by focusing entirely on content creators. During its initial days, YouTube conducted several contests (Monthly video contests, Nano a day, targeting beautiful women to upload videos of themselves, etc.) incentivizing content creators to create and upload videos. Additionally, it allowed content creators to embed their videos off-platform which rapidly spread the word about YouTube (especially on Myspace which did not have a comparable video hosting solution for the bands on it). This created an initial corpus of content and simultaneously leveraged producers to bring in consumers, some of whom eventually converted to producers as well. Strengthening its focus on producers, YouTube even elevated top content creators to a partner status where it shared ad revenue with the video creator.

This unrelenting focus on producers helped in four ways:

1. Seeded the platform with content

2. Created a curation dynamic on the platform (voting up or down) to identify quality content

3. Leveraged producers to bring in consumers

Most importantly,

4. It created a set of content creators who had already invested in the platform, already had a user following and would not be easily incentivized to invest in another one.

If you’re launching a platform, knowing the value propositions offered by your competitors can help you structure your own and compete in a relative whitespace despite having a very similar technical product.

Feel Free to Share

Download

Download Our Insights Pack!

- Get more insights into how companies apply platform strategies

- Get early access to implementation criteria

- Get the latest on macro trends and practical frameworks

MegaUpload: Consumer-first focus

MegaUpload, a YouTube competitor, was faced with the late-mover problem. Most content producers were already active on YouTube, and there was no incentive for them to participate in a new platform with a smaller market of viewers. MegaUpload couldn’t succeed with the same ‘get-producers-on-board’ strategy. Consequently, it focused exclusively on consumers (viewers) by seeding the platform with content internally and specifically seeding content which was increasingly being policed on YouTube (Copyrighted, pirated videos and porn). MegaUpload got significant traction trying to solve an ‘under-served’ need but in the process, ended up exposing itself to lawsuits and the like.

It’s interesting, though, to note that as the second mover, MegaUpload had very little room to compete in and couldn’t compete head-on following the same user acquisition strategy. This is often the case with a late-mover competitor and, as in the case of MegaUpload, the competitor tried an alternative seeding strategy (in-house seeding of videos).

Vimeo: Producer-first but with a different value proposition

Vimeo gained late traction, but it succeeded with a producer-first strategy competing directly with YouTube. In it’s initial days, YouTube’s hosting and bandwidth infrastructure coupled with its flash-based in-browser embeddable player formed a compelling value proposition to producers. As YouTube gained traction among producers, the focus of the platform moved from improving video hosting infrastructure (as a value proposition to producers) to improving match-making of videos with consumers (focusing on video search, and a video feed). Vimeo leveraged this by focusing its platform on the producers and providing them with superior video infrastructure (HD player, a better embeddable player for bloggers). While MegaUpload didn’t have a value proposition for producers to move away from YouTube and instead focused on a value proposition for consumers, Vimeo created a value proposition aimed at producers and competed directly within YouTube to acquire producers who would create a sustainable flow of videos.

As these examples illustrate, three competing platforms took on vastly different user acquisition strategies based on the value proposition they offered and the nature of the competition when they launched.

If you’re launching a platform, knowing the value propositions offered by your competitors can help you structure your own and compete in a relative whitespace despite having a very similar technical product.

State of the Platform Revolution

The State of the Platform Revolution report covers the key themes in the platform economy in the aftermath of the Covid-19 pandemic.

This annual report, based on Sangeet’s international best-selling book Platform Revolution, highlights the key themes shaping the future of value creation and power structures in the platform economy.

Themes covered in this report have been presented at multiple Fortune 500 board meetings, C-level conclaves, international summits, and policy roundtables.

Subscribe to Our Newsletter